Cleanaway – Buy

Cleanaway Waste Management is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

.

Cleanaway Waste Management is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

.

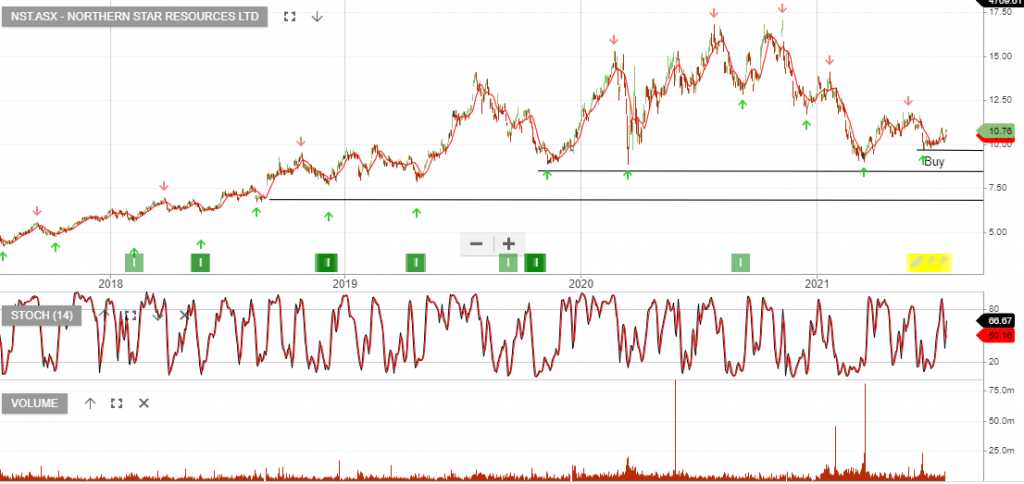

Northern Star Resources is under Algo Engine buy conditions and is our preferred gold exposure.

NST continues to deliver strong results in the June quarter. Group production finished with 450koz at $1460oz, (up 23%), whilst seeing costs come down almost 10%.

We continue to see the twin factors of a strong gold price and cost-saving, (post-merger with SAR), helping to support the share price.

Buy NST

Aurizon Holdings is under Algo Engine buy signals.

Aurizon reported underlying earnings before interest taxation depreciation and amortisation (EBITDA) of $1.48 billion and told investors to expect underlying EBITDA of between $1.42 billion-$1.5 billion in fiscal 2022.

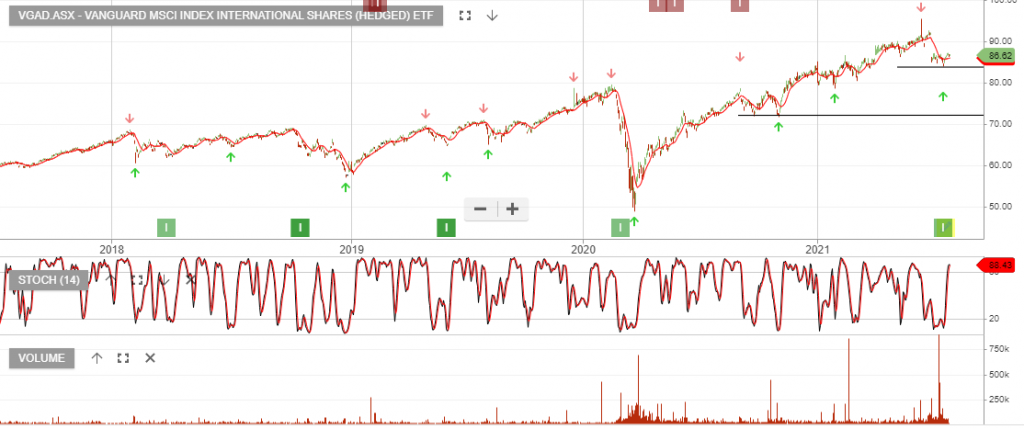

NAB has announced a $2.5bn on-market buyback, which is expected to start in mid to late August 2021.

We expect CBA to launch a $5bn off-market buyback at its FY21 result in August.

The current weakness in the Crown share price could be a buying opportunity. It’s unlikely that the current COVID-related operational impacts are going to deter the interested parties who have put forward takeover offers.

Continue to track the CWN share price and wait for a cross above the 10-day average.

Link Administration Holdings is now under Algo Engine buy conditions and we view $4.80 as an attractive price to begin accumulating the stock.

Gold Road Resources is now under Algo Engine buy conditions.

Gold Road anticipates gold production for the 2021 calendar year will be within the lower half of guidance (260,000 to 300,000 ounces on a 100% basis).

AISC for the 2021 calendar year is anticipated to be between $1,325 and $1,475 per attributable ounce, with lower June 2021 quarter production and higher maintenance and labour costs the main contributors to an increase from the guidance of between A$1,225 – A$1,350.

FY21 revenue forecast is for $300mil generating EBIT of $100mil.

Northern Star Resources is under Algo Engine buy conditions and is our preferred gold exposure.

NST continues to deliver strong results in the June quarter. Group production finished with 450koz at $1460oz, (up 23%), whilst seeing costs come down almost 10%.

We continue to see the twin factors of a strong gold price and cost-saving, (post-merger with SAR), helping to support the share price.

Buy NST

iShares Asia 50 is under Algo Engine buy conditions and is a current holding in our iShares ETF model.

INVESTMENT OBJECTIVE: The fund aims to provide investors with the performance of the S&P Asia 50TM Index, before fees and expenses. The index is designed to measure the performance of the 50 leading companies listed in China, Hong Kong, Macau, Singapore, South Korea and Taiwan.

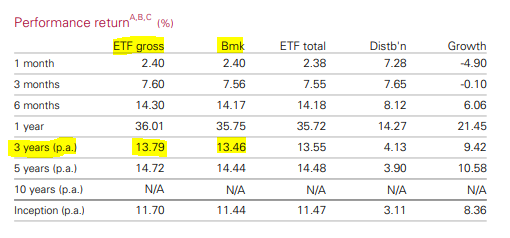

Vanguard MSCI Index International Shares (Hedged) is under Algo Engine buy conditions and is a current holding in our ASX All ETFs model portfolio.

The recent 10% correction provides an attractive long-term entry-level to accumulate a holding.

Investment objective: Vanguard MSCI Index International Shares (Hedged) ETF seeks to track the return of the MSCI World ex-Australia (with net dividends reinvested), hedged into Australian dollars Index, before taking into account fees, expenses and tax.

ETF overview: The ETF provides exposure to many of the world’s companies listed on the exchanges of major developed economies around the world. The ETF offers low-cost access to a broadly diversified range of securities that allows investors to participate in the growth potential of international companies listed outside of Australia. The ETF is hedged to Australian dollars so the return (income and capital appreciation) of the ETF is relatively unaffected by currency fluctuations.