Magnificent 7

In Q4 2023, the group achieved a market-weighted average of 60% YoY operating profit expansion, while Apple contributed an underperforming 11%.

- Tesla Q4: -47%

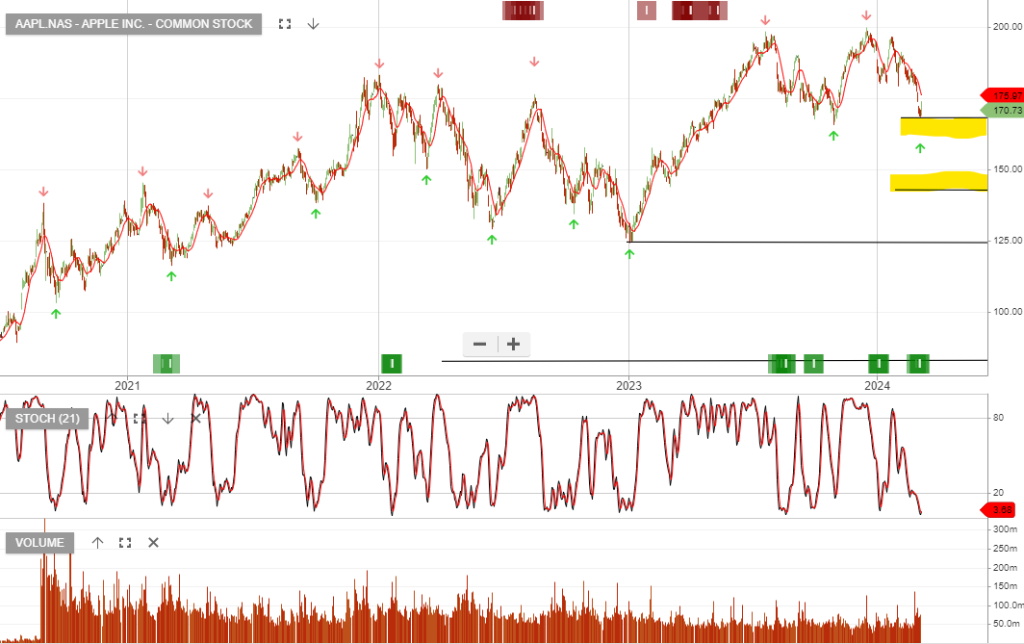

- Apple Q4: +11%

- Google Q4: +27%

- Microsoft Q4: +33%

- Meta Platforms Q4:+41%

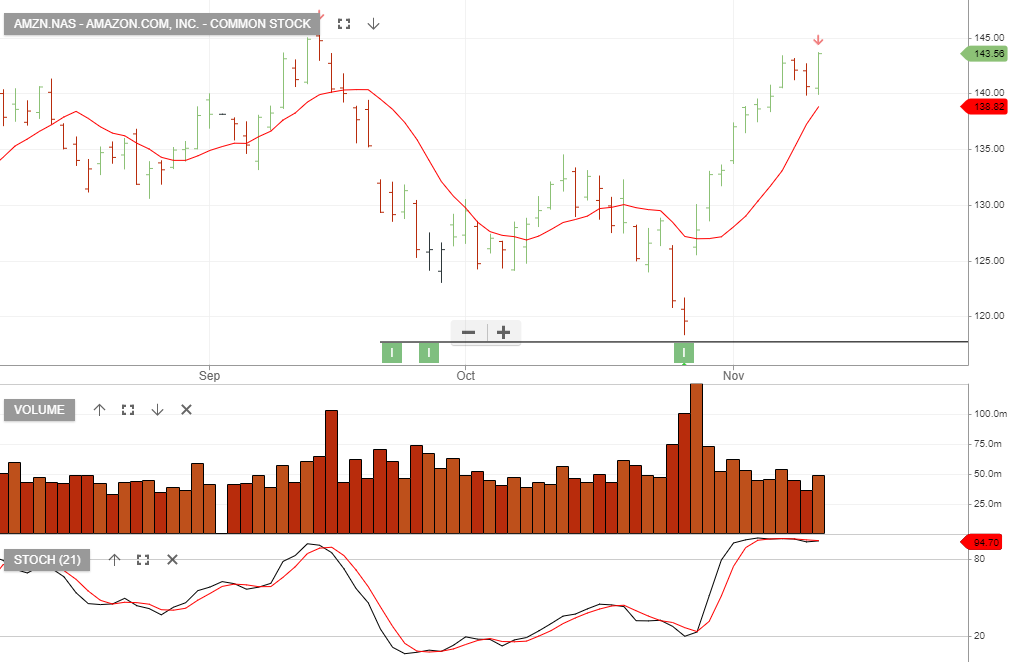

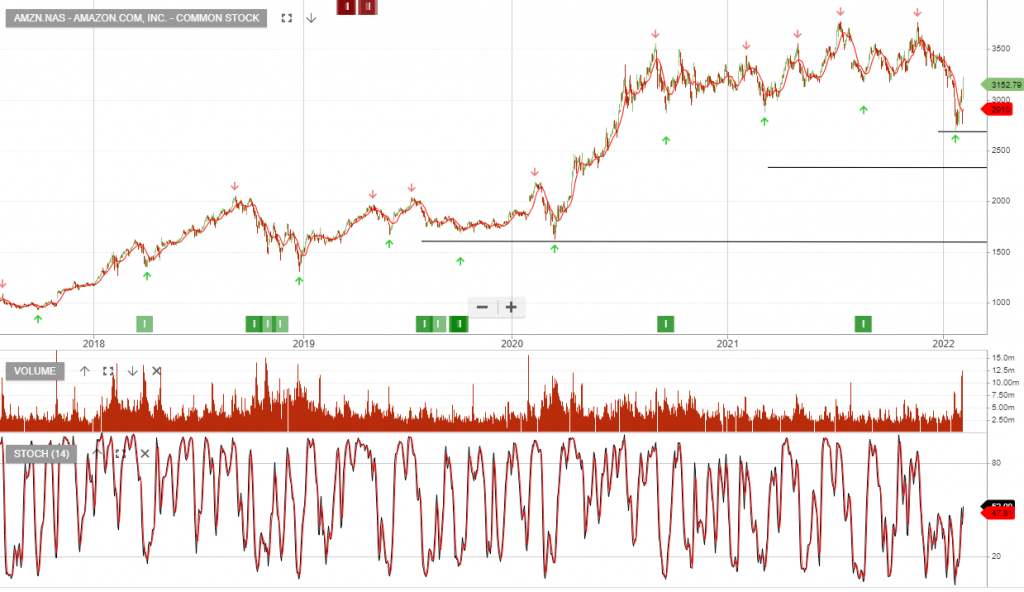

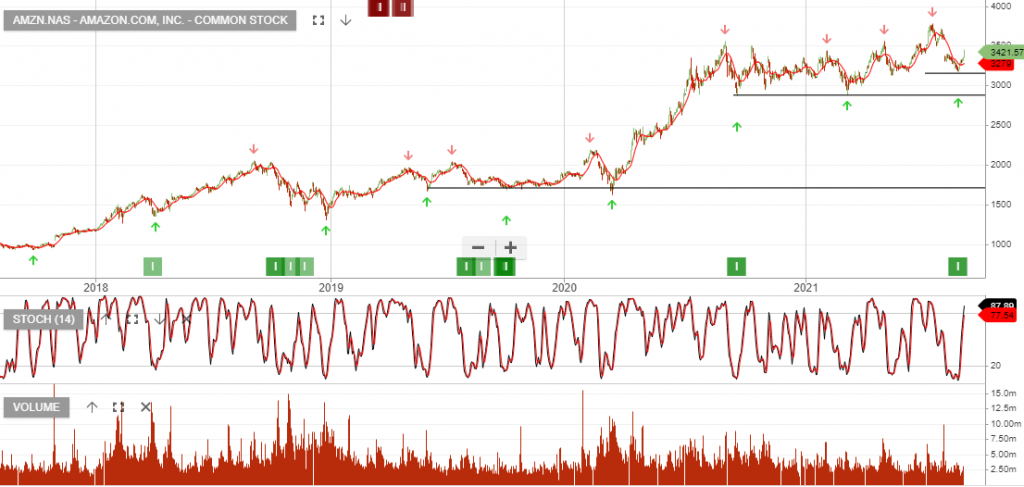

- Amazon Q4: +388%

- Nvidia Q4: +980%

Apple and Google are under recent algo engine buy signals, and we’re now building exposure within the identified value ranges.