Australian Banks

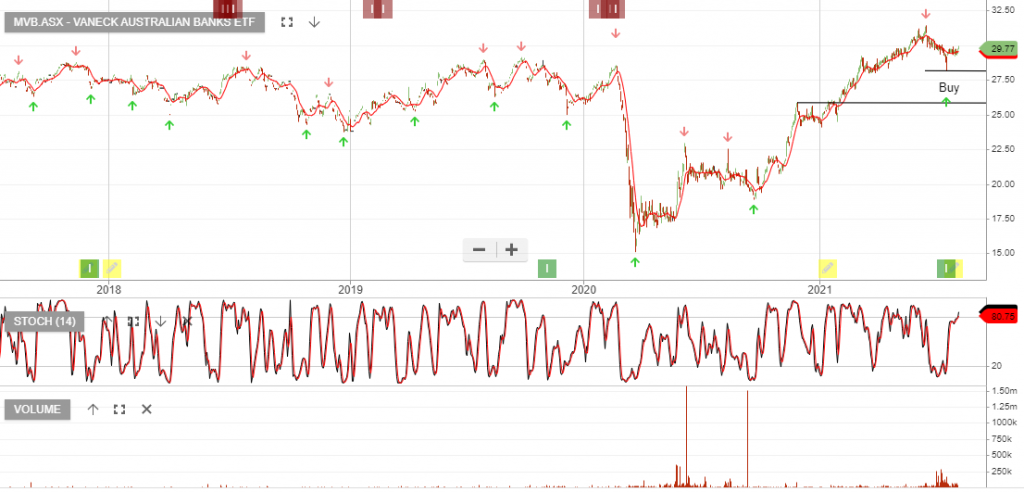

VanEck Australian Banks closed at 27.99

VanEck Australian Banks closed at 27.99

VanEck Australian Banks is under Algo Engine buy conditions.

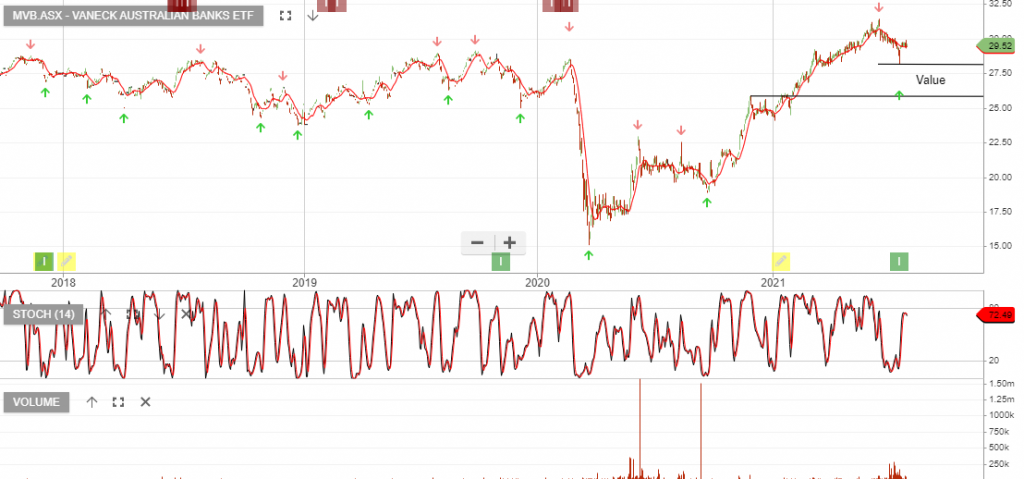

Buy MVB at market and place a stop loss at $28.53

VanEck Australian Banks is under Algo Engine buy conditions.

VanEck Australian Banks is under Algo Engine buy conditions, following the entry signal on 20 July. The ETF is now included in our ASX All ETF model.

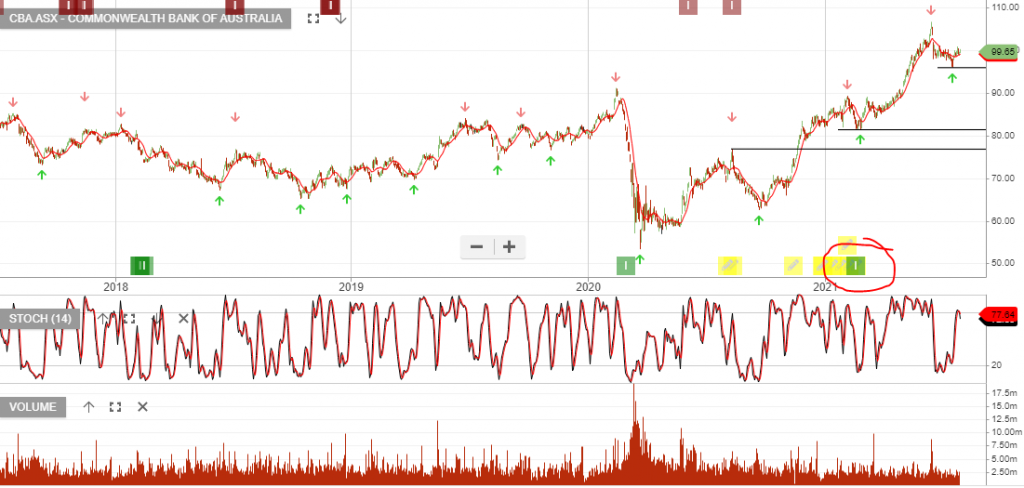

CBA reports full-year earnings on 11 August, Bendigo full-year earnings due on 16 August, along with quarterly updates from NAB, WBC, and ANZ.

NAB has announced a $2.5bn on-market buyback, which is expected to start in mid to late August 2021.

We expect CBA to launch a $5bn off-market buyback at its FY21 result in August.

Retail banking profit margins will struggle as a reduction in interest rates, results in lower profits, due to lower net interest income.

This week the Reserve Bank warned that banks face fresh risks of business insolvencies and tighter margins from record low interest rates.

“The resilience of the banking system up to now doesn’t mean that risks have passed,” Mr Kearns said.

“We’ve had the largest contraction in global output since the Great Depression. And as that impairs some households’ and businesses’ ability to repay their loans, the liquidity phase of the crisis is giving way to a solvency phase.”

US banks report earnings tonight and we’ll analyze the breakdown in profits from investment activities versus retail banking. This will be a key determinant in global fund managers deciding to sell into this result or hold existing long exposure within the sector.

A reference point to consider will be tracking the ASX listed MVB ETF. The suggested approach is to stay long the sector but re-evaluate, should we see the price action trade below the 10-day average.

Further updates will be provided following tonight’s US bank results.

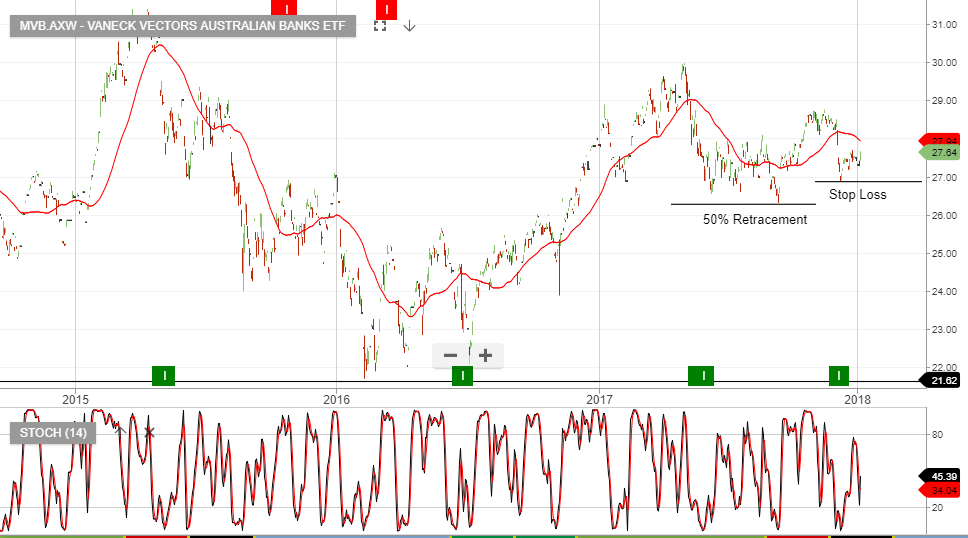

Our Algo Engine triggered a buy signal in MVB, (Vaneck Vectors Australian Bank ETF), on 4th December at $27.14.

With the current momentum across equity markets, we consider the signal an opportunity to gain broad based exposure to the banking sector, with a stop loss below $26.50.

Or start a free thirty day trial for our full service, which includes our ASX Research.