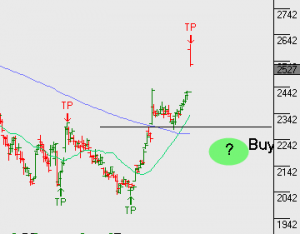

ALGO Buy Signal For Woolworth’s

The ALGO engine triggered a buy signal on WOW at yesterday’s close at $25.10.

This is purely a technical signal. However, with the dividend yield close to 3.8% with the price at $25.00, it looks like a reasonable defensive stock in an uncertain market.

We’re looking for a price recovery to the $27.00 area to take profits or write covered calls to enhance portfolio returns.

Woolworth’s