Shares of NCM have dropped over 5% in early trade reaching an 8-month low of $20.30.

The selling pressure is in response to the weekend news that the Cadia mine west of Sydney has been closed due to a failure of an embankment at a tailings storage area.

Initial investigations suggest the break in the wall is related to 2 local tremors, of 2.7 magnitude, which struck the region on Friday.

NCM officials have released a statement today saying that no tailings will reach the local environment, but that 2018 production guidance could be impacted.

Based on the information disclosed so far, we don’t expect a protracted production halt at Cadia like after the seismic event in April of last year.

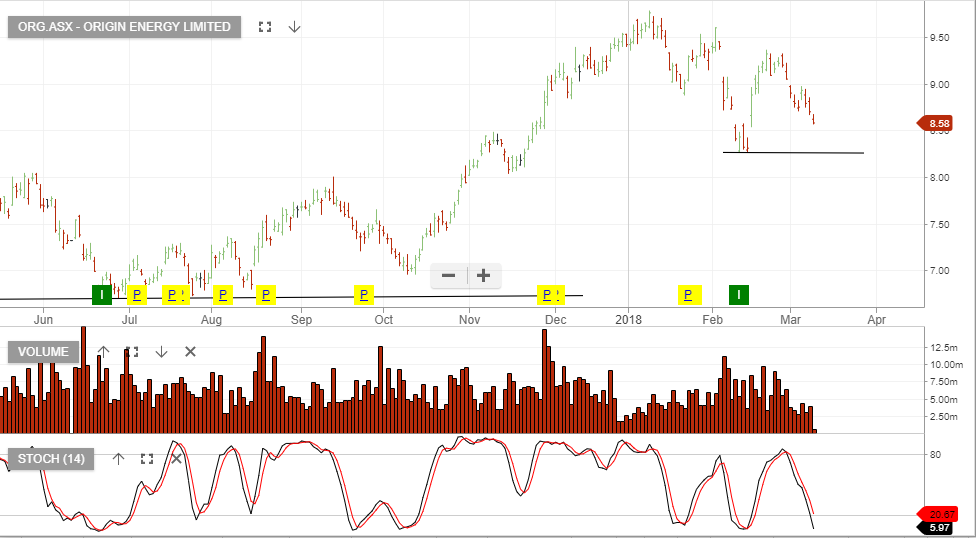

As such, we believe that increased production efficiency at the Lahir mines in PNG combined with an upward trajectory in Spot Gold prices will see NCM shares stabilize above the $20.00 support level.

NCM is part of our ASX Top 50 model portfolio and we believe adding to long positions in the $20.40 area is a reasonable strategy.

Newcrest Mining

BHP

BHP