Bitcoin

Bitcoin is up 32% after being added to our model portfolio earlier this year. We highlight to investors that we’ve recently seen another Algo Engine buy signal and a new pivot low is in place at 24930.

XJO & Market Direction

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

S&P500 & Market Direction

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

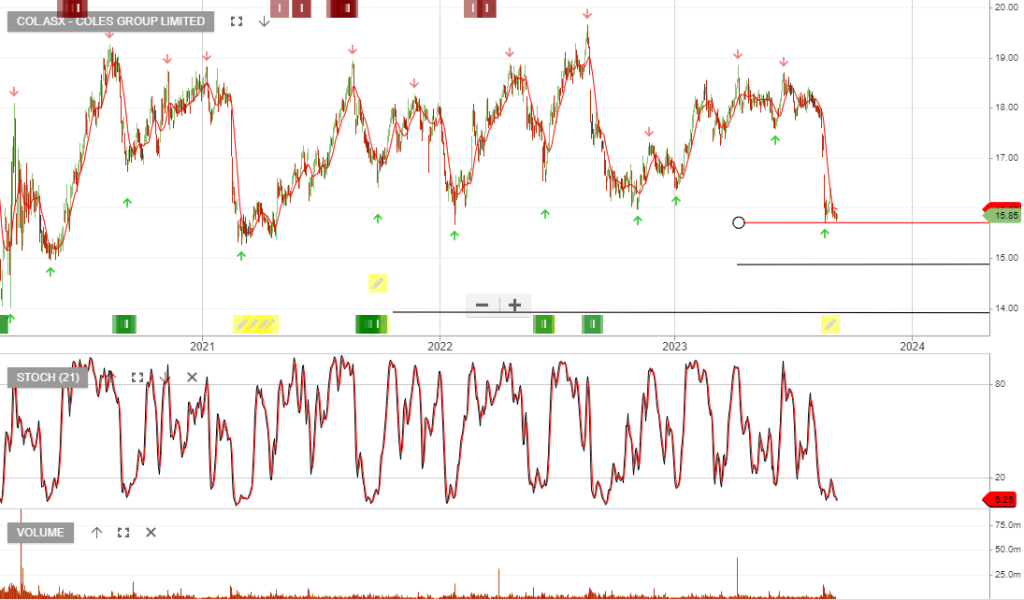

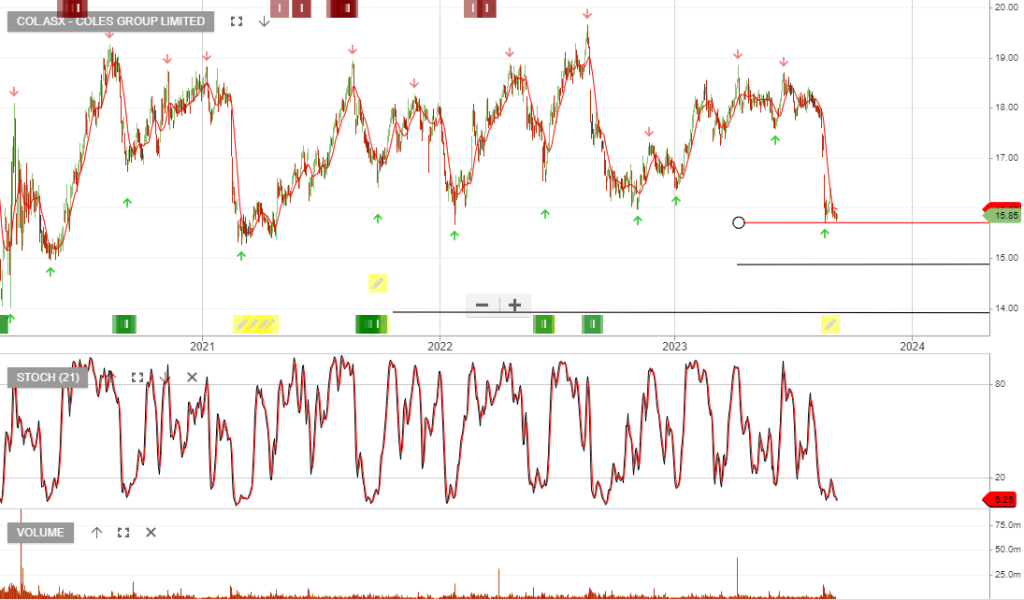

Coles

Coles Group is under Algo Engine buy conditions and we recommend investors accumulate the stock within the $15 – $16 price range.

Fisher & Paykel Healthcare

Fisher & Paykel Healthcare Corporation is within a value price range, where investors should consider adding a small portfolio allocation.

Aurizon Holdings

Watch Last Night’s Webinar

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

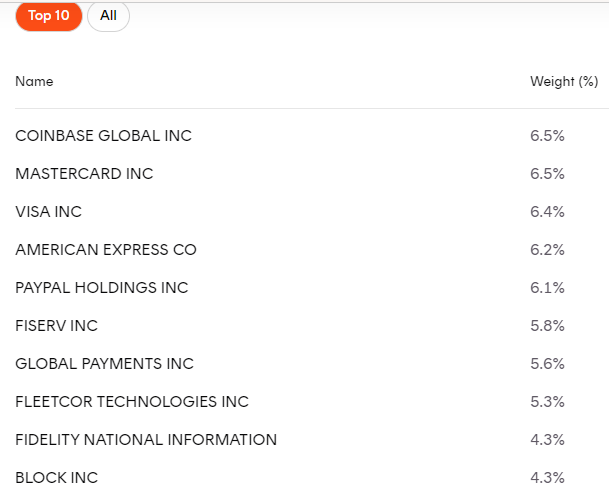

Future of Payments ETF

IPAY:ASX aims to track the performance of an index (before fees and expenses) that provides exposure to a portfolio of global companies at the forefront of innovation in digital and mobile payments.

Coles

Coles Group is under Algo Engine buy conditions and we recommend investors accumulate the stock within the $15 – $16 price range.