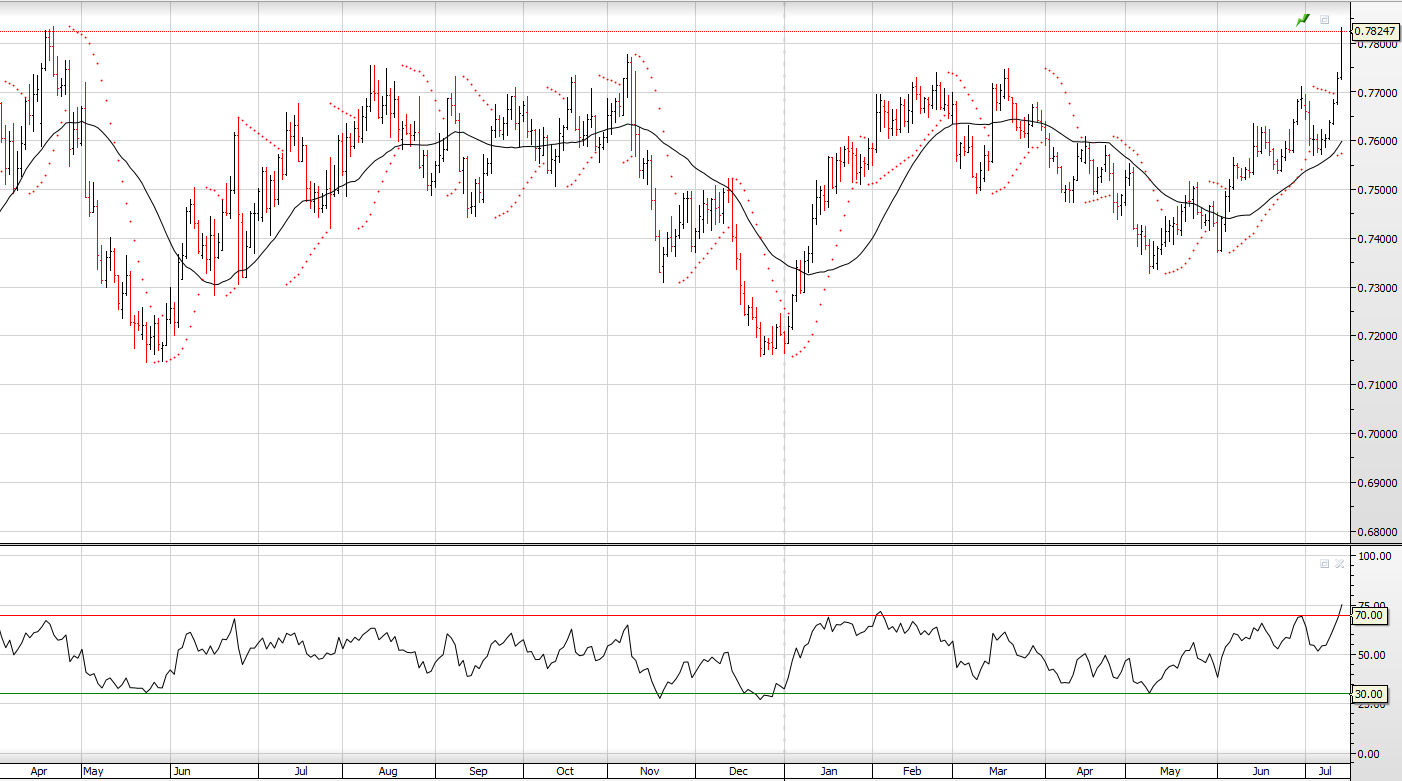

The AUD/USD traded higher everyday last week as the currency traded to a 15-month high versus the USD at .7833.

General weakness in the USD combined with stronger Chinese import data gave the AUD/USD the momentum to break above the .7825 level last traded in April last year.

It’s worth noting that over the last 15 months, the AUD/USD has traded over .7750 four times. On each of these occasions, within a month, the AUD/USD had dropped by 4%, or more.

More precisely, after trading up to .7825 on April 21st, 2016, the AUD/USD lost over 8.5% to trade at .7150 on May 24th.

With both the RBA minutes and the monthly employment data set for release this week, we could hear some comments from the RBA regarding the impact of a higher currency on Aussie exports and the economy.

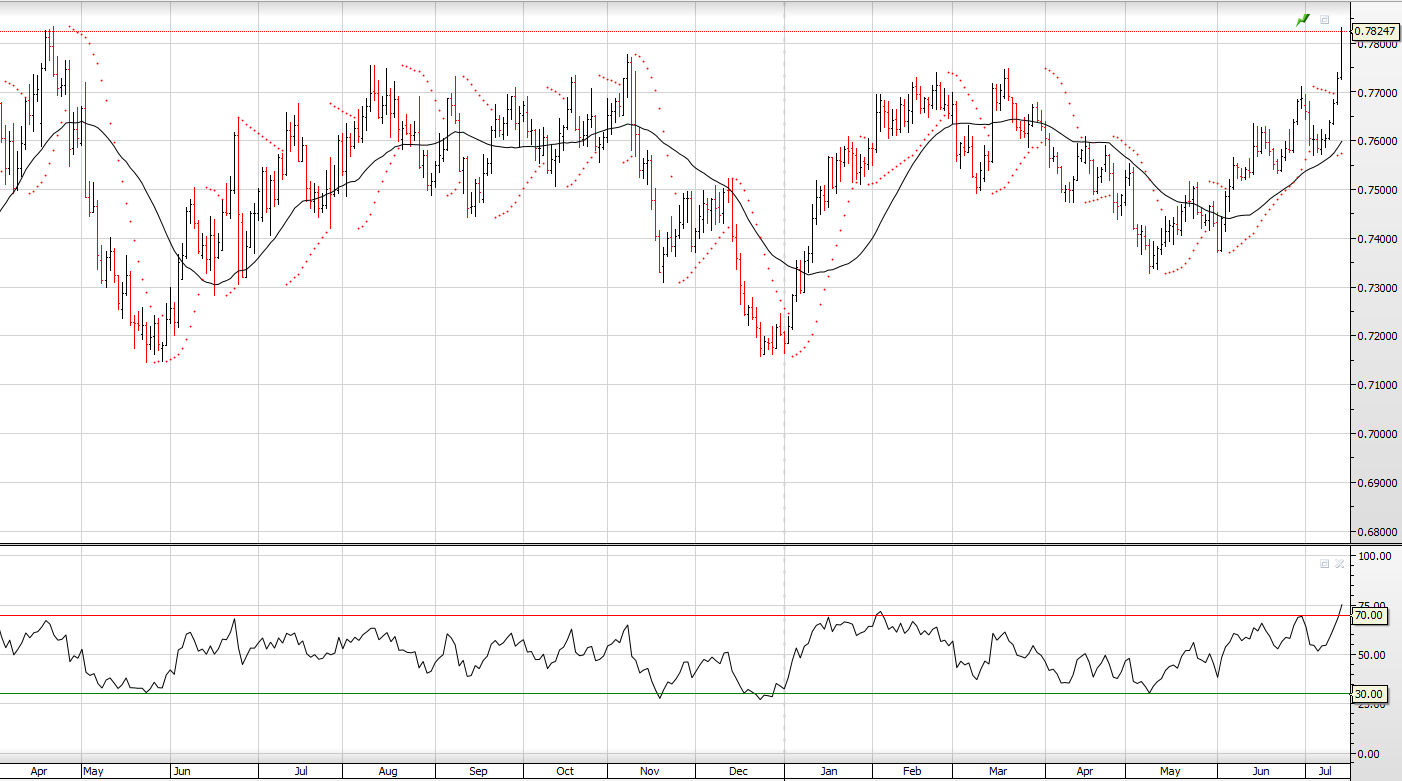

Investors looking to profit from a lower AUD/USD can look to buy the BetaShare ETF with the symbol: YANK.

YANK is an inverse ETF, which means the unit price increases as thew AUD/USD trades lower.

YANK has a 2.5% weighting, which means a 1% move in the AUD/USD translates to a 2.5% move in the unit price. The unit price is currently $13.50, we calculate that when the AUD/USD falls back to .7300, the unit price of YANK will be over $16.00.

BetaShare ETF: YANK

AUD/USD Spot price.