CNEW ETF – Algo Buy

VanEck Vectors China New Economy is under Algo Engine buy conditions and is a current holding in our Global ETF model portfolio.

VanEck Vectors China New Economy is under Algo Engine buy conditions and is a current holding in our Global ETF model portfolio.

Fisher & Paykel Healthcare Corporation is under Algo Engine buy conditions and is now within our highlighted range.

The short-term momentum indicators are now turning higher and it looks like buying support is building near the recent $26 low.

CURE:AXW is under Algo Engine buy conditions and the current pullback to $65 provides another buying opportunity.

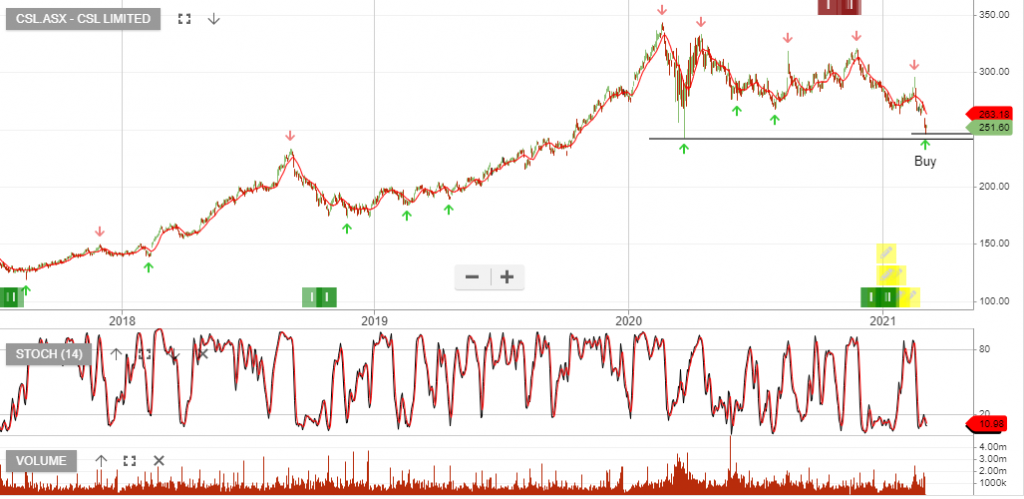

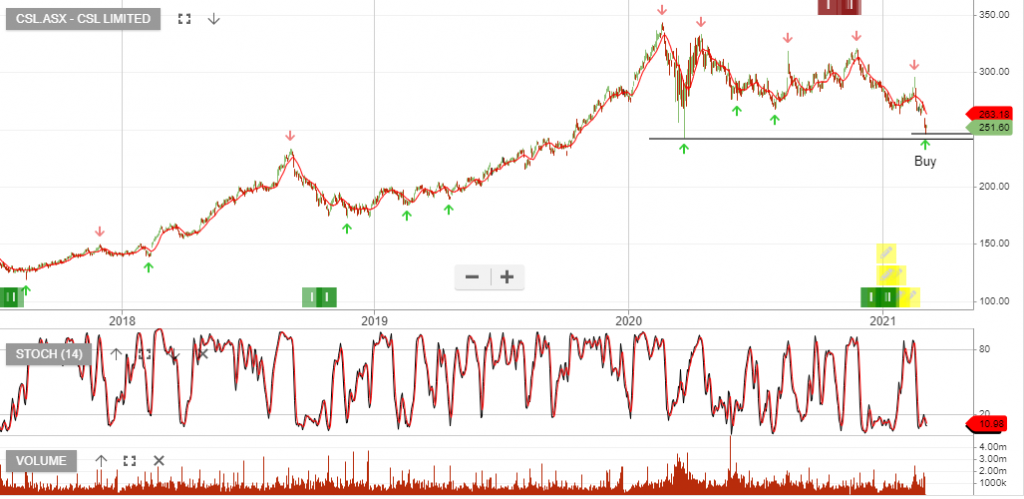

CSL:ASX 1H21 NPAT of US$1.8bn. FY21 guidance retained at US$2.2bn, which implies a weaker 2H21.

We expect to see earnings upgraded prior to the completion of the 2H.

CSL trades on a forward yield of 1%.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

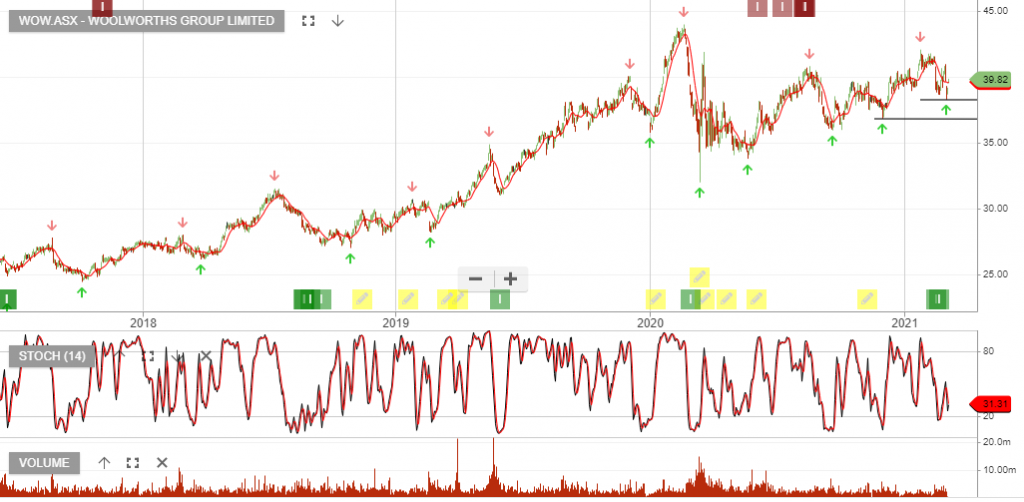

WOW:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolios.

Woolworths’ Chief Executive, Brad Banducci said the retailer remained committed to the $10bn spin-off and possible demerger of its liquor and hotels business, Endeavour Group.

The higher low at $38.30 has resulted in increased buying support and the demerger will remain an attractive bonus for shareholders.

ASX is under Algo Engine buy conditions and is now find buying support. The short-term indicators have turned higher.

ASX went ex-div $1.12 on 4 March.

{ASX:CWY) is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support above the $2.20 level.

CSL:ASX 1H21 NPAT of US$1.8bn. FY21 guidance retained at US$2.2bn, which implies a weaker 2H21.

We expect to see earnings upgraded prior to the completion of the 2H.

CSL trades on a forward yield of 1%.

Or start a free thirty day trial for our full service, which includes our ASX Research.