Sonic Healthcare – Buy

Sonic Healthcare is finding buying support and we’re likely to see an improvement in the short-term indicators as the stock price stabilizes near the $33.50 level.

Sonic Healthcare is finding buying support and we’re likely to see an improvement in the short-term indicators as the stock price stabilizes near the $33.50 level.

Xero is under Algo Engine buy conditions and is a current holding in our ASX 100 model.

Goodman is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

FY20 NPAT was up 12.5% to A$1,060.2mn, and the company is guiding to 9% EPS growth in FY21.

Relative to its A-REIT peers, GMG is trading on an elevated earnings multiple, however, this is not the case when compared to its global peers.

NCM is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support developing near the $25 – $26 level.

Cimic Group is under Algo Engine sell conditions. Despite this, we’ve held a view that the company has cleaned up the balance sheet and offers exposure to an increasing infrastructure build thematic.

The FY20 earnings result and FY21 guidance was below market consensus and we’ve seen the stock sell off as a consequence.

FY21 NPAT guidance of $400-430m down from FY20 NPAT of $600m.

The silver lining is the business does appear to be de-risking and likely to manage its way through the transition to new, lower risk contract wins.

The forward yield is now 4%, but the free cash flow generation will need to be watched closely.

Telstra has reported underlying 1H21 EBITDA $3.8bn.

An interim dividend of 8¢ps was declared, comprising a $0.05 ordinary and $0.03 special.

FY21 guidance now stands at $6.6bn to $6.9bn and FY22 & FY23 targets increased to $7.5-8.5bn.

Telstra will provide an update on towers later this quarter with binding offers expected by FY22. Some analysts have a standalone valuation on towers of $2.50+.

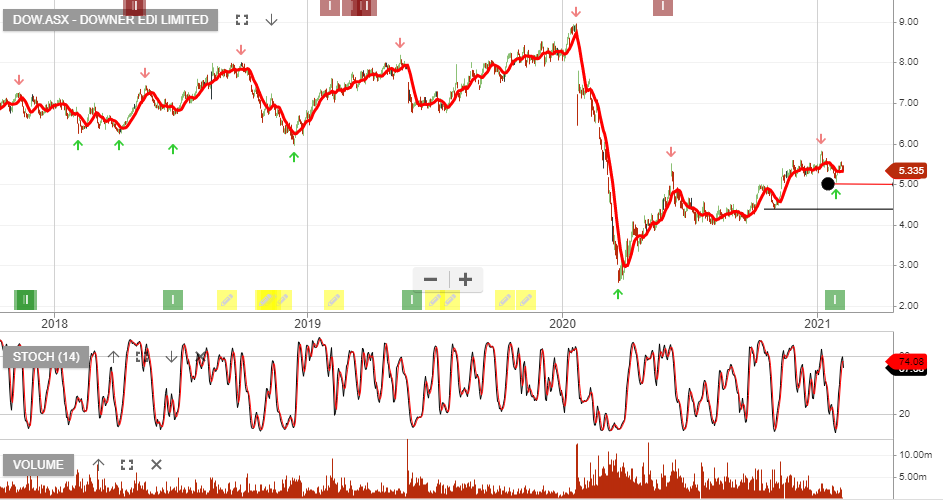

Downer EDI is now under Algo Engine buy conditions, following the entry signal at $5.15. The stock is now included in our ASX 100 model portfolio.

The company is making progress on its urban growth strategy and the divestments within the mining services sector are helping to sure up the balance sheet and de-risk the business outlook.

We see scope for double digit EPS growth into FY22 & FY23.

,

NCM is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support developing near the $25 – $26 level.

Northern Star Resources is under Algo Engine buy conditions and should be well supported by the cost-out story following the merger with Saracen.

NST announced 1HFY21 earnings with NPAT ahead of analysts forecasts.

$0.095 interim dividend.

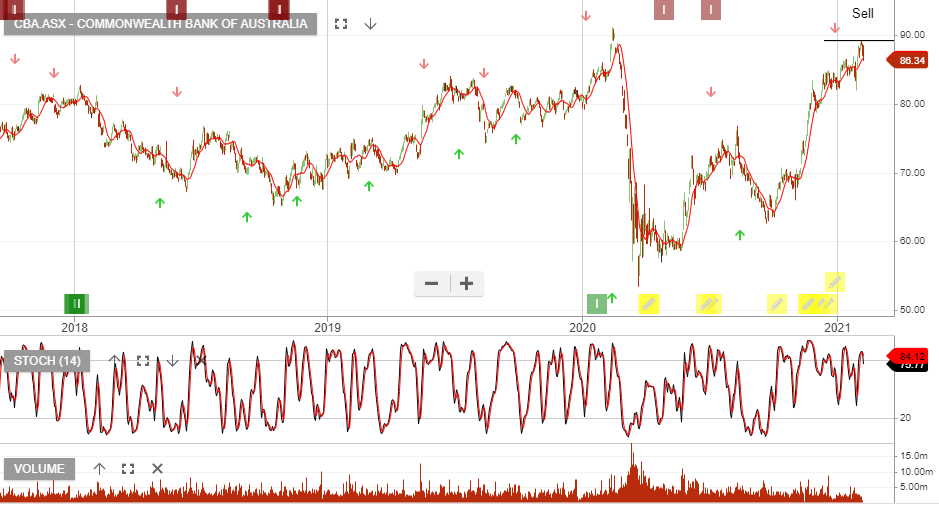

Commonwealth Bank of posted a 21% fall in half-year net profit to $4.88bn in the six months through December from $6.16bn a year earlier. Cash earnings fell 11% to $3.89bn.

An interim dividend of A$1.50 a share, down 25% on year.

We remain cautious on the local banks following the strong run-up in share values.

Or start a free thirty day trial for our full service, which includes our ASX Research.