Inghams

Inghams Group has been removed from the ASX200 but remains on the ASX300 watchlist. The buying interest is rebuilding, and the pivot low is in place at $2.35.

Buy with a stop loss at $2.45

Inghams Group has been removed from the ASX200 but remains on the ASX300 watchlist. The buying interest is rebuilding, and the pivot low is in place at $2.35.

Buy with a stop loss at $2.45

Inghams Group : Add to watchlist and wait for the price action to cross above the 10-day average.

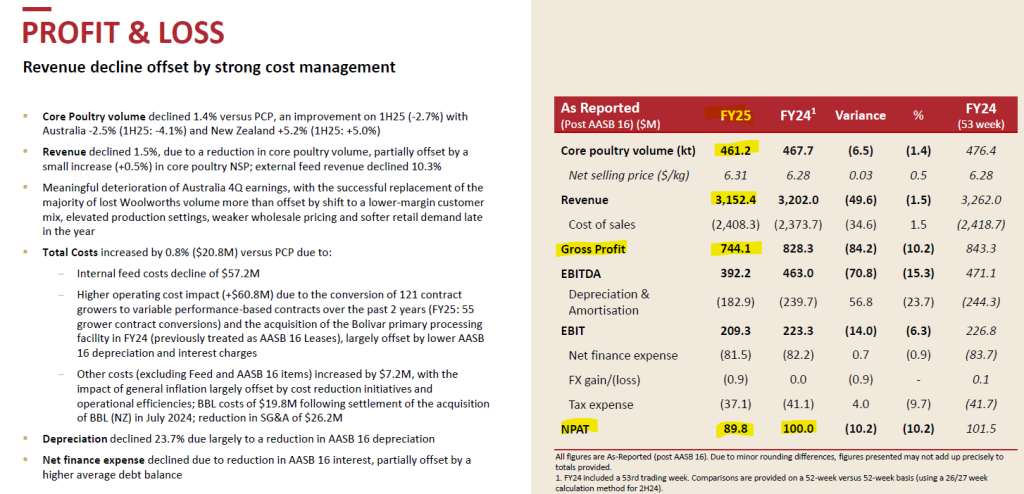

Inghams Group FY25 after-tax profits fell 10% and the business is focusing on cost cuts following the loss of Woolworths volume.

Outlook: FY26 Underlying EBITDA (pre AASB 16) expected between $215.0M and $230.0M. Earnings profile expected to be significantly weighted to 2H26, reflecting lower FY25 exit run rate and timing of benefits from operational reset.

We rate Inghams as a buy and see value at the current price level.

CHALLENGING SECOND HALF CONDITIONS

FY25 Results Presentation | 22 August 2025

Australia (AU) – Challenging demand environment with operational disruptions

▪Replaced majority of lost Woolworths volume, albeit with shift to a lower-margin mix reflected in 2H25 run-rate

▪Retail and out-of-home demand subdued, with cost-of-living pressures dampening Retail category volumes during 4Q25

▪Significant Wholesale pricing pressure reduced FY25 margins

▪Net 2H25 impact: Softer demand and margin pressure from Wholesale/new business pricing and mix; lower Retail and higher Wholesale volumes in 2H25, partly offset by operational efficiencies

Inghams Group : Add to watchlist and wait for a break above the 10-day average.

Inghams Group will likely find buying support within the $2.75 – $2.95 price range.

Inghams Group will likely find buying support within the $2.75 – $2.95 price range.

Inghams Group is rated a buy with a stop loss at $3.43.