Shares of Wesfarmers have lost over 7% this month and posted a six-month low of $40.50 yesterday.

The main drag to the share price has been the growing losses and poor outlook for their UK-based Bunnings hardware stores.

After writing off close to $1 billion on Monday, analysts have estimated that WES may have to invest another $540 million into the venture for a chance to break-even by 2022.

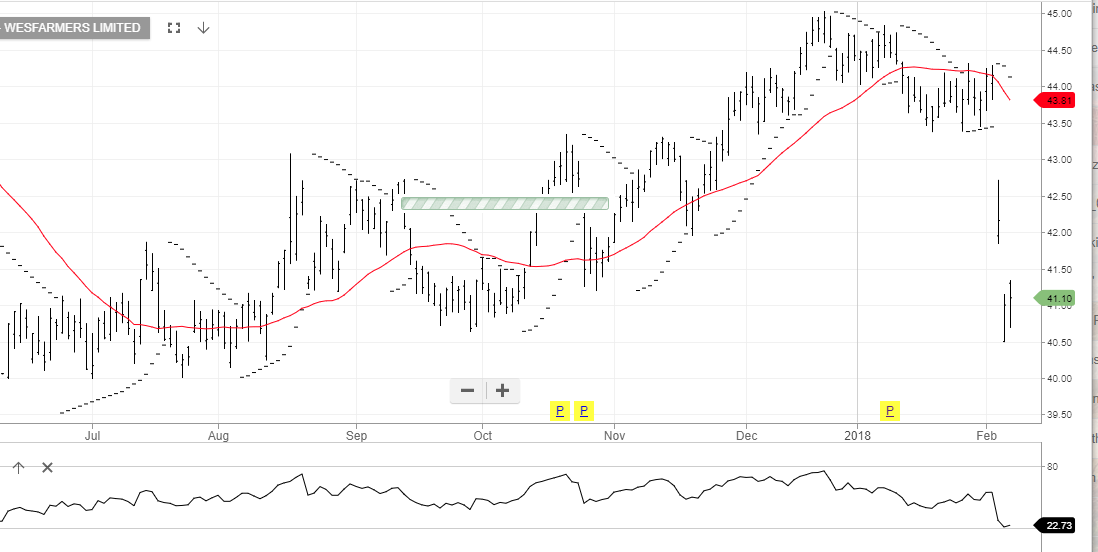

Over the last three years, the share price has traded in a broad range with resistance near $45.00 and investor support coming in near $39.00.

In the January 9th daily blog, we suggested selling a $45.00 June call for $1.02 to increase cash flow and keep exposure to the $1.03 dividend on February 20th.

WES has been in our ASX Top 50 model portfolio since January 2016 from $39.05. We continue to view WES as a range-bound stock and will use the derivative overlay strategy to enhance returns.

Wesfarmers