On balance, 2016 wasn’t a bad year for RIO Tinto. After posting a 7-year low at $36.50 on February 1st, shares of the mining giant closed out the year just below the $60.00 mark (a 64% gain).

This impressive turn-around was supported by a broad rebound in Iron Ore, Copper, Coal and Aluminium. Rio has an impressive portfolio of assets. It anticipates solid growth in Iron Ore production in 2017, with a large copper project coming online over the next decade.

The company has a market cap of just under $80 billion.

On Tuesday, RIO will release its Q4 2016 production report. We expect the report to show a modest 1% lift in quarter-to-quarter production, driven primarily by Q4 strength in Iron Ore production and shipments from the Pilbara.

In addition, forecasts expect RIO to have lifted group production by 5% YoY in 2016, with strong gains in Copper (3%), Iron Ore (6%) and Aluminium (10%).

We also expect RIO to lift group production forecast by a further 7% for calendar year 2017.

In FY17, we expect revenue to up 5% to $37b, net profit up from $5.2b in FY16 to $7b in FY18. EPS will increase from $2.90 in FY16 to $4.00 in FY18, helping to push the dividend yield from the current 3% to almost 5% in 2018.

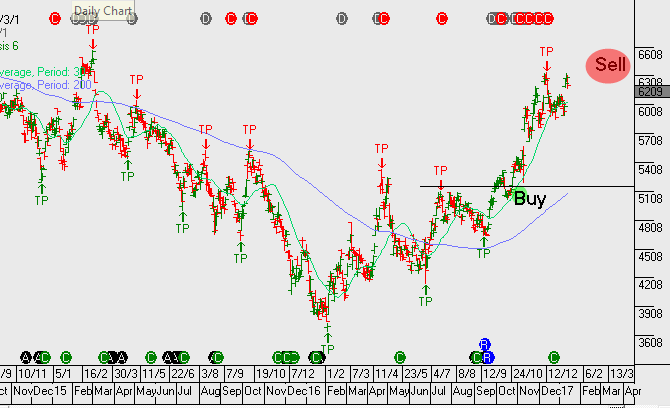

We’re keeping exposure to resources and selling tight covered calls 5% above current market valuations.