Iluka

Iluka Resources is rated a buy with the stop loss at $5.73

Iluka Resources is rated a buy with the stop loss at $5.73

Iluka Resources is under Algo Engine buy conditions.

Iluka Resources Limited is a prominent Australian critical minerals company, specializing in the exploration, project development, mining, processing, and marketing of mineral sands and rare earths. The company is a globally significant producer of zircon and high-grade titanium dioxide feedstocks, including rutile and synthetic rutile. Iluka also has a growing presence in the rare earths sector, with a focus on becoming a material supplier of refined rare earths through its Eneabba refinery in Western Australia.

As of December 19, 2025, Iluka Resources had a market capitalization of approximately A$2.33 billion. The company’s shares are listed on the Australian Securities Exchange (ASX) under the ticker ILU and it is a constituent of the S&P/ASX 200 Index.

Recent market conditions have presented both challenges and strategic adjustments for Iluka. The company announced a temporary production halt at its Cataby mine and Synthetic Rutile Kiln 2 (SR2) operations in Western Australia, effective December 1, 2025. This decision was a response to challenging market conditions, specifically reduced global demand for mineral sands and downstream products in the titanium dioxide pigment sector, indicating a disciplined approach to resource management during cyclical downturns. Despite these short-term adjustments, Iluka continues active operations at its Jacinth-Ambrosia mine in South Australia and is progressing with commissioning activities for its Balranald mine in New South Wales.

The company’s long-term outlook appears robust due to its diversification into rare earths, which positions it well for growing technology metals markets. Analysts covering Iluka Resources have a consensus target price of AU$7.34, suggesting a potential upside of 34.89% from its recent closing price of AU$5.44. This reflects cautious optimism regarding the company’s future prospects as demand signals for its products are closely monitored.

Iluka Resources is breaking out after forming a higher low at $3.50.

Iluka Resources is rated a buy.

Iluka Resources reported 2023 underlying EBITDA of $609mn & NPAT of $343mn, a strong beat vs consensus.

An update was provided on the mineral sands market, major projects including the rare earth refinery, and 2024 guidance. The zircon market is showing signs of further improvement, with ILU’s contracted zircon sand sales in 1Q24 now up nearly 100% to ~45kt.

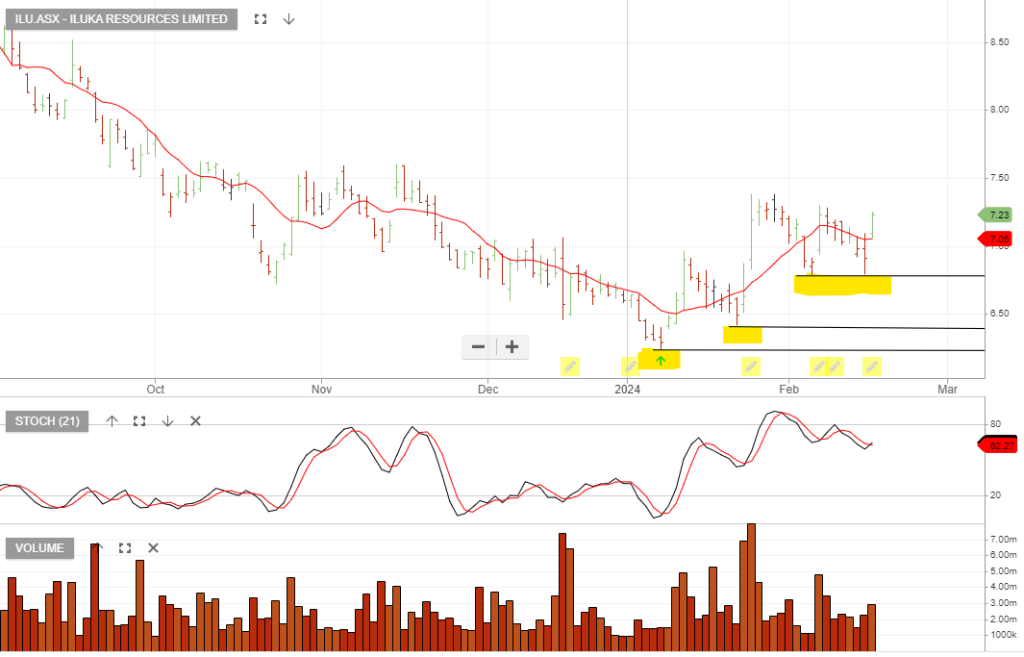

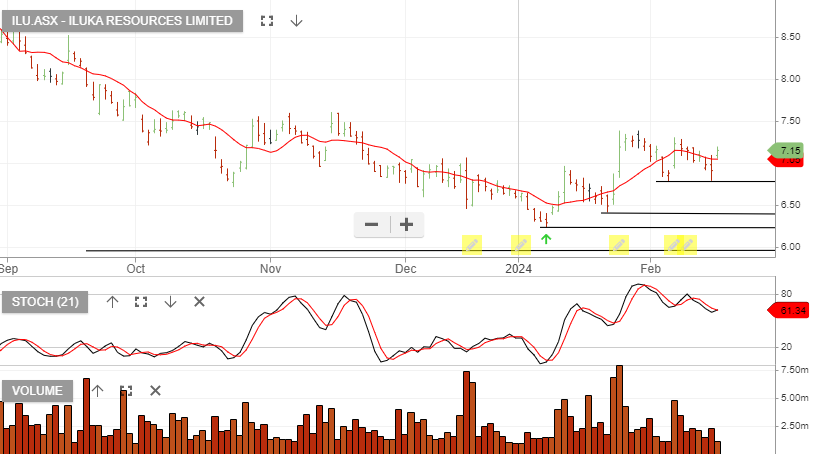

Iluka Resources is under Algo Engine buy conditions and the higher low support levels continue to build, as indicated by the highlighted areas. Traders can consider buying ILU and placing a stop loss at $6.79.