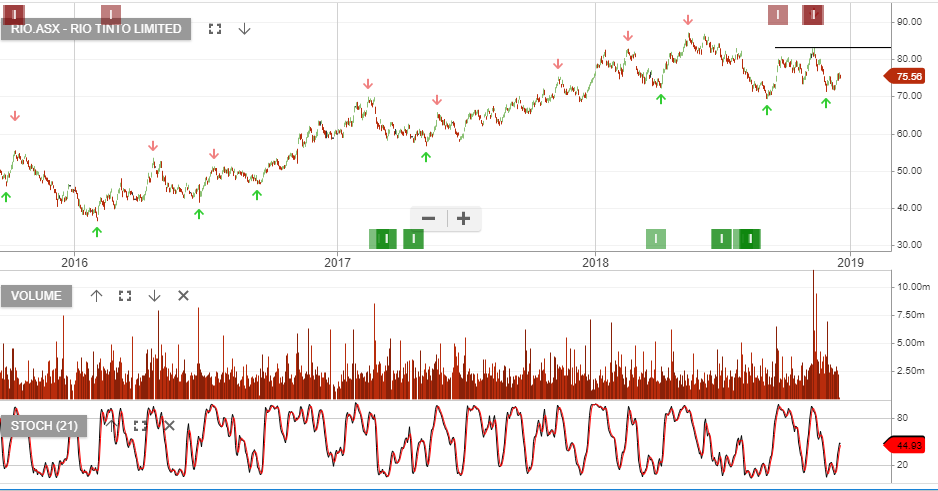

RIO, OZL, NCM & FMG – Sell Conditions

RIO has completed US$5bn plus in asset sales and has the potential to free up a further $3bn plus, should the Grasberg sale proceed as planned.

RIO has returned significant cash to shareholders in the last 18 months. By the time the portfolio restructure is complete, the number may top US$15bn, with further asset sale proceeds returned to shareholders next year.

We remain cautious of RIO, OZL, NCM & FMG as these names are under Algo Engine sell conditions.

Our preference remains BHP, WPL and S32.