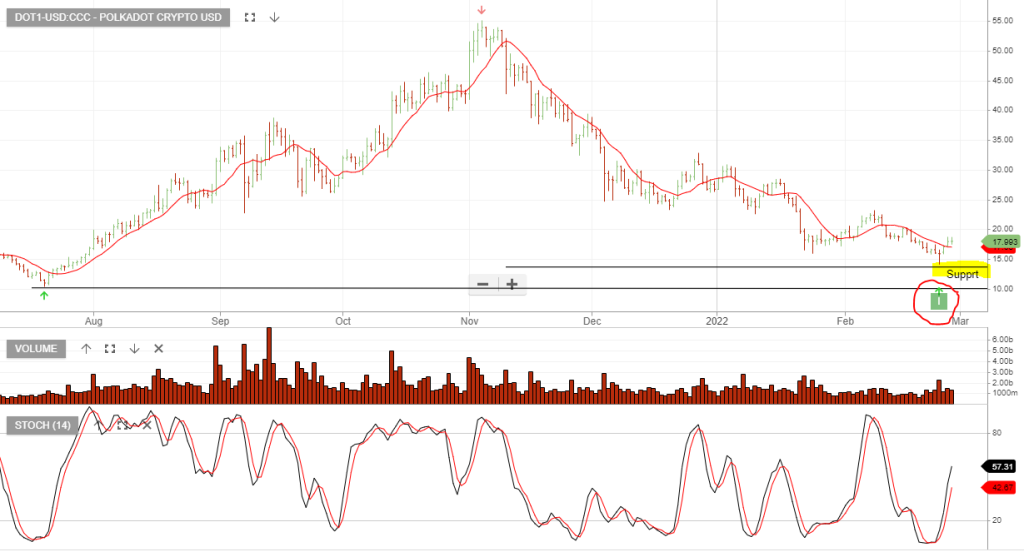

Polkadot – Large Cap Crypto

Polkadot Crytop is now under Algo Engine buy conditions after creating a higher low formation and a pivot low at $14.15.

The price action has been supported by increased buying activaty above the $14.15 pivot low and we now have two trading sessions that have closed above the 10-day average.

Polkadot is an open-source platform that allows for distributed computing. The protocol was adapted by the Ethereum co-founder Gavin Wood and is developed by the Web3 Foundation with the initial implementation by Parity Technologies.

Polkadot’s first token sale closed on October 27, 2017, raising a total of 485,331 ETH (Ether, the currency of the Ethereum blockchain).

Polkadot allows for cross-chain transfers of data or assets, between different blockchains, allowing for cross-chain DApps (decentralized applications) to be built using the Polkadot Network.

The Polkadot network has a primary blockchain named relay chain and many user-created parallel chains called parachains. The beating heart of Polkadot is called the Relay Chain. It is the origin of the network’s shared security and consensus and facilitates cross-chain interoperability. Parachains can be attached to the Relay Chain and used for transaction verification and validation.