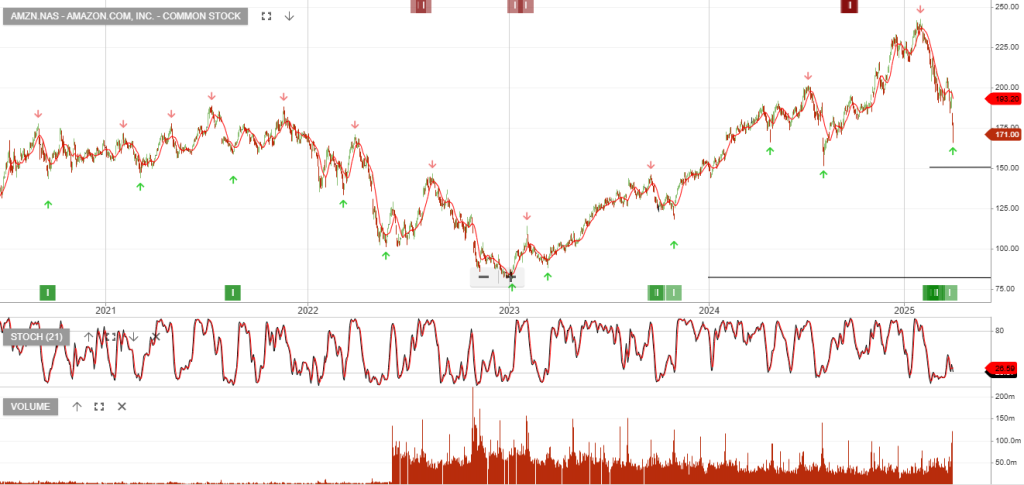

Amazon

Amazon.com, Inc. – Common is under Algo Engine buy conditions.

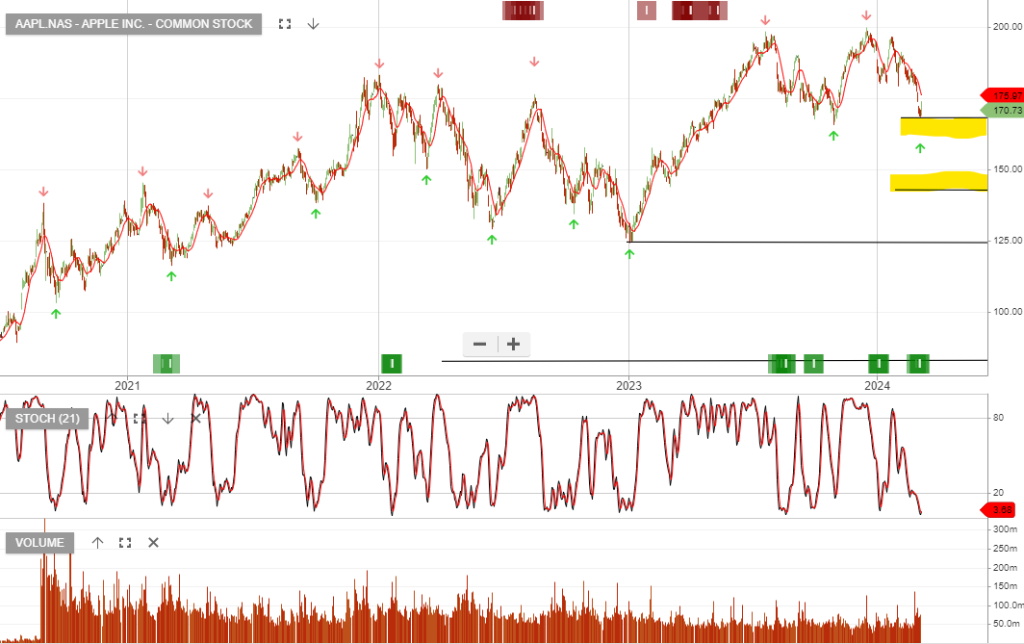

Magnificent 7

In Q4 2023, the group achieved a market-weighted average of 60% YoY operating profit expansion, while Apple contributed an underperforming 11%.

- Tesla Q4: -47%

- Apple Q4: +11%

- Google Q4: +27%

- Microsoft Q4: +33%

- Meta Platforms Q4:+41%

- Amazon Q4: +388%

- Nvidia Q4: +980%

Apple and Google are under recent algo engine buy signals, and we’re now building exposure within the identified value ranges.

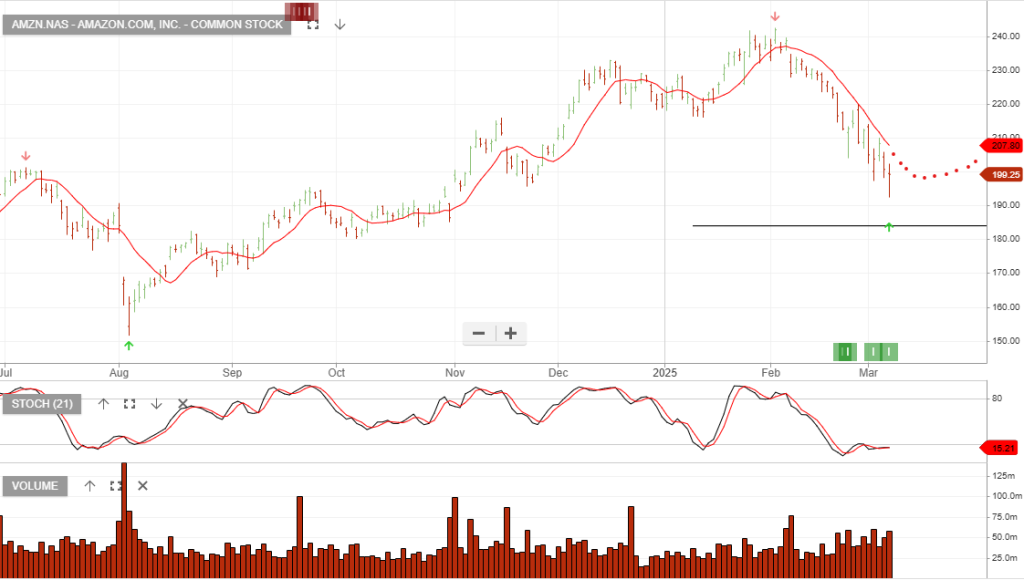

Amazon: Trade Table +12.4%

Amazon.com, Inc. – Common is a current holding in the US Trade Table.

Amazon – Earnings

Amazon.com, Inc. – Common is under Algo Engine buy conditions and has been in our US S&P100 model portfolio since Aug 2019. The stock is up 70% after 919 days.

Amazon delivered 9% revenue growth in Q4.

- Earnings per share (adjusted): $5.80 vs $3.57 expected, according to a Refinitiv survey of analysts

- Revenue: $137.4 billion vs $137.6 billion expected, according to a Refinitiv survey of analysts

- AWS revenue: $17.8 billion vs $17.37 billion expected, according to StreetAccount

Amazon guided for first quarter revenue of between $112 billion and $117 billion

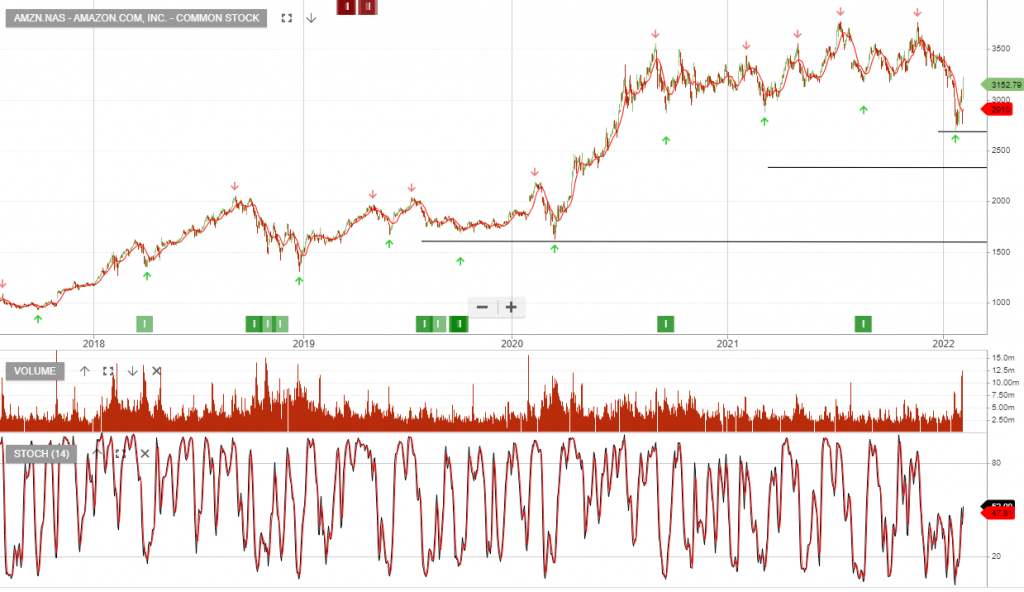

Amazon – Buy Signal

Amazon.com, Inc. – Common is under Algo Engine buy conditions and has been in our US S&P100 model portfolio since Aug 2019. The stock is up 84.40% after 761 days.

Last week’s low at $3,175 triggered another buy signal which makes it the third cluster of buy signals since the original switch to buy in 2019.

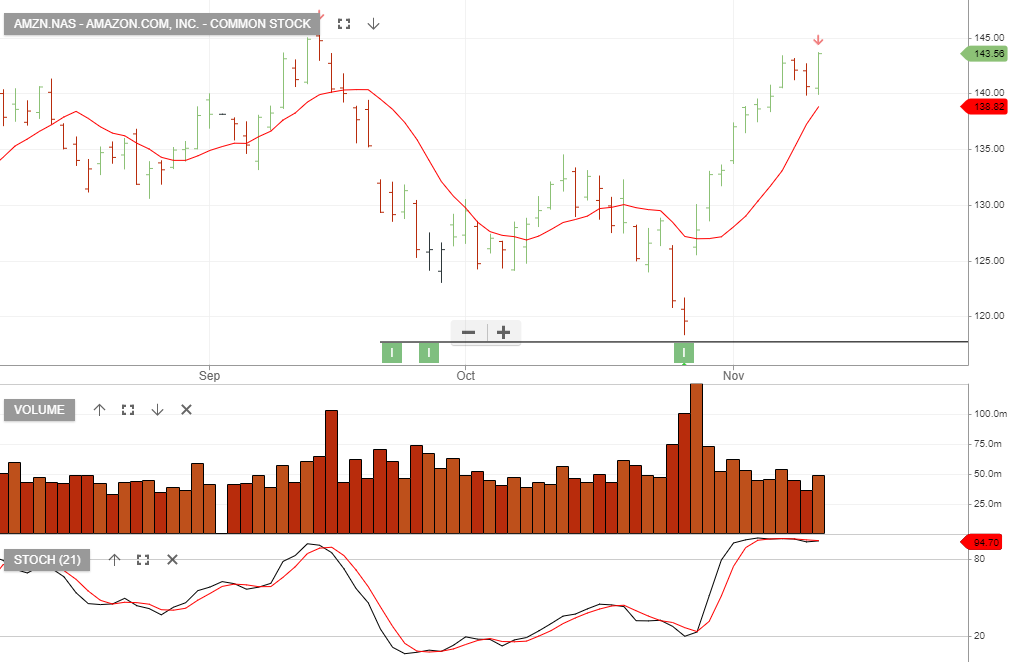

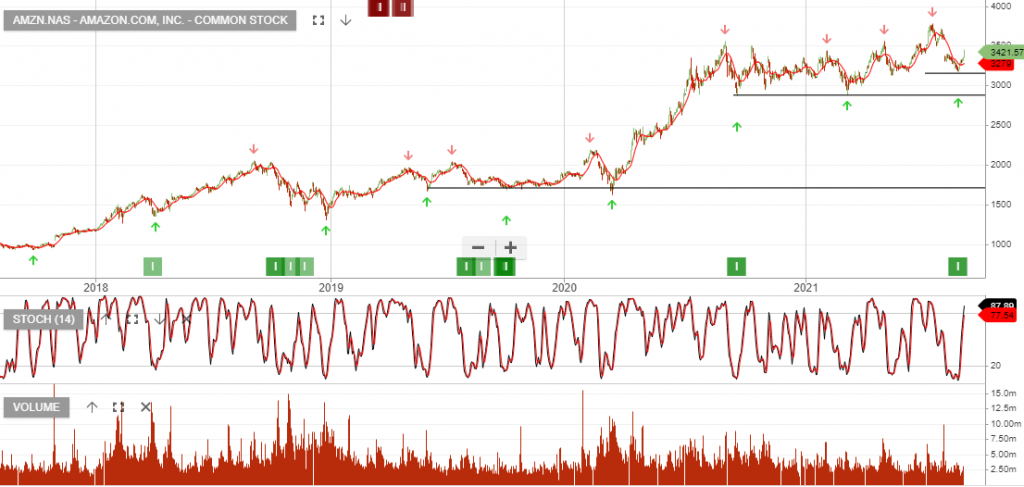

Amazon – Buy Signal

Amazon is under Algo Engine buy conditions and is a current holding in our US S&P100 model portfolio.

We see price support developing near the $1735 level.