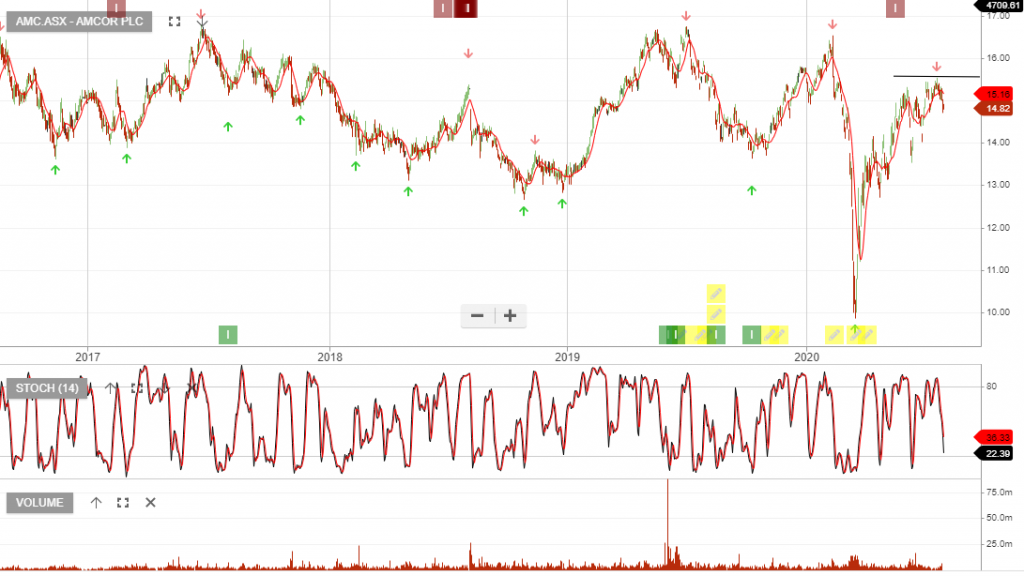

Amcor – Resistance $15

Amcor is under Algo Engine sell conditions and we see increasing selling pressure due to a weak earnings outlook.

Risks remain elevated coming into the next earnings release.

Amcor is under Algo Engine sell conditions and we see increasing selling pressure due to a weak earnings outlook.

Risks remain elevated coming into the next earnings release.

Amcor look for short-term momentum indicators to roll over and selling resistance to build within the range indicated below.

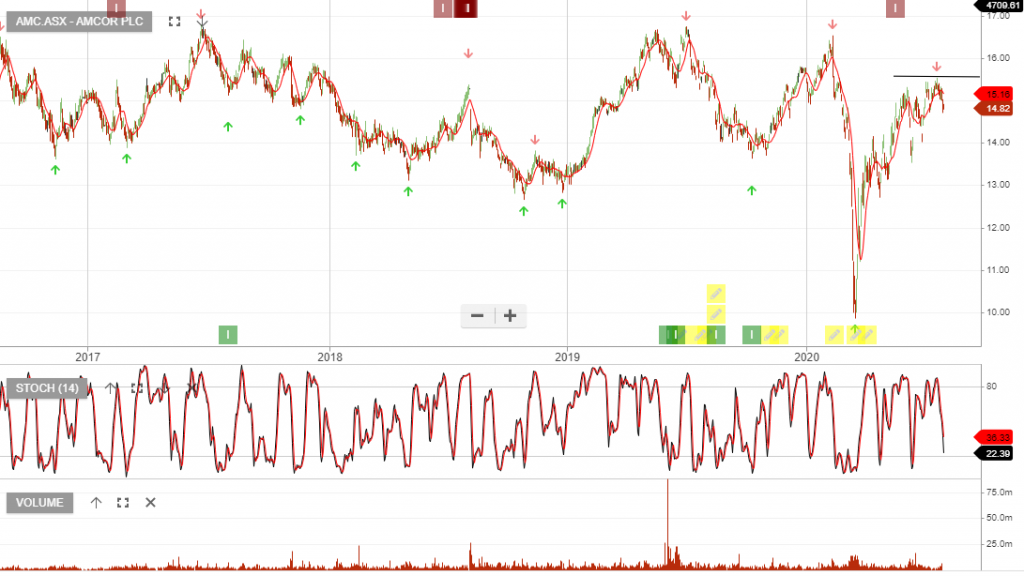

Amcor is a leading company within the global packaging space. Their business is directly impacted by slower global consumption and it’s understandable their share price has been hit with a 30% sell-off.

However, if you believe the sun will rise again and people will go out to play, Amcor is a market recovery opportunity that’s worth considering at these levels.

High Volatility – buy

Amcor is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Buy AMC at $15

Amcor reaffirmed their guidance for 5 – 10% EPS growth and US$160mn in cost synergies over the next 3 years from the Bemis acquisition.

Half of the forecast EPS growth is being achieved through cost savings, so the underlying business remains at low single-digit growth. The Q1 update removes medium-term downside risks and with the stock offering a 4.8% yield, we expect support to build at $14.50.

Amcor is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Amcor will provide an investor update on the 8th of November. We anticipate the commentary around cost synergies, post the Bemis acquisition and the share buyback will help renew buying interest in the stock

Buy Amcor for a move back towards $15.50

Amcor and is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We move to a “high conviction” buy on the stock and see long term value.

Buy Amcor within the $14 – $14.50 range.

Amcor is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The defensive earnings stream and the prospect of a share buyback next year will help to underpin any near-term share price weakness.

Buy Amcor within the range indicated below.

Amcor is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The stock made a recent high at $16.75 and has since corrected back to $15.50. The share price has found buying support and the short-term indicators have turned positive.

Amcor is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The stock made a high last week at $16.75 and has since corrected back to $15.50. Investors should add AMC to their watchlist and we suggest looking for an entry level once the short term indicators turn positive.

Or start a free thirty day trial for our full service, which includes our ASX Research.