Woolworths – Valuation Review

Woolworths has recently sold their petrol business to BP for $1.8b which helps to underpin the groups balance sheet. As a result, we’re likely to see Woolworths accelerate their store refurbishment program.

In late February we’ll see the earnings update from Woolworths and based on consensus numbers we expect $58b in revenue, EBIT of $2.5b with reported profit around $1.5b.

On a forward basis the underlying earnings growth should track around 4% with FY18 EPS of $1.30 and DPS $0.88, this will place the stock on 3.7% yield.

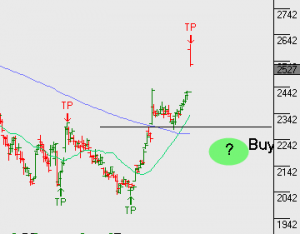

Any rally in the share price following the Feb result, we feel adding a covered call at or near $25 – 26.50 offers a suitable risk reward payoff.