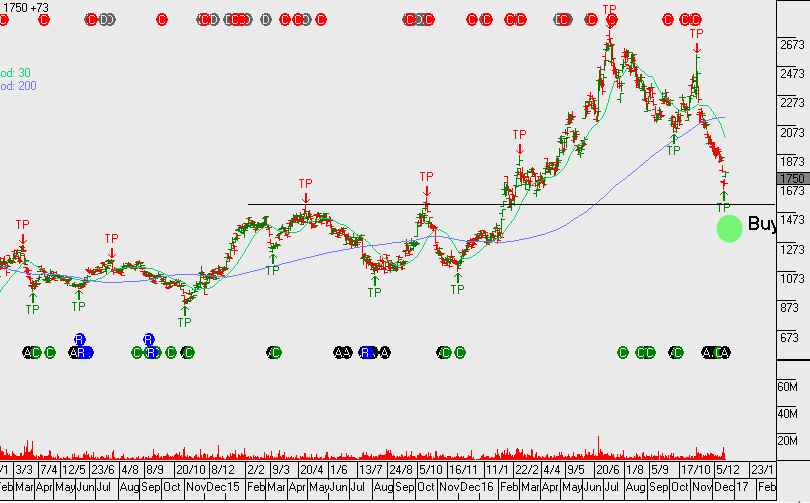

The US Dollar Index has rallied to its strongest level in more than 13 years as the market continues to digest the ramifications of the FED’s more aggressive interest rate policy trajectory.

Financial markets weren’t surprised when the FOMC announced an increase to the Fed Funds target from .50% to .75%. The move had been widely expected since the October meeting and the FED funds futures had been pricing in a 100% percent certainty of the move.

However, financial markets were not expecting the FED’s “dot plots” to reflect expectations of at least three more rate moves during 2017. Since Wednesday’s announcement, we have seen the EUR/USD trade back below the 1.0400 level and the USD/JPY break the 118.50 level for the first time since February.

It’s important to remember that with a stronger USD comes headaches for other Central banks around the world who will incur a higher cost of servicing USD denominated debt. The stronger USD also poses a risk for the US economy especially in an environment of rising US finance costs.

In short, if the new administration doesn’t come up with a viable stimulus package quickly, the US economic growth story could fade. This could translate into a significant correction in US Stocks, US Treasury rates and the Greenback.

However, before hitting the sell button on long US asset trades, it is important to realize that for the dollar rally to end, dollar bulls need a reason other than year end profit taking to give up on their trades. The latest round of economic reports continues to support the bullish move in the US Dollar.

Despite a stronger USD, manufacturing activity in the NY and Philadelphia regions accelerated. Consumer prices also grew 0.2%, which was in line with expectations and jobless claims dropped to 254K from 255K. The NAHB housing market index jumped to its highest level in 11 years.

The stronger USD over the last month should have softened these data: weakened the trade figures, manufacturing activity and made it more difficult for the Fed to achieve its inflation target, but we need to see evidence of that before selling the USD and US Stocks.

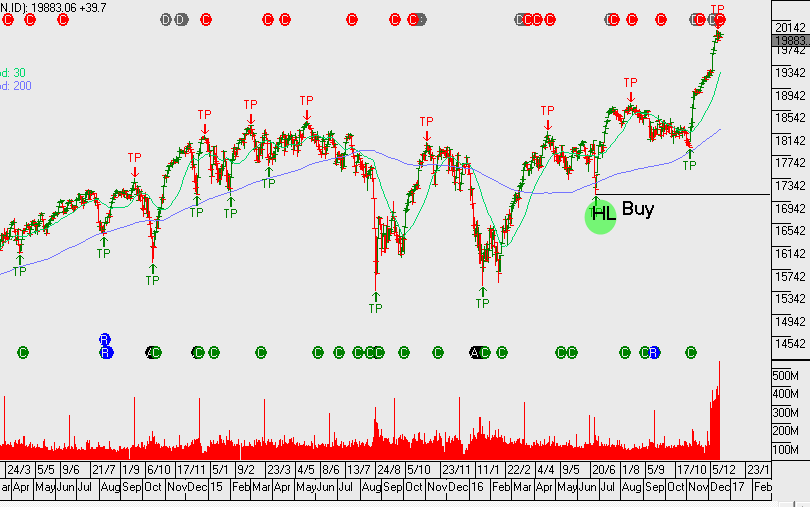

In the meantime, US assets remain in a strong uptrend targeting 20,000 in the DJ 30 and a move in the direction of parity for the EUR/USD.