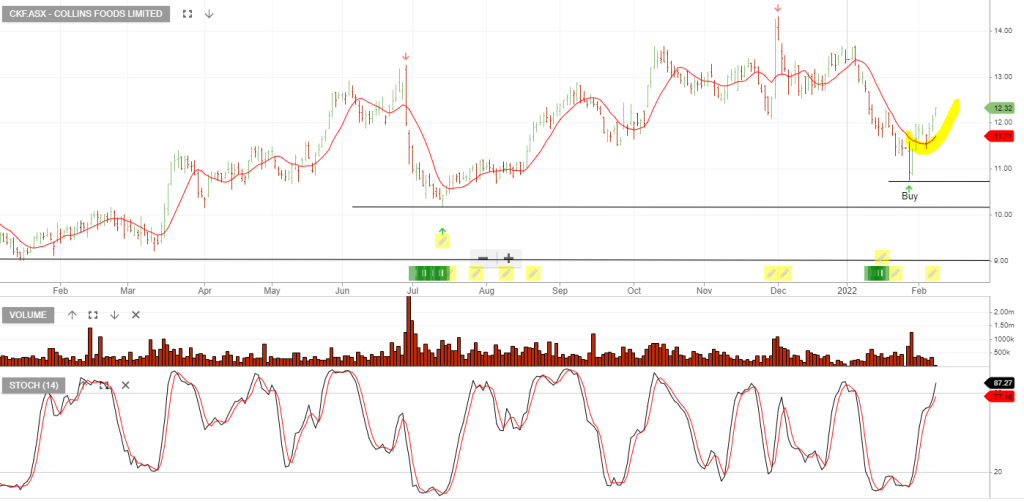

Collins Foods – Live Education

Collins Foods is under Algo Engine buy conditions. Buying support is likely to increase within the highlighted price range.

7/2/2022 Update: The price action has found buying support at $10.70 and is now trading $12.00

8/2/2022 Update: Investors will hold Collins Foods as long as the stock remains under Algo Engine buy conditions.

Traders will refer to the 10-day average as their trailing “take profit” marker.