At the start of the year, the market consensus was for the Aussie Dollar to fall against the major currency pairs during 2017. So far this year, the AUD/USD has climbed 10% and almost touched .8000 last week.

At 1pm today, RBA chief Philip Lowe will be giving a speech in Sydney. Since many exporters look at .8000 as a pain level, it’s reasonable to expect Mr Lowe to comment about the level of the Aussie.

The strengthening AUD/USD has created a headwind for domestic companies with earnings exposed to the softening USD.

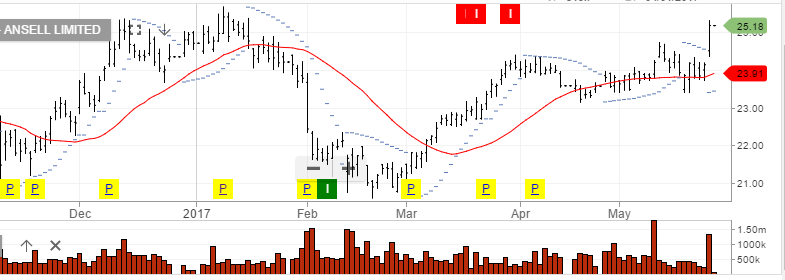

Four companies that we follow which have seen their share prices dampened due to a stronger Aussie are: BXB, CPU, ANN and JHX.

Australian Dollar