Woodside Rallies 25%

Woodside Petroleum is under Algo Engine buy conditions and is a current holding in our ASX 100 model.

17/2 Update: WPL has now rallied 25%+

Woodside Petroleum is under Algo Engine buy conditions and is a current holding in our ASX 100 model.

17/2 Update: WPL has now rallied 25%+

Goodman is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We expect 14% EPS growth into FY22 .

17/2 Update: GMG has now rallied 10%+

Insurance Australia Group is under Algo Engine sell conditions.

1H22 cash NPAT of A$173m. Outer year growth could be material for IAG and we’ll be watching for a return to algo buy conditions later this year.

Risks to our IAG valuation and target price revolve around the pricing and claims

environment for insurers in Australia and New Zealand, including catastrophe

events.

Aurizon Holdings is under Algo Engine buy conditions. 1H22 underlying EBITDA was down 1.5% to $727m and underlying NPAT was $257m.

We expect Bulk to continue being strong, with record crop production across Australia and new

contracts, although a soft volume outlook for Coal leaves low single-digit earnings growth at best for FY22.

The dividend was $0.105 with a payout of 75%. The forward div yield is now 5.7% and EPS growth likely to be flat to +2%. OneRail transaction is progressing with key ACCC assessment due in

March.

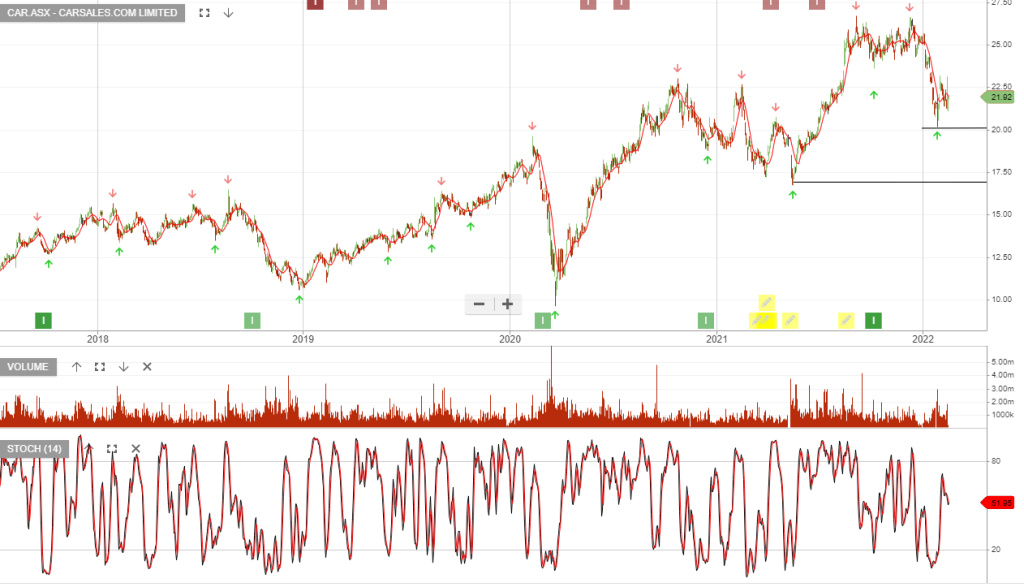

Carsales.Com delivered a solid 1H22 result particularly on the revenue line. The outlook has seen slight downgrades and the focus for investors will be the performance of the international businesses in FY23.

EBIT is expected to grow by 10% and the forward yield now represents 2.5% and the stock trades on 27x FY23 earnings.

Seek is under Algo Engine buy conditions.

The 1H22 performance looks strong, with revenue from continuing operations increasing 59% to $517m, reported profit up 152% to $126m. Total reported profit rose 32% to $88.1 million.

The company expects full-year revenue to be in the range of $1bn to $1.1bn and EBITDA to be in the range of $490m – $515m, NPAT to be in the range of $230m – $250m.

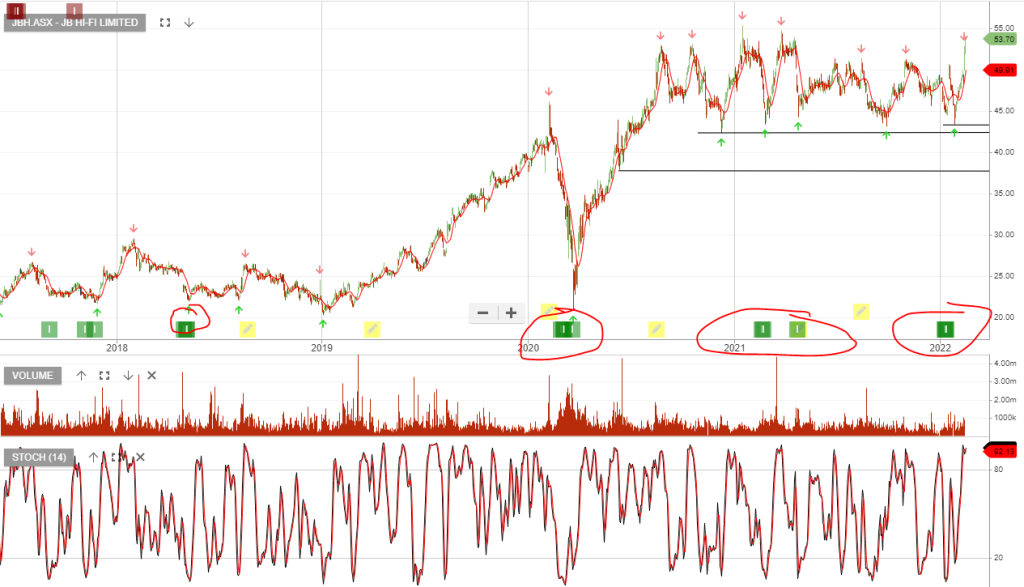

JB Hi-Fi is under Algo Engine buy conditions.

1H22 total sales fell 1.9% to $3.29bn but have increased 20% over a two-year period and net profit for the six months fell 9.4% to $288m.

JB Hi-Fi said it will return up to $250m of capital to shareholders via an off-market buyback,

BHP Group is under Algo Engine sell conditions. 1HFY22 result was strong with headline earnings above consensus and impressive cash flow supporting a higher dividend, Iron-ore being the dominant contributor.

First-half net profit US$10.68bn.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

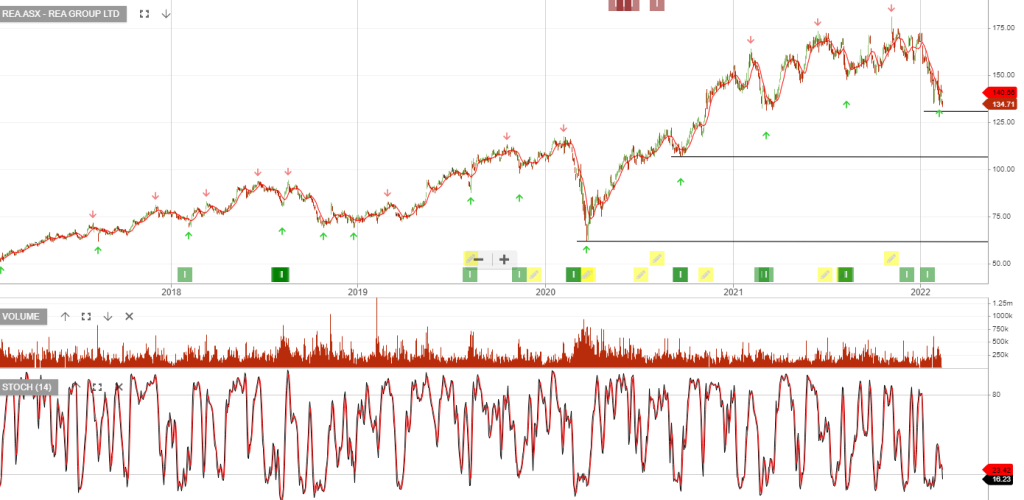

REA Group reported 1H FY22 revenue growth of 25% or $109mn with EBITDA of $84mn. Full-year EPS is forecast to be up 20%+ on the prior year and the stock now trades on a forward yield of 1.2%.

Buying support is likely to rebuild within the $115 to $135 price range.