Buckle-Up For A Busy Week

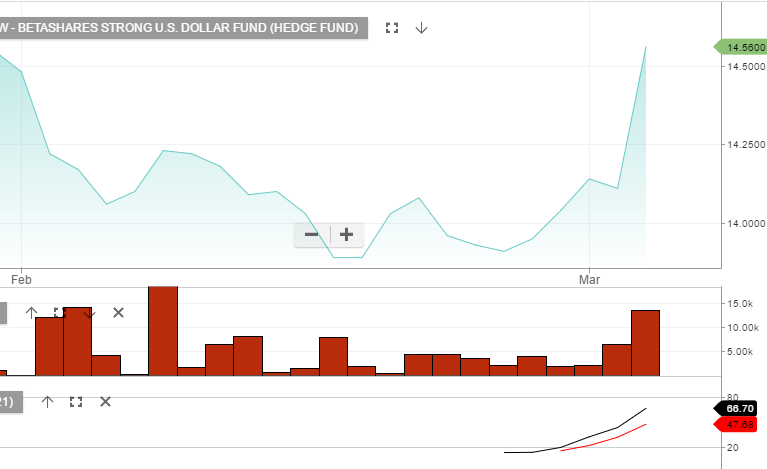

The FOMC is pretty much certain to raise the Fed Funds target rate to 1% on Wednesday.

The US employment report released last night was mixed, with the headline number of 235,000 new jobs above expectations, the hourly earnings growth below expectations at .2% and the Unemployment rate unchanged at 4.7%.

These data were solid enough to hold the US indexes within recent ranges and even move the odds of a June rate hike slightly above 50%.

However, there are several other events next week which could also move the market.

On Tuesday, UK PM Theresa May will be addressing the House of Commons. There is a good chance that she may announce Article 50, which will formally start the Brexit process.

On Wednesday, Dutch citizens go to the polls to elect a new PM. The anti-EU candidate, Geert Wilders has a very good chance of winning.

Also on Wednesday, the US Debt ceiling agreement from 2015 will expire, further clouding an already murky legislative agenda in the USA.

On Thursday, the Australian employment report will be released, which will have an acute bearing on future domestic interest rate policy measures.