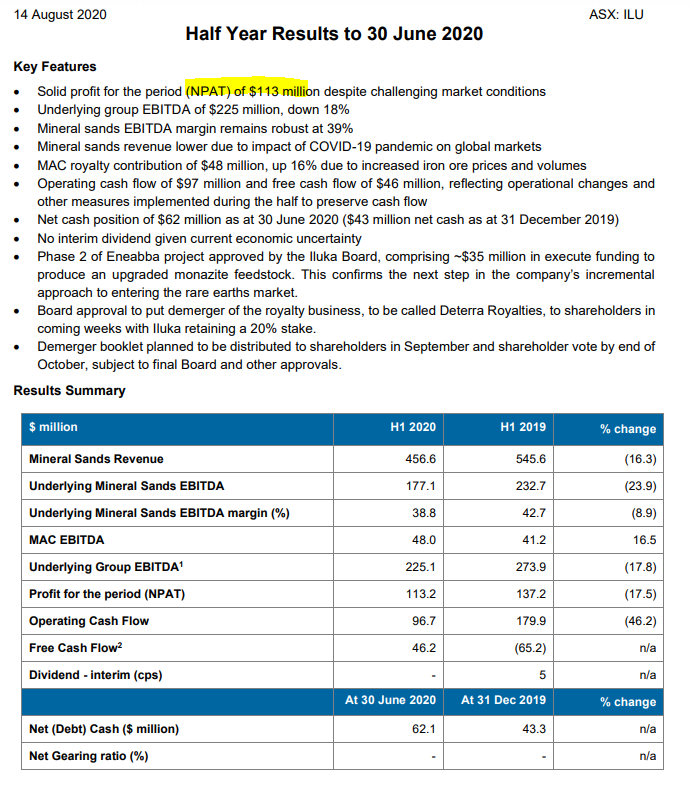

Iluka Resources

Iluka Resources is under Algo Engine buy conditions.

Iluka Resources is under Algo Engine buy conditions.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Iluka Resources is under Algo Engine buy conditions.

Iluka shareholders will have the opportunity to vote on the demerger at a meeting on 16 October 2020.

If the demerger proceeds, eligible shareholders will receive one share in Deterra for every Iluka share held at the demerger record date. Iluka will retain a minority shareholding interest of 20 percent in Deterra as a long-term investment.

The demerger will result in two independent ASX-listed companies – Iluka Resources Limited, a global leader in the mineral sands industry and Deterra Royalties Limited, the largest independent royalty company listed on the ASX, with the MAC iron ore royalty as its cornerstone asset.

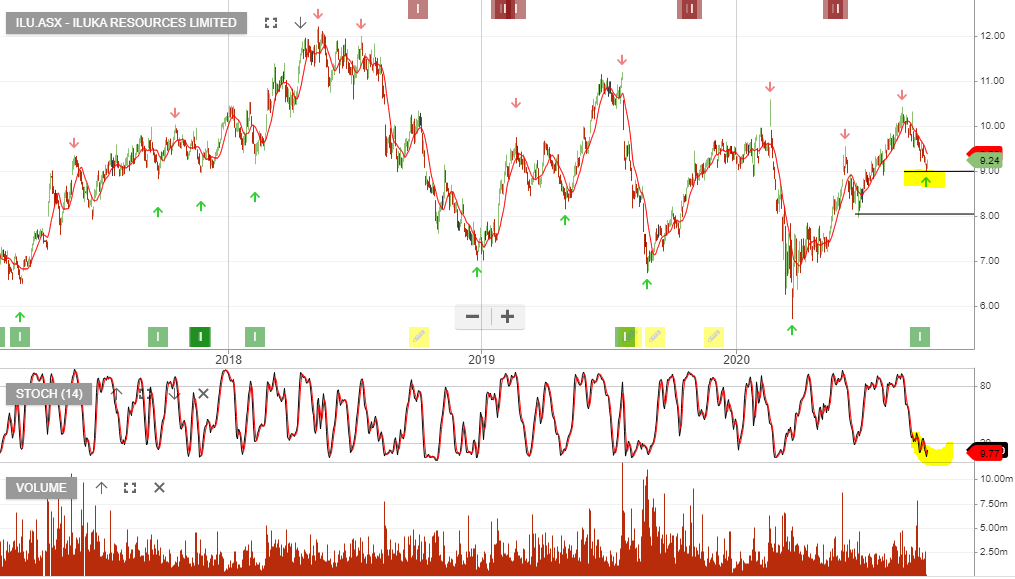

Iluka Resources is now under Algo Engine buy conditions and we see buying support increasing at $9.00.

Iluka Resources is under Algo Engine sell conditions and we’re watching the price action for selling pressure to build near the $10 level.

ILU is now on our radar as a potential short.

Iluka Resources is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We expect to see buying interest pick up near the current $7.00 price level.

Buy ILU within the $7.00 – $7.50 price range.

Iluka Resources is now under Algo Engine buy conditions and we have identified the $8.00 – $8.50 price range as a likely area of support.

Watch the short-term indicators for a turn higher.

Iluka Resources is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The share price has found support at $9 and the short-term indicators have now turned positive.

Or start a free thirty day trial for our full service, which includes our ASX Research.