ASX200 Trade Table: Monodelphous Group

Monadelphous Group is up 2.3% after 5 days.

Monadelphous Group is up 2.3% after 5 days.

Weebit Nano is 3.8% after 5 days.

AGL Energy is a high-risk counter-trend trade. Watch for the price action to cross above the 10-day average.

Downer EDI continues to trade higher and the stop loss can be lifted to $4.11

IGO may have created a new pivot low at $6.75

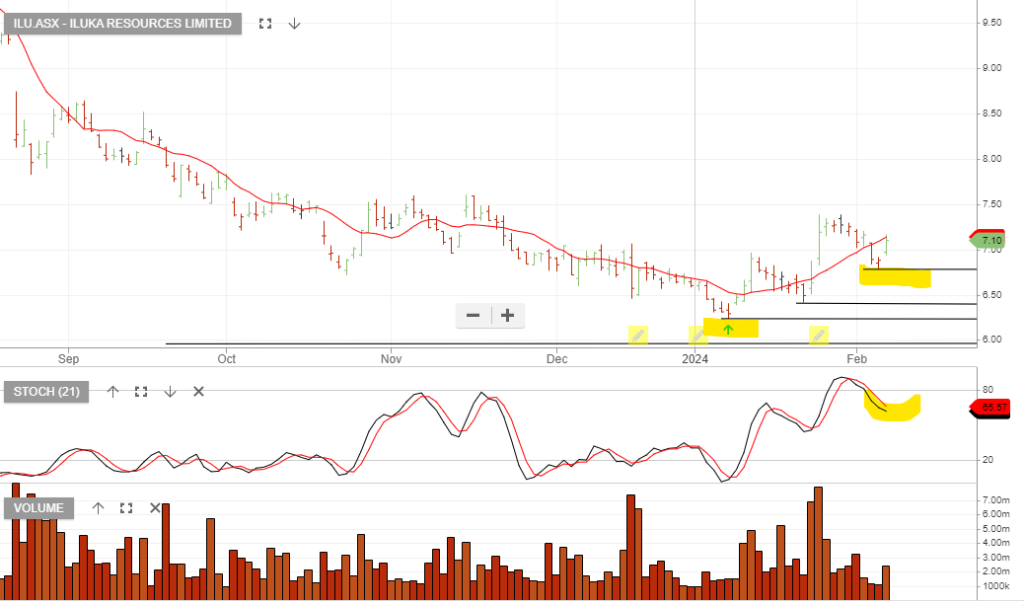

Iluka Resources has a new higher low formation, the stop loss on a new trade entry will go at $6.79

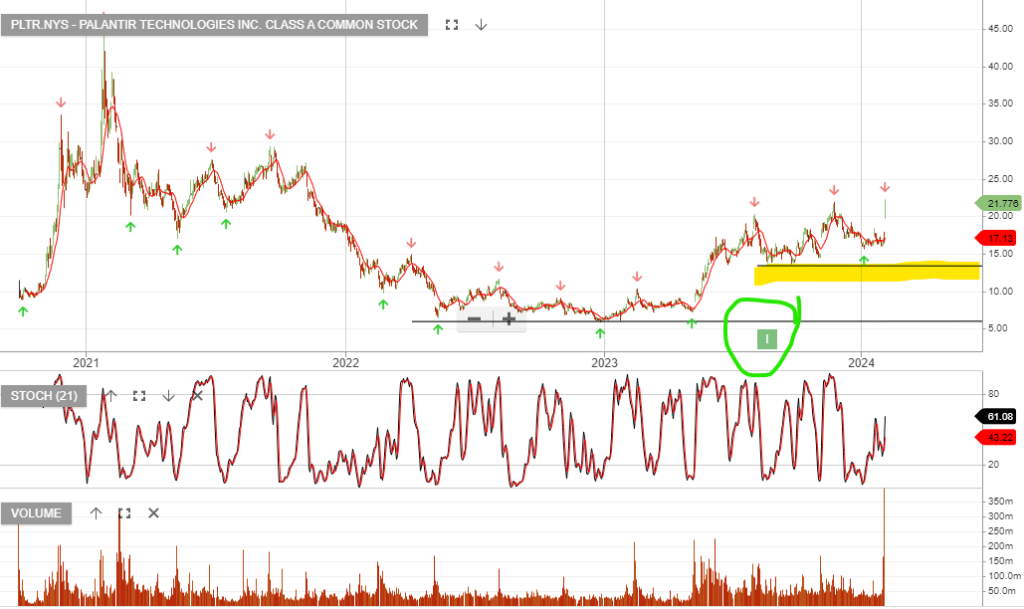

PLTR:NYS shares were more than 30 per cent higher after the company reported big demand for its artificial intelligence technology and gave a higher-than-expected profit outlook for 2024.

Wedbush Securities called Palantir “an undiscovered gem and a core part of our thesis in the AI Revolution just now taking shape across the tech world”. Wedbush said it believes Palantir is on track to be included in the S&P 500.

FY 2023 Highlights

{JD.NAS}

In case you missed it, you can watch last night’s webinar here.