Aurizon Holdings:

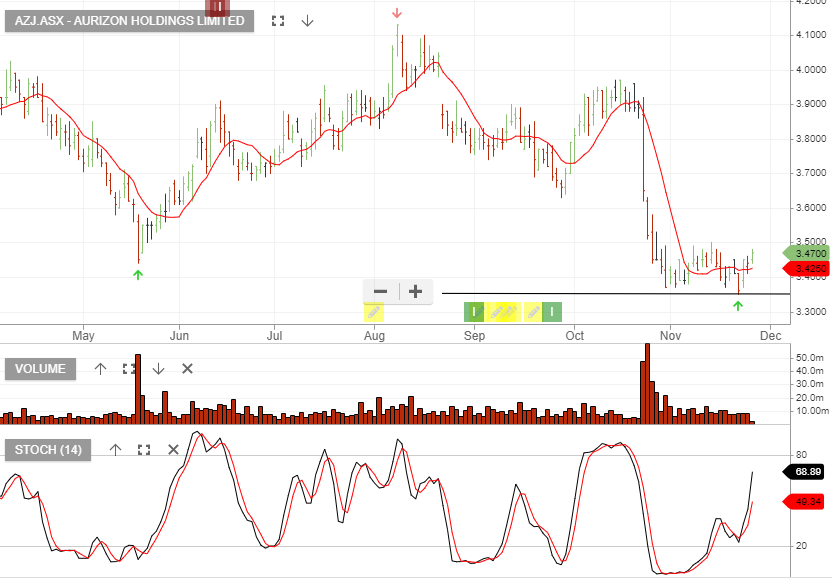

Aurizon Holdings is under Algo Engine buy conditions. Watch for this to drop into the Trade Table on a close above the 10-day average.

Aurizon Holdings is under Algo Engine buy conditions. Watch for this to drop into the Trade Table on a close above the 10-day average.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Aurizon Holdings is under Algo Engine buy conditions. 1H22 underlying EBITDA was down 1.5% to $727m and underlying NPAT was $257m.

We expect Bulk to continue being strong, with record crop production across Australia and new

contracts, although a soft volume outlook for Coal leaves low single-digit earnings growth at best for FY22.

The dividend was $0.105 with a payout of 75%. The forward div yield is now 5.7% and EPS growth likely to be flat to +2%. OneRail transaction is progressing with key ACCC assessment due in

March.

Aurizon Holdings offers value and we expect buying support to build above the $3.35 support level.

Aurizon Holdings is under Algo Engine buy signals.

Aurizon reported underlying earnings before interest taxation depreciation and amortisation (EBITDA) of $1.48 billion and told investors to expect underlying EBITDA of between $1.42 billion-$1.5 billion in fiscal 2022.

Aurizon Holdings is under Algo Engine buy signals.

Aurizon reported underlying earnings before interest taxation depreciation and amortisation (EBITDA) of $1.48 billion and told investors to expect underlying EBITDA of between $1.42 billion-$1.5 billion in fiscal 2022.