Defensive Stocks For An Uncertain Market

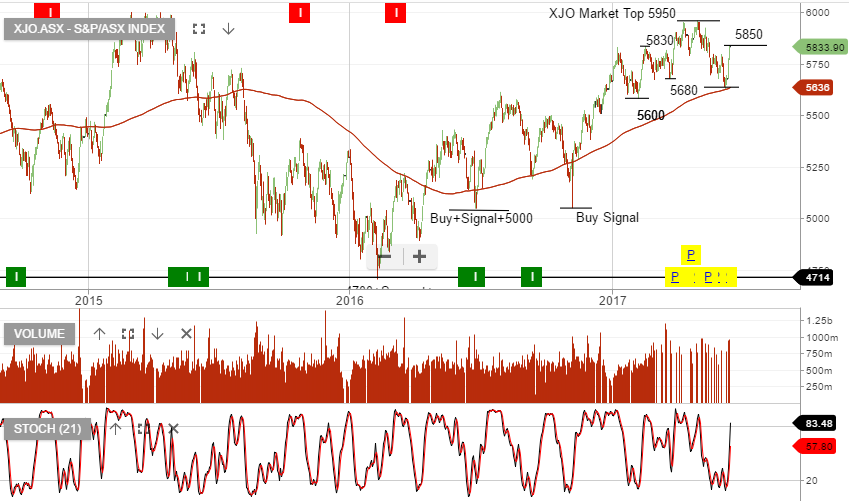

Recent price action in the local ASX market suggests we’ve entered a period of heightened volatility and potential for downside risk. Since posting the high for-the-year at 5945.00, the index for Australian shares has dropped almost 4%.

Looking across the spectrum of ASX top 100 stocks, we have found several names which can offer defensive value in a broadly sideways to lower share market.

These include: IPL, MPL, WOW, CTX, QBE, SHL, SYD, TCL, AMC, and IAG.

We consider these stocks to have the potential for moderate capital growth and, combined with a buy/write strategy, will offer 10 to 12% cash flow on an annualized basis.

ASX: XJO Index