Commonwealth Bank of Australia reported 3Q19 cash earnings of A$2.2bn,

being below market consensus by 10%.

Analysts have downgraded FY19 earnings by 6%, (which incorporates the $500m post tax remediation charge), while FY20 and FY21 estimates are also lowered on weaker revenue numbers.

CBA currently trades 13x earnings on a 5.8% yield. A key risk for the business is an adverse turn in the credit cycle, which is not reflected in the current share price.

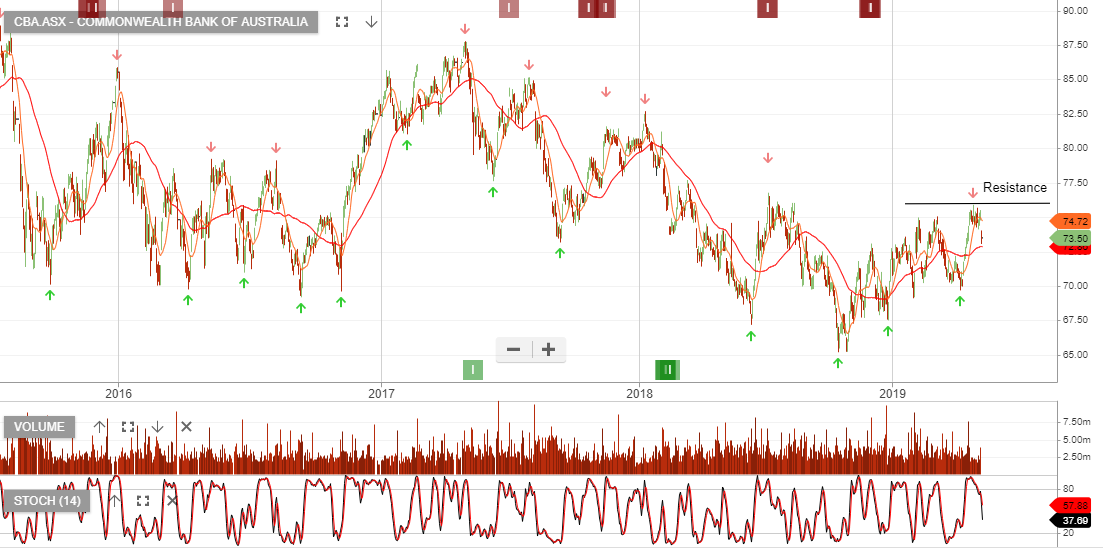

CBA has been under Algo Engine sell conditions following the lower high formation over the past 3 years.