IPL – Take Profits Or Sell Call Options

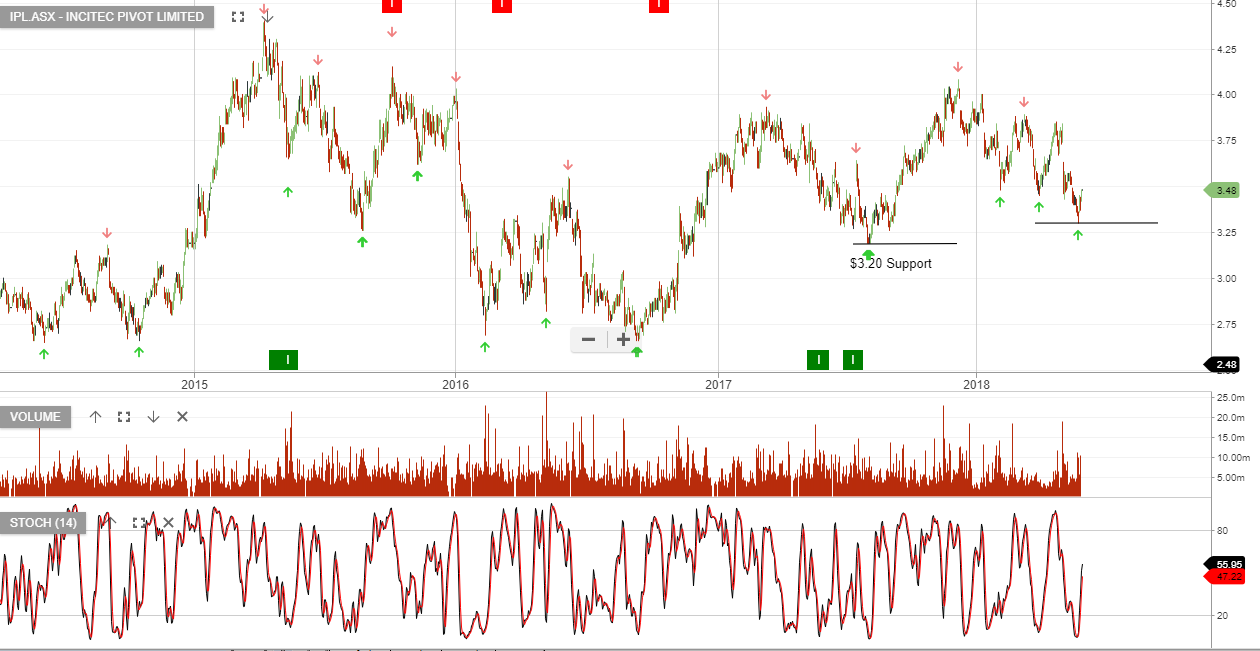

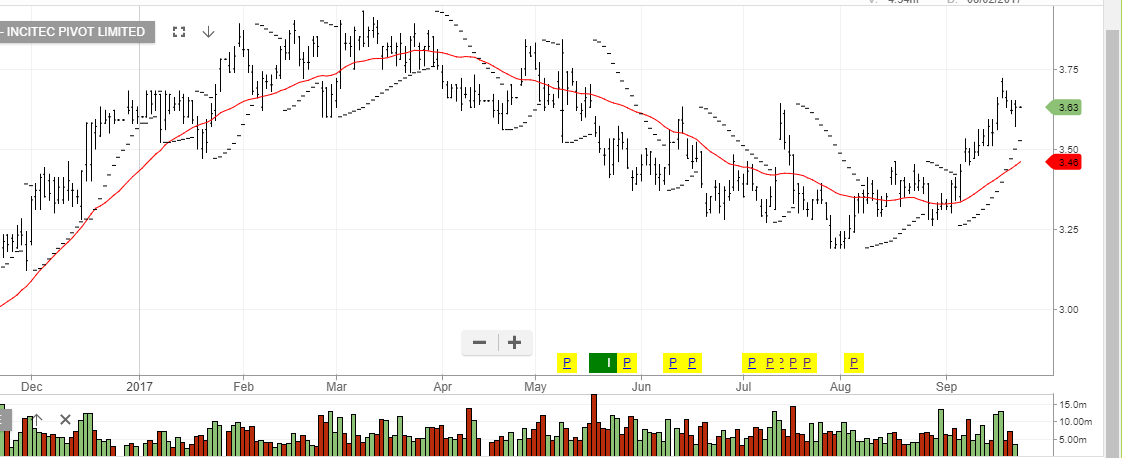

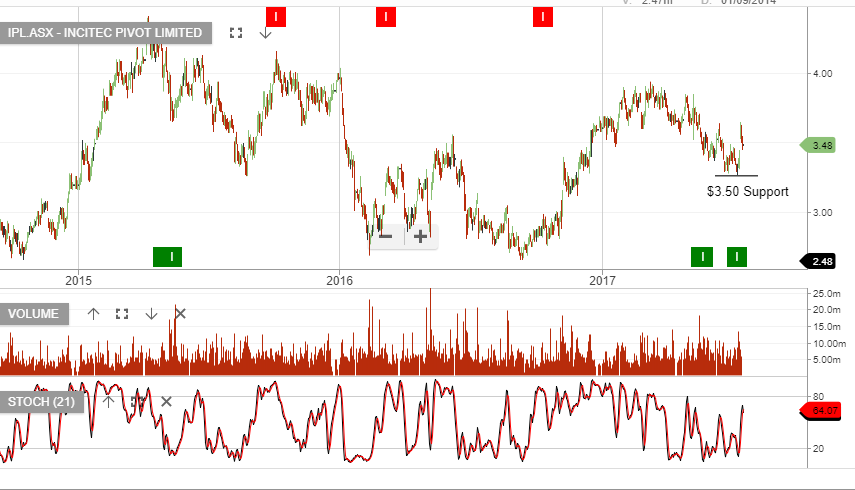

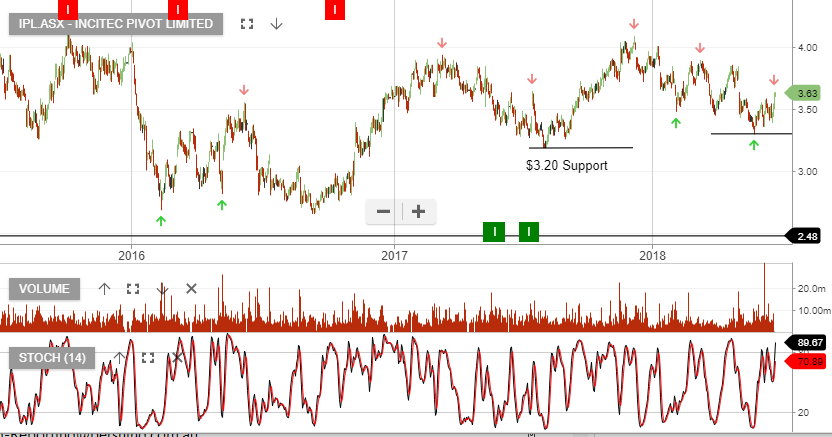

In mid-2017, our Algo Engine generated a buy signal in IPL and more recently we reaffirmed the entry into IPL when the stock looked to be finding support near $3.40 range.

Since then, IPL has rallied 8% and is now closing in on our $3.70 price target. The short term momentum indicators are also now approaching an overbought range.

IPL goes ex div 5 cents on the 23rd of November. Selling $3.70 September call options will add an additional 11 cents of income per share.

IPL