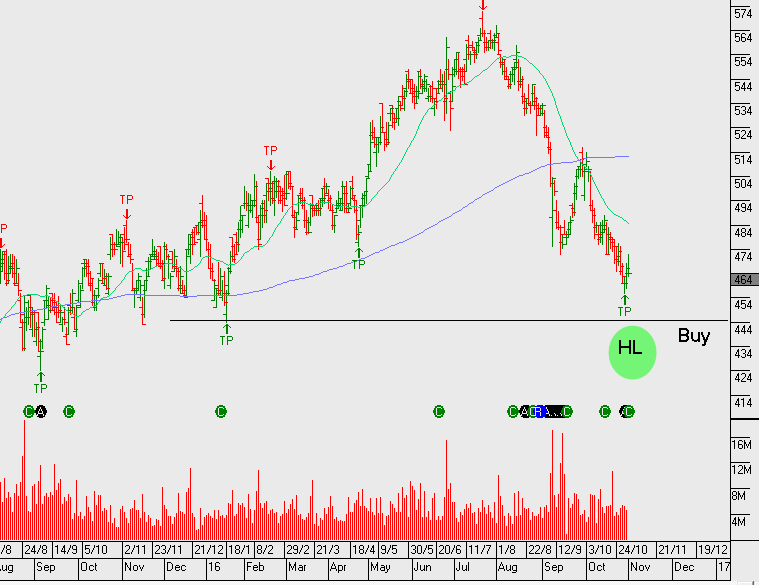

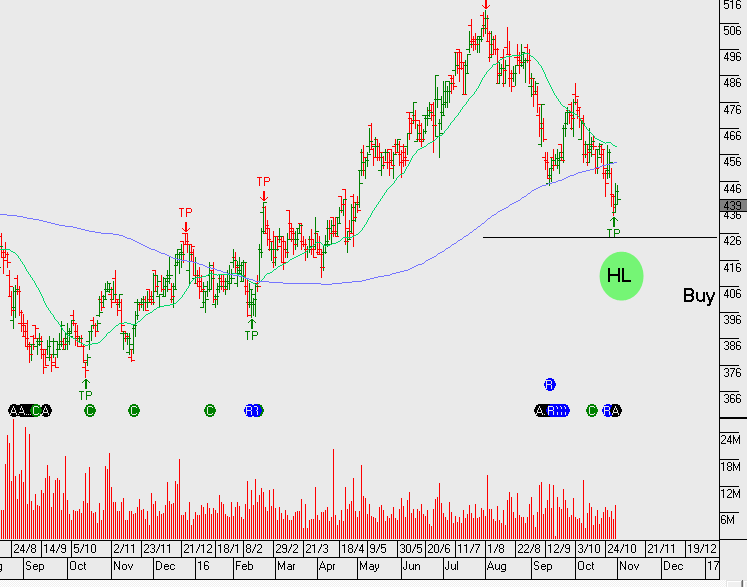

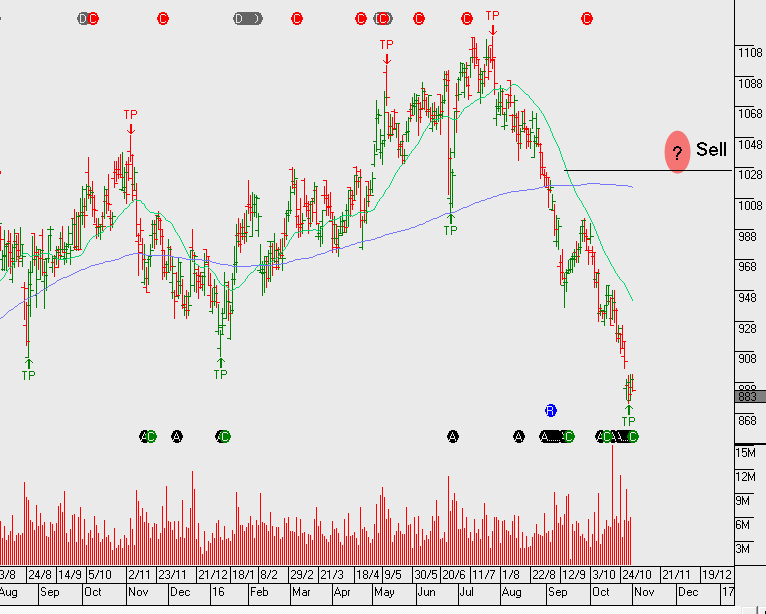

Over the last two months, bond markets have been repricing the probability of a US rate increase. During that time, we’ve watched the US10YR yields trade up from 1.3% to 1.9% . As a consequence, money managers have sold-off defensive yield names. This has been most evident in ASX 50 names within the infrastructure and property sectors.

We maintain a positive interest in these names as the current share prices now have many of the yields offering 100 basis points, (or 1%), more than they were trading at 2 months ago.

WFD and GMG are now trading back on 4% yield, whereas TCL, SYD, GPT and SCG are on average trading near 5% yield.

The December FOMC rate decision meeting will likely be the catalyst for a bounce, however, we’re not expecting these names to recapture the recent highs. Therefore, we’ll look to sell the rally into the early part of 2017. The algorithm engine will track these names and I’ll be certain to alert you to the next lower structural high, but for the time being, you may want to position around the short term bounce which could offer up to a 10% rally.