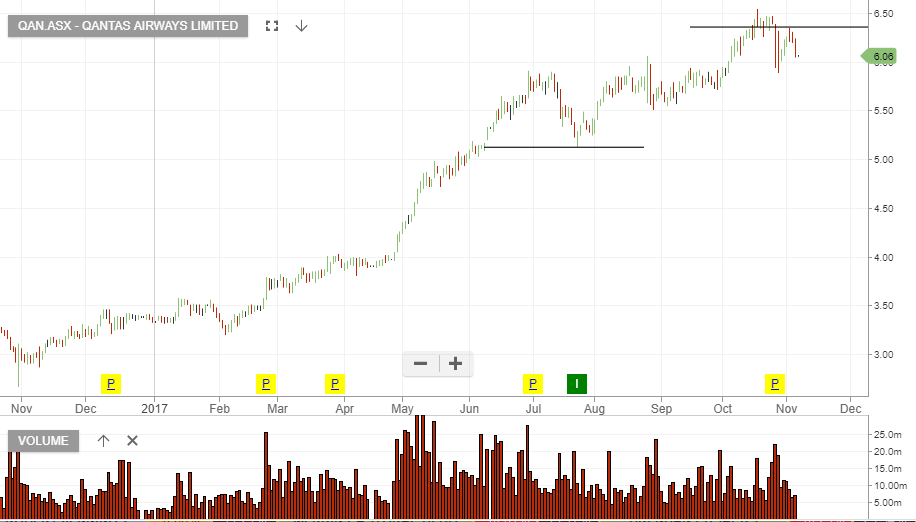

Buy BHP and Sell Qantas

With oil rallying and the US dollar retracing, (yields in the US retreat), it’s reasonable to consider buying BHP and selling Qantas.

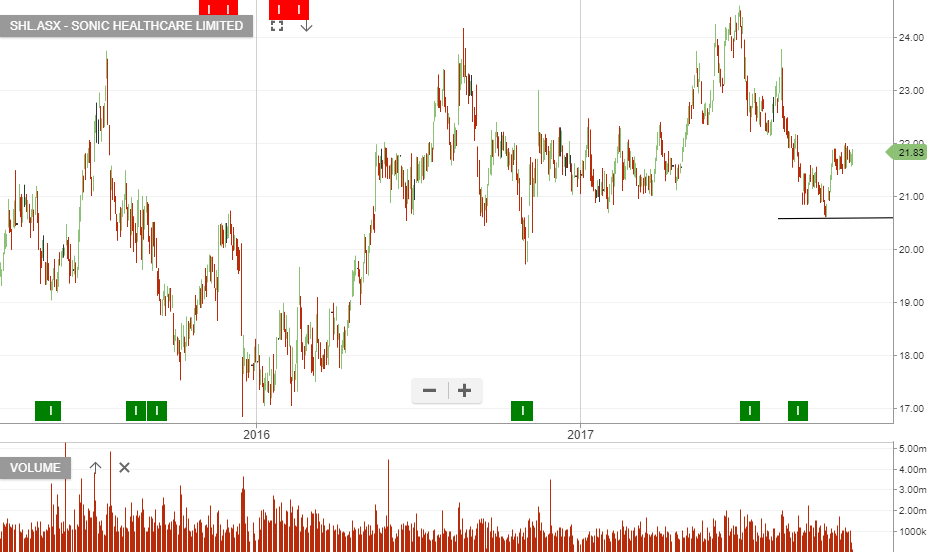

Apply stop losses on a price reversal through prior support/resistance levels as indicated on the charts below.