Wesfarmers – Limited Growth

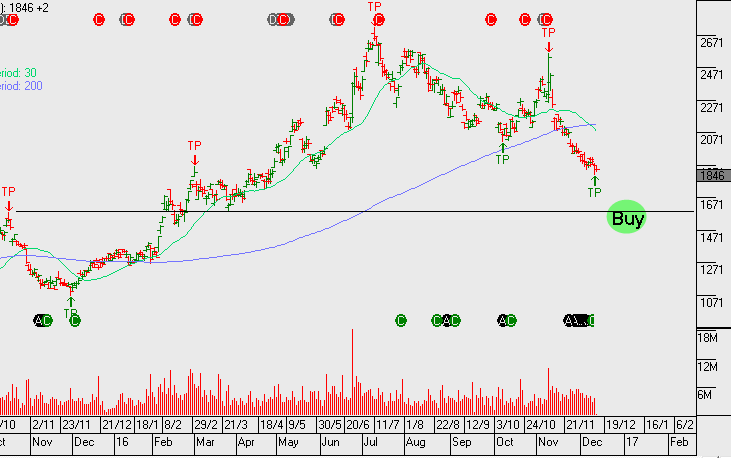

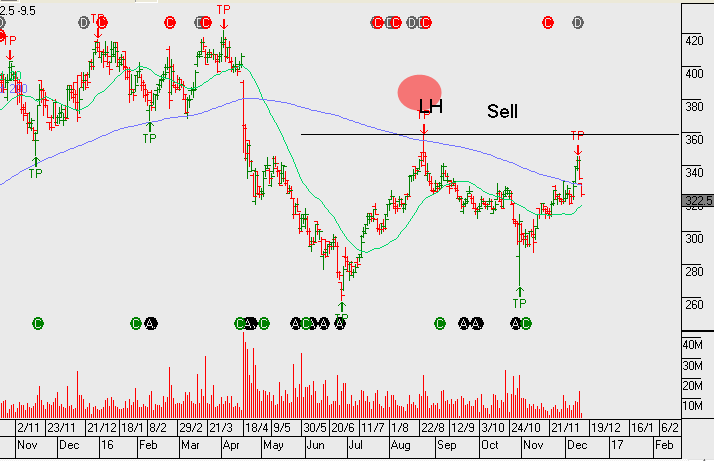

Over the last four years, Wesfarmers’ share price has traded in an $8.00 range between $38.00 and $46.00. Although the diversified company has consistently paid out fully franked dividends and has been yielding around 5% over the past few years, the lack of share price appreciation has been a concern for longer-term shareholders.

While the Bunnings division of the company has been gaining market share with the demise of Masters, it seems the market rates Wesfarmers earnings lower reflecting a view that the Coles division faces increased competition from the discount chain, Aldi.

Wesfamers has also entered the UK hardware sector with the acquisition of Homebase January of this year, which has yet to show a similar level of success as the Bunnings division.

We don’t expect the limited upside of the share price to improve anytime soon and will continue to employ the covered call strategy on rallies up to the $43.00 area; collecting the franking credits, a dividend of over $2.00 per share and the option premium. Our strategy is helping to boost cash flow to 13%+ per annum