Telstra – Buy Signal

Telstra Corporation is under Algo Engine buy conditions.

Telstra Corporation is under Algo Engine buy conditions.

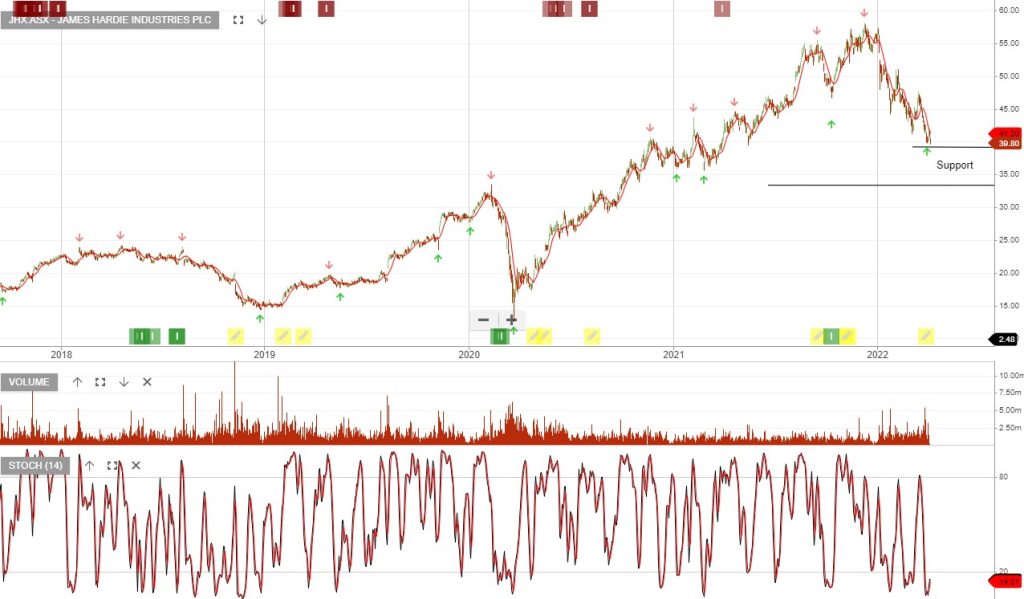

James Hardie Industries is approaching an oversold range where investors should begin monitoring the short-term momentum indicators for a pick-up in buying activity.

The price range for a reversal in price action remains wide at $33 to $39.

James Hardie Industries is approaching an oversold range where investors should begin monitoring the short-term momentum indicators for a pick-up in buying activity.

The price range for a reversal in price action remains wide at $33 to $39.

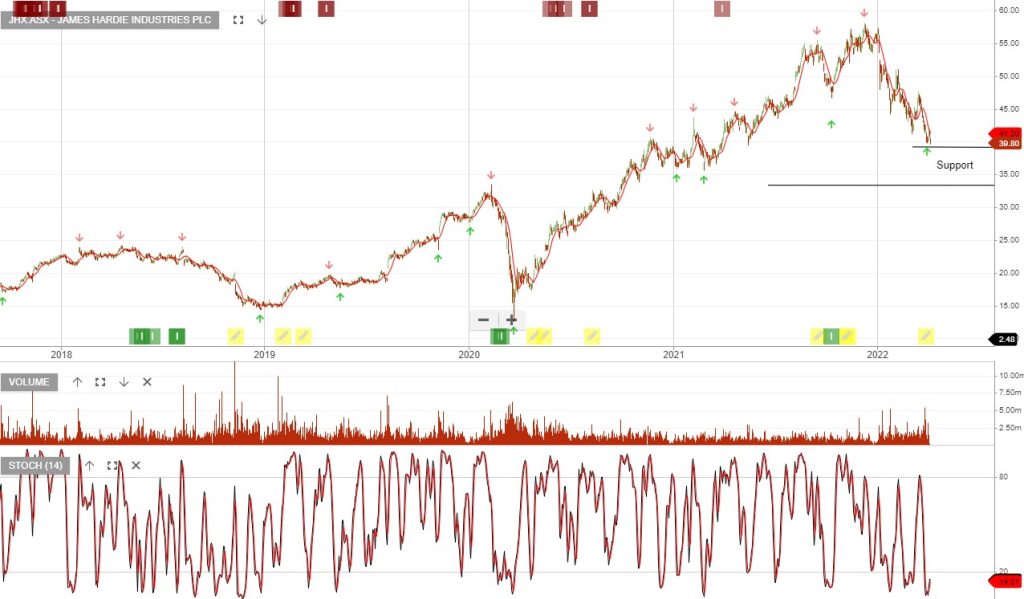

Aristocrat Leisure is under Algo Engine buy conditions.

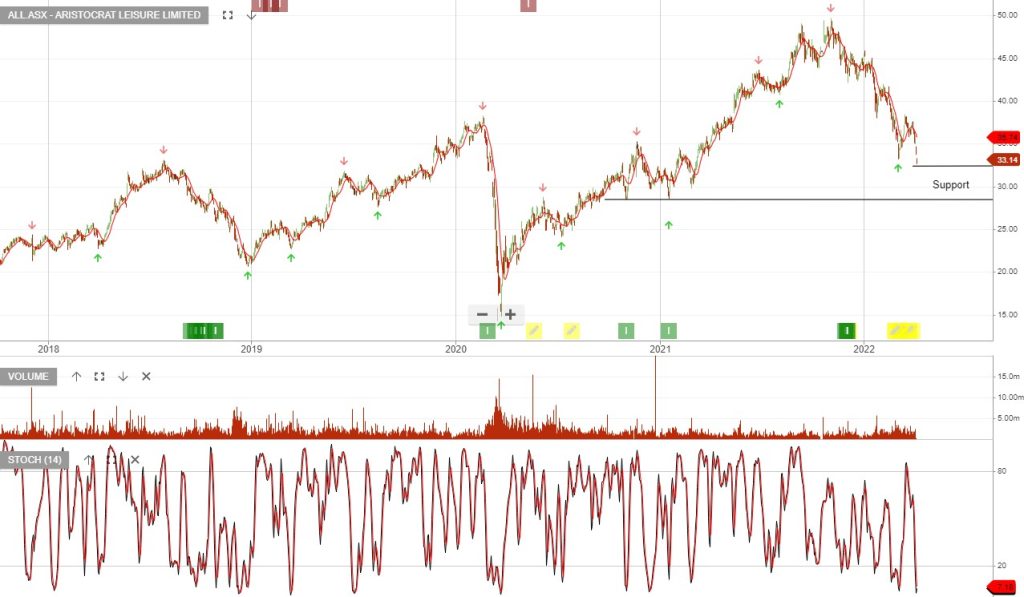

Wesfarmers is under Algo Engine buy conditions.

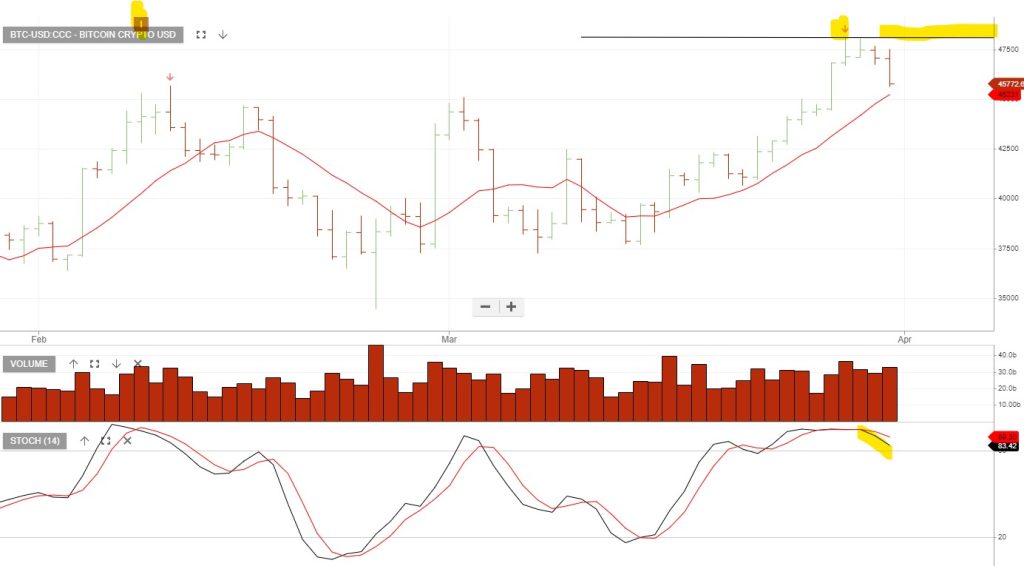

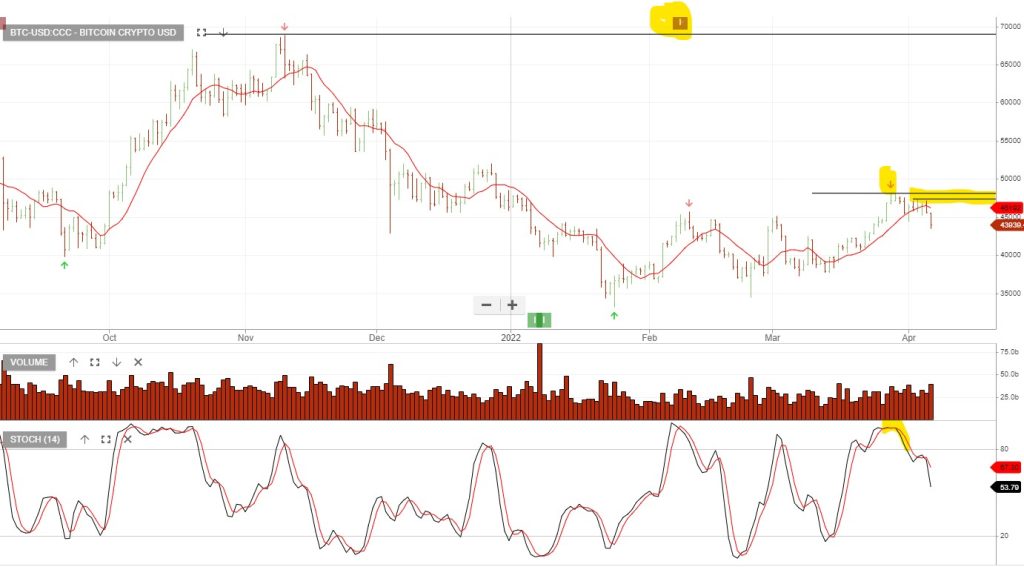

The rebound in the NASDAQ has been sharp and it’s possible we’re now looking at a level of overhead resistance. For crypto investors, this provides an opportunity to consider hedging or an outright short position.

The strategy requires a stop loss which means any short exposure is closed out if the market rally continues.

7/4/22 update: BTC-USD has rolled over and the technical setup remains negative.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

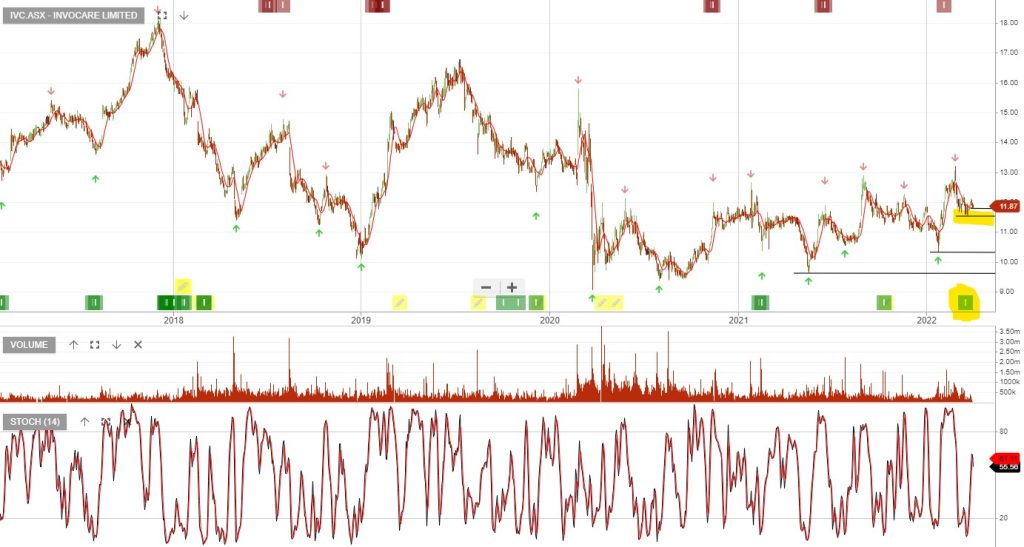

InvoCare is under Algo Engine buy conditions.

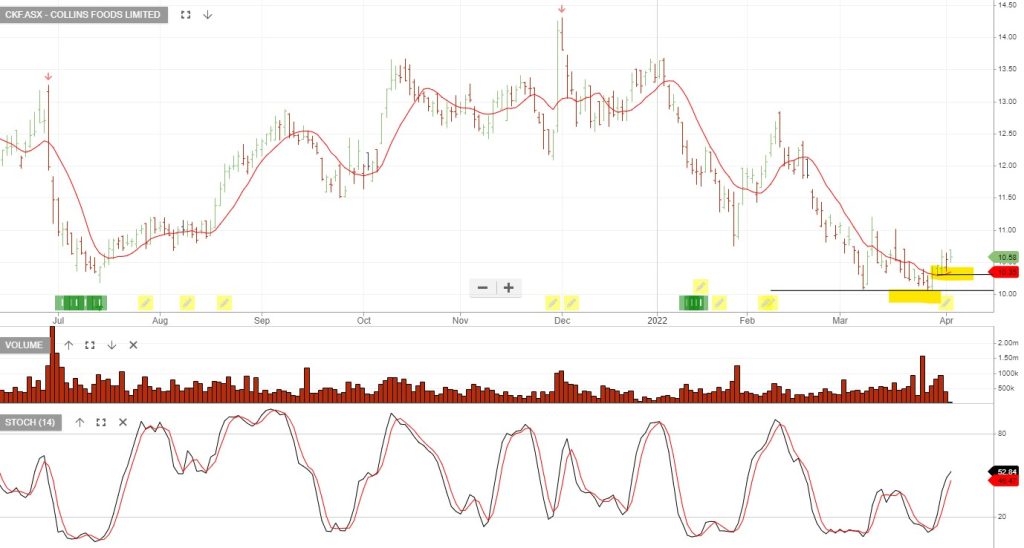

Collins Foods is under Algo Engine buy conditions.

Short-term traders may consider applying a stop loss below the recent pivot low.

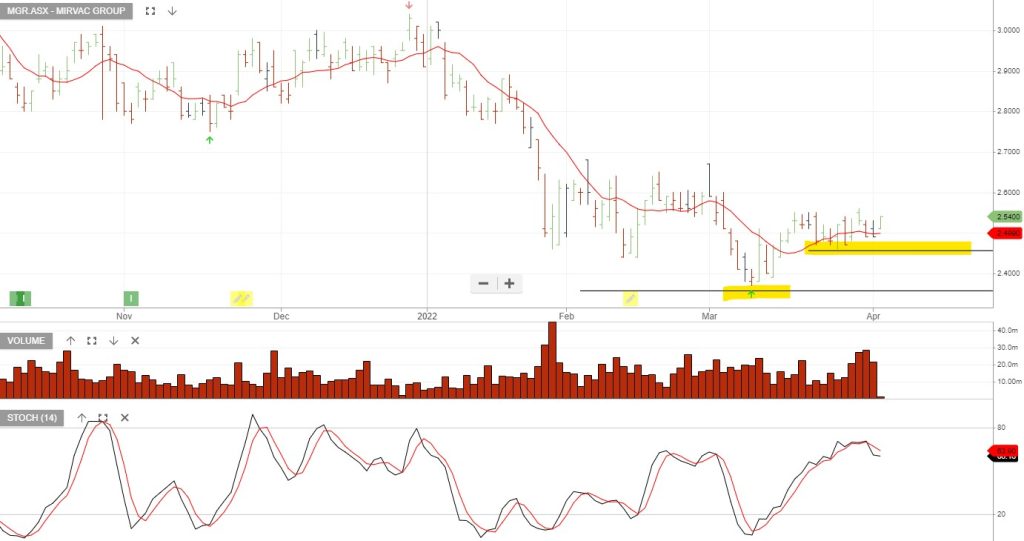

Mirvac reported 1H22 operating EPS of $0.075. FY22 guidance was reaffirmed at $0.15, aided by higher commercial development profits.

We continue to view the apartment and commercial pipeline as a key driver of growth following a softer-than anticipated 1H22 update.

MGR is now trading on a forward yield of 4%.

Or start a free thirty day trial for our full service, which includes our ASX Research.