Buy AMC & SHL

AMC and SHL offer low risk entry points following the recent selling pressure.

AMC and SHL offer low risk entry points following the recent selling pressure.

FMG is a short with stop losses above the recent high at $6.05 Initial downside target of $5.40

Fortesque Metals

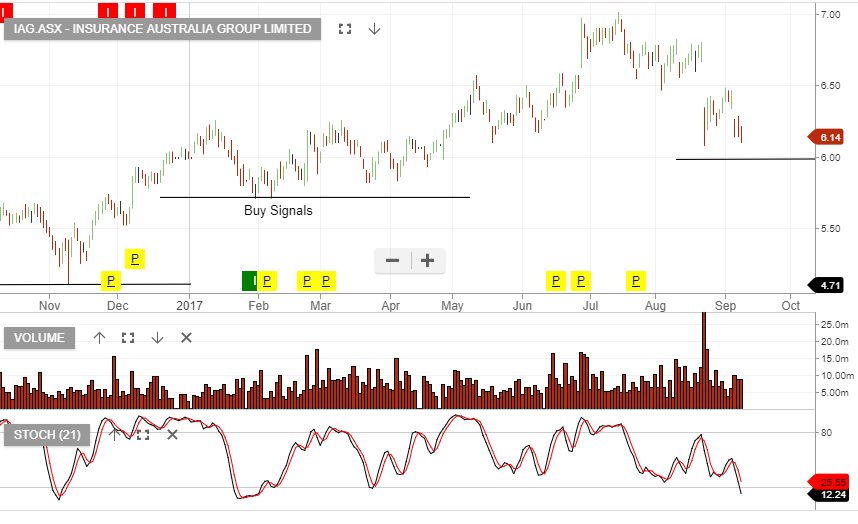

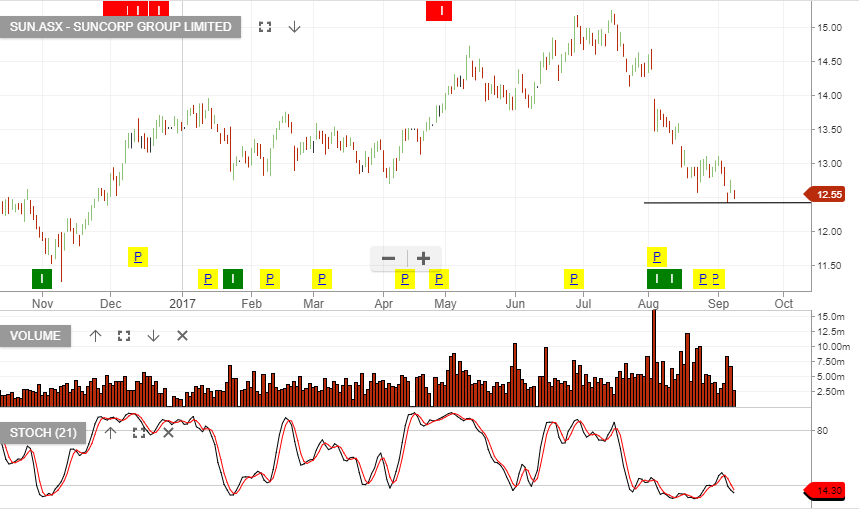

The Insurance sector in the US rebounded in Friday’s session, following oversold levels which were caused by concerns about weather related claims.

We’re expecting the local insurance companies to find buying support near the current price levels. This will likely be a short-term trade higher, as we anticipate the sector will then make a “lower high” formation.

Our two preferred names are IAG and SUN.

With the recent hurricane activity near refinery locations in the USA, the price of Crude Oil has been volatile and difficult to forecast accurately.

This has kept our ALGO sell signal for STO offside since it was triggered on Wednesday at $3.81.

With spot Crude Oil prices dropping over 3%, and below $47.50, during yesterday’s NY trade, the Short STO signal may look more attractive on Monday.

Santos

Santos

Crude Oil

Crude Oil

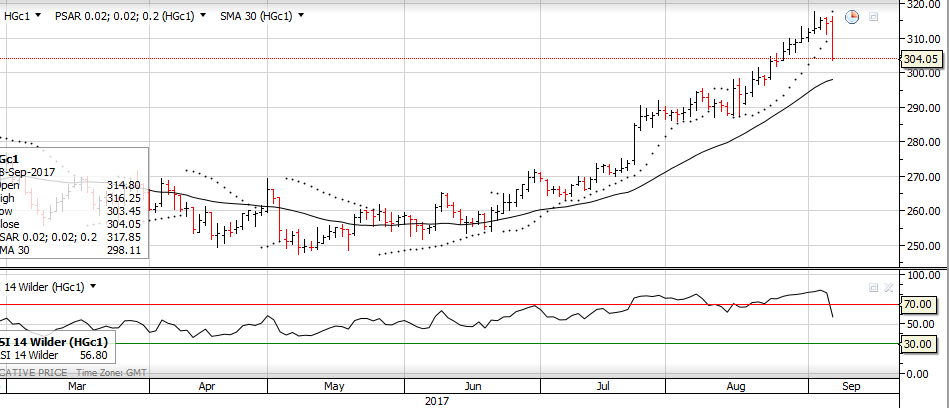

Our ALGO engine triggered a sell signal in Sandfire Resources on the ASX close on Friday at $6.44.

The WA-based copper producer has seen its share price rise over 17% since posting a low of $5.50 on August 29th. The spot price of copper has rallied 10.4% over the same period of time.

However, NY High-Grade Copper futures fell 3.25% in overnight trade on reports that recent Chinese demand has peaked and a price correction in copper is forthcoming.

The recent share price action illustrates that SFR is strongly correlated to the spot copper price and could revert lower if the spot price declines.

We will follow this ALGO signal closely and update for a potential trade strategy.

Sandfire Resources

Sandfire Resources

NY High-Grade Copper

NY High-Grade Copper

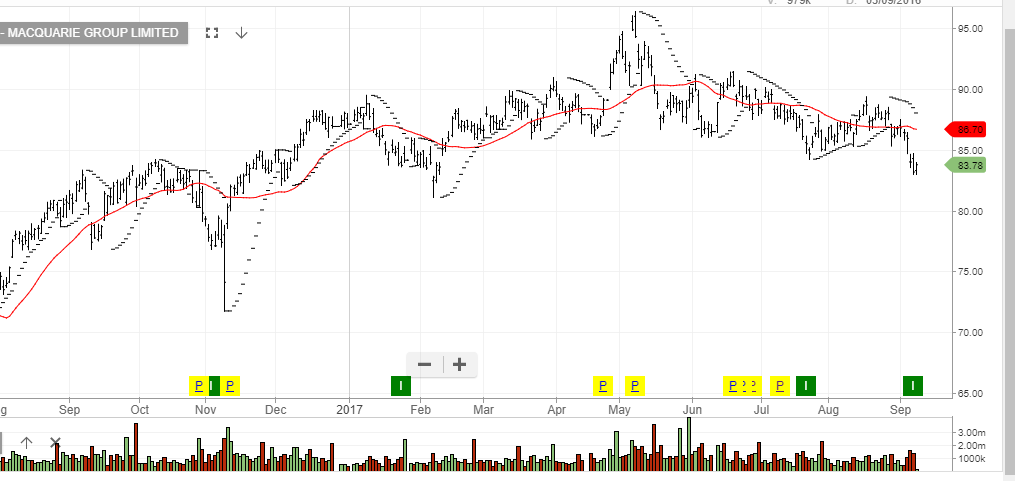

The ALGO engine triggered a buy signal on MQG at yesterday’s ASX close at $83.01.

The stock has dropped over 7% since posting an intra-day high at $89.35 on August 17th.

This swift decline has pushed internal momentum indicators into an “oversold” area, which the technical ALGO engine picked up on when creating the buy signal.

We remain cautious of the forward earnings potential in the local banking sector and will monitor this trade over the next few trading sessions.

At this point, we would consider any move in MQG up into the $84.90 area as a corrective reversion and an area to sell long holdings or establish short positions.

Macquarie Group

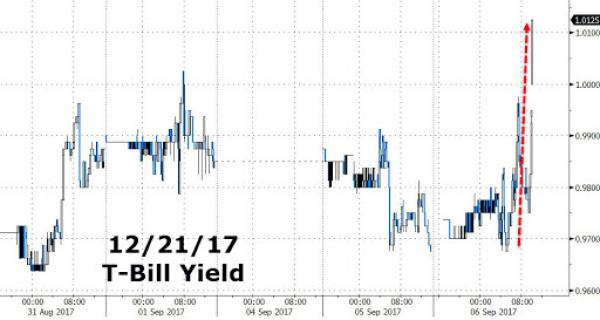

US Stock indexes may have dodged a bullet today when President Trump defied his White House advisors and sided with Democrats to defer the debt ceiling debate until December.

Using the legal structure of a “continued resolution” linked to emergency aid to victims of hurricane Harvey, the proposal would suspend the borrowing cap, currently at $19.9 trillion, until December 15th.

And while this manoeuvre calmed the nerves of T-Bill investors into the October maturity, the fear premium of a government shutdown has just been transferred to the December maturity.

Over the next few days we expect to hear more about how this political tactic will impact the administration’s legislative goals on tax reform, infrastructure programs and border security.

The prime risk to US equity markets is that credit agencies view this failure to address the debt ceiling as cause to downgrade US Sovereign debt ratings.

In short, “kicking the can” down the road has not made US assets less risky at current levels.

December T-Bill Yields

December T-Bill Yields

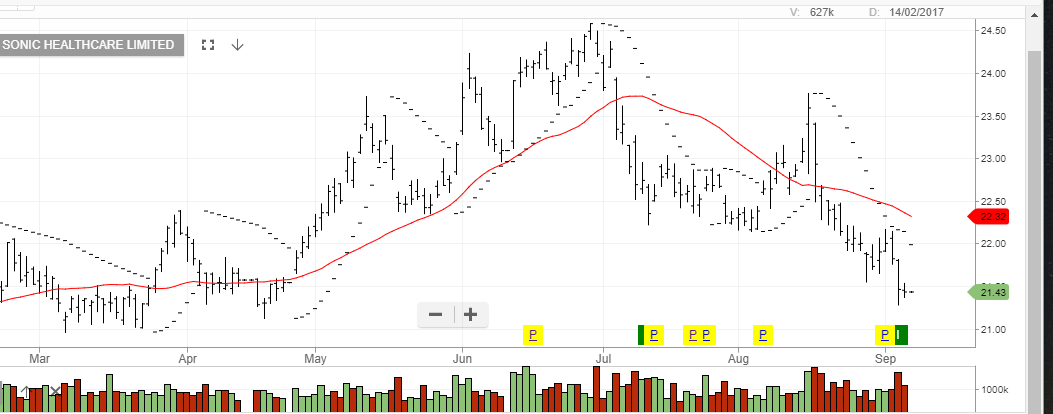

On August 16th, shares of Sonic Health care posted an intra-day high of $23.76.

The next day the company announced that NPAT fell 5% to $427 million, which was the worst component of a reasonably good earnings report.

Our ALGO engine triggered a buy signal on SHL on Tuesday at $21.46.

We consider SHL a defensive stock, which has been oversold, and has now found good buying support in the $21.40 area.

Investors with a medium-term outlook can look to buy SHL with an initial target of $22.35 and a $21.20 stop.

Sonic Healthcare

Our ALGO engine triggered a sell signal for Santos into the close of trade yesterday at $3.81.

Recently, Santos reported solid earnings growth and have paid down a higher percentage of debt than the market expected earlier in the year.

In addition, the current rebound in Crude Oil prices has been a factor in the stock rising from $3.25 to $3.80 over the last two weeks.

With the US refineries based in Houston still preparing to come back online, and hurricane Irma now targeting Southern Florida, Santos shares could could firm into the the $4.00 resistance level, near-term.

Over a longer time-frame, we expect both Crude Oil prices and shares of Santos to trade lower.

We will watch these two markets closely and give specific trade levels once a clear trade signal emerges.

Santos

Santos

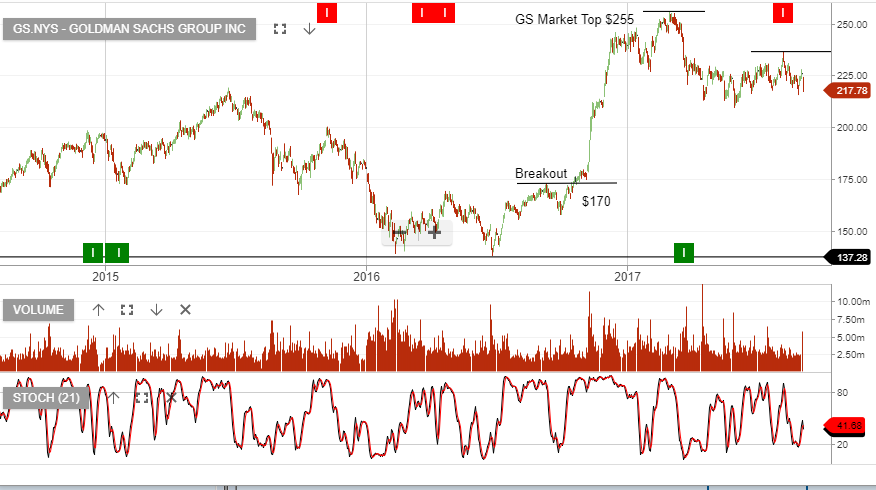

The following charts illustrate the recent Algo Engine sell signal in leading financial names, Goldman Sachs and Commonwealth Bank.