Algo Short Signals – CBA, SUN & QBE

QBE, SUN and CBA are recent examples of the “lower high” formation being identified by the Algo Engine.

QBE, SUN and CBA are recent examples of the “lower high” formation being identified by the Algo Engine.

SEEK provided a trading update at its AGM yesterday, upping its guidance for

EBITDA growth to 13% and reaffirming NPAT guidance of $220-230m.

FY18 Revenue $1.3b, EBIT $340m, EPS $0.63, DPS $0.44, placing the stock on a forward yield of 2.4%.

Our Algo Engine last triggered a buy signal back in June, when SEEK was trading at $16.40. A pullback to $17 will provide a lower risk entry level.

SEEK

Our ALGO engine triggered a sell signal in BXB on yesterday’s ASX close at $10.19.

This was the highest closing price since June 26th, but still within the technical “lower high” pattern based on the May 29th high trade at $10.70.

We consider the current price level to be near the top of the counter trend range and ready to trade lower.

Fundamentally, BXB is trading at 19X earnings and a 3.1% yield based on FY18 earnings

For those CFD traders using our SAXO Go platform, we see the next significant price support level near the early November lows at $9.40.

Brambles

BHP’s medium-term cost guidance for iron-ore and coal is better than expected and will help to underpin EPS targets into FY18 and FY19.

FY18 revenue will be up slightly to $40b, EBIT $13b with reported profit in FY18 forecast to increase 10% to $6.4b.

Assuming dividends per share of $0.80, BHP is placed on a forward yield of 4%.

We see upside in BHP’s share price to $30 and suggest selling a March $29.50 call option to enhance the yield.

ORG indicated it’s targeting a Crude Oil price of US$40 per barrel distribution break-even for FY20.

ORG hosted its 2017 investor day, this week, at which time they reaffirmed their FY18 guidance with respect to capital expenditure, debt management and APLNG.

The market is encouraged by the potential for up-to $500m in cost savings, ($110m OPEX and $400m CAPEX), over the next 2 – 3 years.

ORG will likely reinstate dividend distributions, building to $0.40 per share in FY19 and $0.50 in FY20.

These targets have ORG trading on a FY19 forward yield of 5%.

We continue to see ORG as a buy on the dip opportunity and look to keep exposure to the name in portfolios over the next 3 to 5 years.

Origin Energy

CSL, SHL, RMD & RHC remain our preferred healthcare names.

Resmed is looking a little expensive and we’d like to repurchase on the next retracement.

Sonic Healthcare: we expect 5 – 8% EPS growth and consider this a good buy/write addition to portfolios.

Ramsey Healthcare – Accumulate with $74 price target

CSL: 15 – 20% EPS growth remains attractive and adding a covered call option enhances the yield.

CSL

Our Algo Engine triggered a buy signal in AGL back in July at $23.00.

We see the current retracement from $26 back to $24 as another opportunity to add AGL to portfolios.

We hold AGL in our ASX 50 model and we’re encouraged by the double-digit EPS growth outlook and the 5% dividend yield.

We’ve also added a covered call option to boost the cash-flow yield to 10 – 12% p/a.

AGL

South32 announced plans to run its South African Energy Coal (SAEC) business separately from the rest of the company from April 2018.

We see this announcement as a net positive for shareholders.

Risks to South 32’s earnings relate to their exposure to commodities which have performed strongly over the near term.

S32 trades on a forward yield of 4.1% and we hold the stock in our ASX 50 model.

South 32

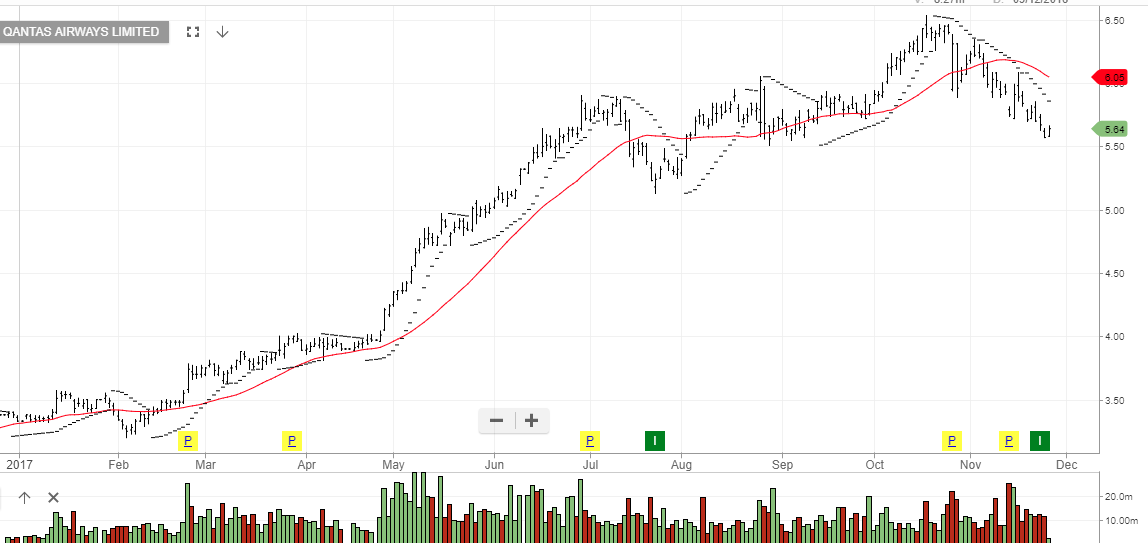

Our ALGO engine triggered a buy signal in QAN last Friday at 5.60.

Since posting a 52-week high at $6.53 on October 18th, QAN shares have traded down to a low of $5.57 last Thursday.

Technically, the share price is still tracking a “higher low” pattern which is bullish and suggests the recent sell off is a correction within a broader uptrend.

the company is currently trading on a P/E of 13X and will likely improve on the FY 17 after tax profit of $853 million announced back in October.

QAN is also one of the ASX companies that will benefit from a weaker Aussie Dollar as inbound tourism is likely to increase.

Over the near-term we are looking the share price to reach the $6.25 area.

QANTAS

Our Algo Engine generated a recent buy signal in AMP.

With the price action finding support at $4.75 and now trading into the $5.15 range, we continue to see upside momentum.

AMP looks well positioned to benefit from domestic trends in mandated super and search for yield in infrastructure & property.

AMP is currently in our ASX 20 and ASX 50 model portfolios.

AMP