IPL up 39%

Incitec Pivot was added to the ASX model portfolio in May this year and is now up 39%. Today, the company announced a 91 percent increase in net profit for FY21.

Incitec Pivot was added to the ASX model portfolio in May this year and is now up 39%. Today, the company announced a 91 percent increase in net profit for FY21.

Incitec Pivot is now under Algo Engine buy conditions.

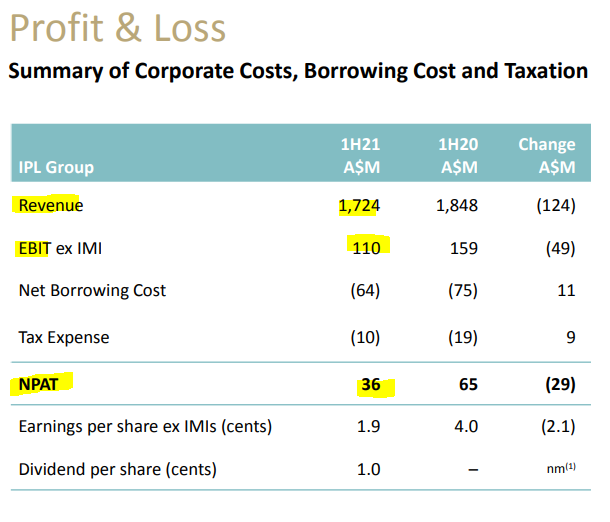

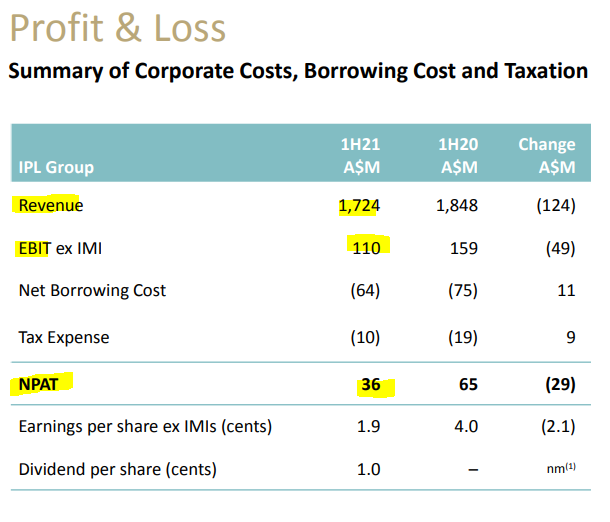

The company reported 1H21 Sales of $1.72m with underlying EBITDA of $286m. The EBIT miss was primarily driven by Fertilizers and Dyno Americas, with Dyno APAC largely in-line.

Our Option Lab AI technology suggests looking at the following call.

3/6 Buy IPL

Call options are now trading $0.20 to $0.24

Incitec Pivot is now under Algo Engine buy conditions.

The company reported 1H21 Sales of $1.72m with underlying EBITDA of $286m. The EBIT miss was primarily driven by Fertilizers and Dyno Americas, with Dyno APAC largely in-line.

Our Option Lab AI technology suggests looking at the following call.

Incitec Pivot operates in explosive/mining services and fertilizers. The stock remains under Algo Engine sell conditions, but we continue to watch the buying momentum and the upcoming earnings result for signs of strength.

We are encouraged by the recent capital raising which has helped to strengthen the balance sheet and should help navigate any short-term COVID-19 volatility.

IPL trades on a forward yield of 2.2%.

Incitec Pivot is under Algo Engine sell conditions.

IPL is raising A$600mn via an underwritten placement and A$75mn via a share purchase plan at a 9% discount to the closing price on 8 May.

IPL’s capital raising is likely to be a positive near-term catalyst as a result of removing the funding risk. Although, we expect downward pressure on commodities to make the near-term operating conditions difficult for both IPL and ORI.

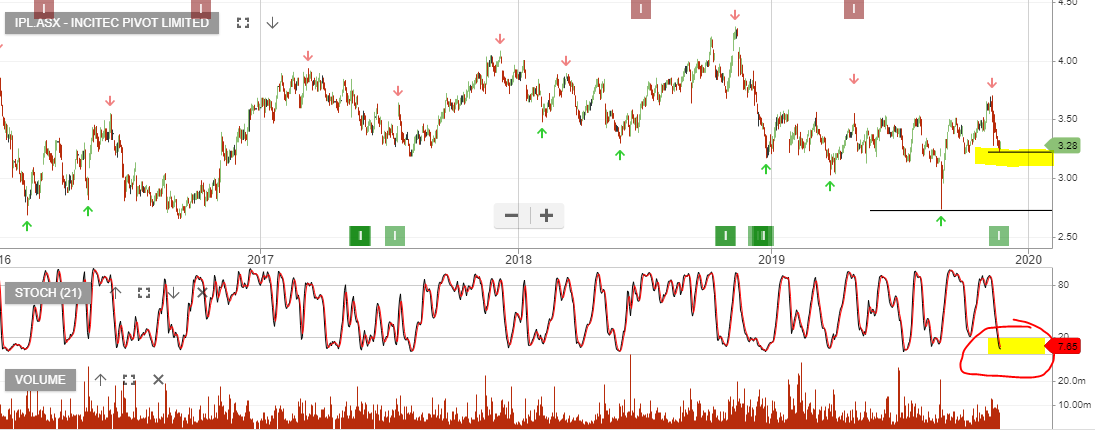

Incitec Pivot was triggered as an Algo Engine buy signal on Thursday 21st November. With an improving outlook for earnings in FY20 & 21 we’re willing to take a closer look at the upside potential.

The short-term technical indicators are about to turn positive and we’re likely to see buying interest pick-up near the $3.20 support level.

We’ll revisit this opportunity as the entry conditions playout next week.

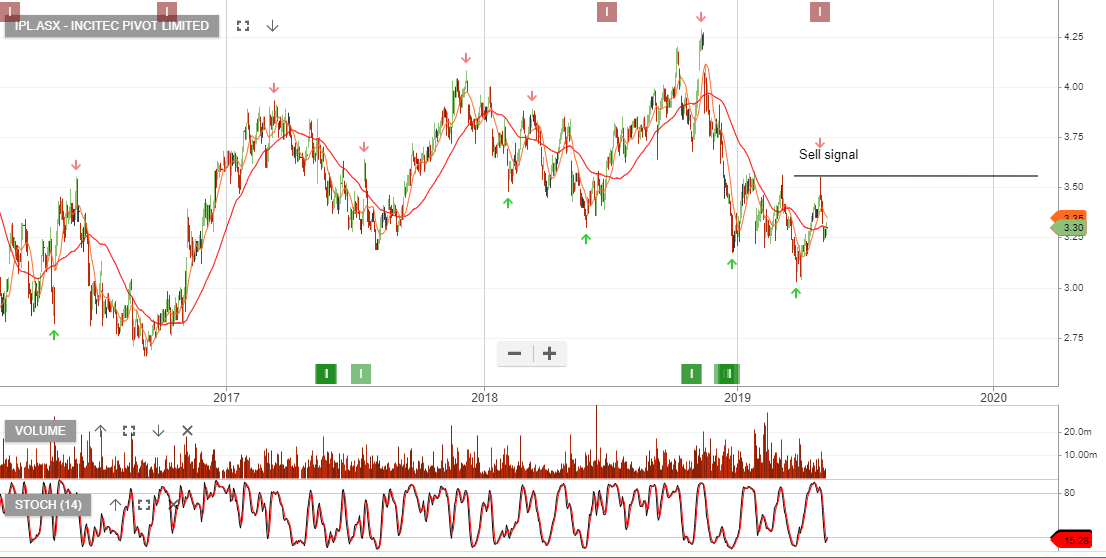

Incitec Pivot reports 1H19 earnings on Monday the 20th of May. We’re expecting the result to disappoint the market and we place our readers on alert.

Queensland floods and plant disruptions will offset any benefit from higher fertilizer prices. If the earnings release is as negative as we forecast, we feel that a buying opportunity will present soon after the announcement.

We see the FY19 issues largely as one-off in nature and there will likely be an opportunity to profit from a recovery in the back-half of 2019.

Keep this one in your diary and look out for next week’s update on the blog. We’ll identify the entry level, post the result.

Incitec Pivot is under Algo Engine buy conditions and is a current holding in the ASX 100 model.

The FY19 earnings of IPL will be impacted by the Queensland floods and we’ll see the numbers revealed in the coming weeks. There’s a chance the impact will be greater than current consensus, which may result in short term selling. If this occurs and an opportunity to buy IPL sub $3.00 eventuates, we would consider this a “high conviction” accumulation play.

Add IPL to your watch list.

IPL is under Algo Engine buy conditions following the higher low formation at $3.20.

The stock price has been sold off following concerns around the impact of the Queensland floods. In particular, the short term closure of the Phosphate Hill plant and the impact to rail transport.

With the stock now trading 10x FY20 earnings we see much of the downside risks, already priced in.

Accumulate IPL between $3.00 and $3.20

Incitec Pivot, (IPL) is under Algo Engine buy conditions and despite the earnings impact from the North Queensland floods, we see value for patient investors.

Heavy rainfall in North Queensland has resulted in the shutdown of Incitec Pivot’s Phosphate Hill plant, (closure of the rail line between Townsville and Phosphate Hill).

Or start a free thirty day trial for our full service, which includes our ASX Research.