Over recent weeks, our Algo Engine has been flagging a number of short signals. This is indicating there’s a large number of stocks that are at the peak of their counter trend rallies. As the key indices start to struggle, we’ll begin focusing on the short signals with a view towards either taking profit on existing long positions, overlaying a call option on defensive names or positioning on the short side to profit from any sell-off in over valued names.

In the January Video Market Update on the ASX Top 50, which we will release in the coming days, we’ll explain more on the algo short signal patterns emerging and how we’re positioning portfolios for what we think is a period of increased market risk.

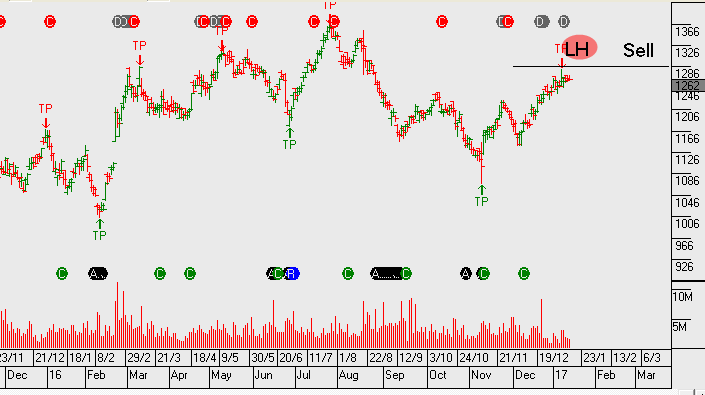

We’ve used the chart below of BXB to help illustrate the counter trend pattern referred to in the text above. In the case of BXB, the algo signal has drawn our attention to the recovery BXB has had since November, the compressed forward yield of now only 2.8% and the high PE ratio. In response, we’ve used the signal as a trigger to sell $12.50 at-the-money call options into April for a $0.50 credit, whilst expecting to keep exposure to the March $0.15 dividend.