Wesfarmers – Algo Buy

AS:WES is under Algo Engine buy conditions.

AS:WES is under Algo Engine buy conditions.

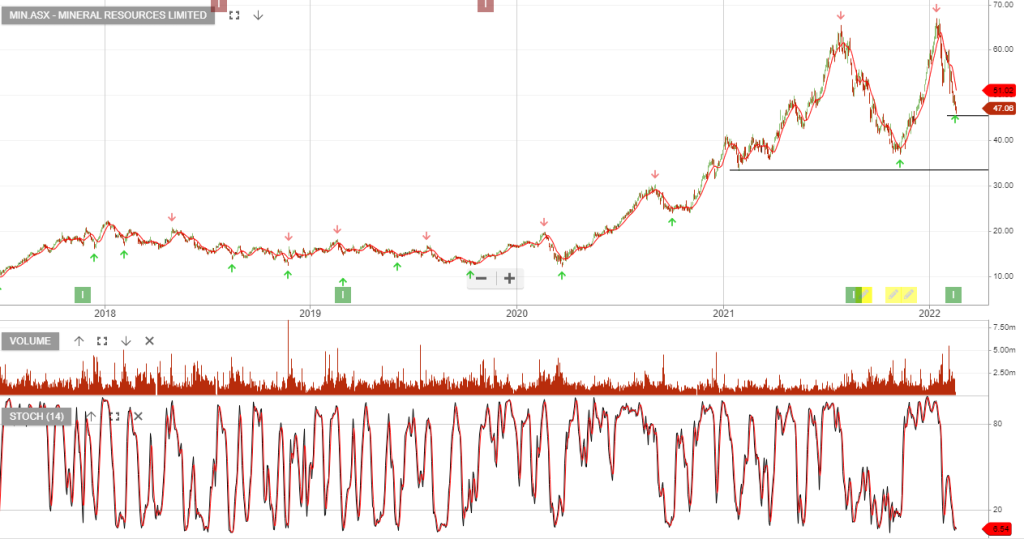

Mineral Resources is under Algo Engine buy conditions and is in our ASX 100 model portfolio.

Sunrise Energy Metals is progressing its world-class Sunrise Battery Materials Complex in New South Wales.

The Sunrise Project is one of the largest and most cobalt-rich nickel laterite deposits in the world and is development-ready, with all key permits and approvals in place. Sunrise is also one of the largest and highest grade scandium deposits globally.

The company requires a funding solution, (or JV partnership), to continue the development of the Sunrise project and we expect to hear news on this front within 6 – 9 months.

SRL is a high risk, high reward speculative opportunity, however, we feel the risks are skewed to the upside and traders may wish to run a stop loss on a break below $1.60

11/3/2022 Update:

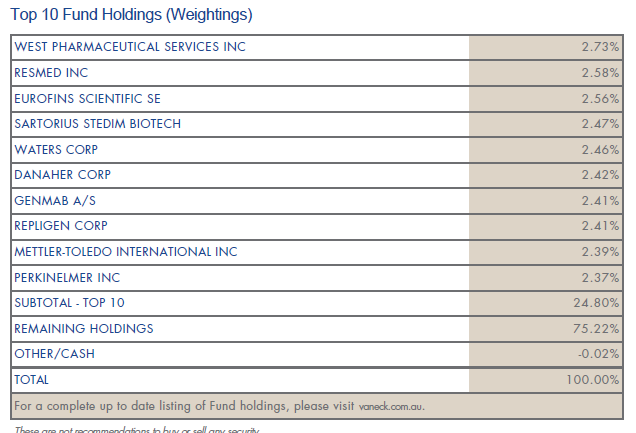

VanEck Vectors Global Health Leaders is under Algo Engine buy conditions. We suggest accumulating the fund within the value range indicated below.

Fund Description: HLTH invests in a diversified portfolio of leading international developed markets (ex-Australia)

companies with the best growth at a reasonable price (GARP) attributes from the global healthcare sector with the aim of providing investment returns, before fees and other costs, which track the performance of the Index.

The MarketGrader Developed Markets (ex-Australia) Health Care Net Return AUD Index seeks to identify the largest companies in the healthcare sector with the best GARP attributes, being the best drivers of long-term capital appreciation. The Index constituents are selected on the basis of the strength of their fundamentals across four-factor categories: growth, value, profitability and cash flow.

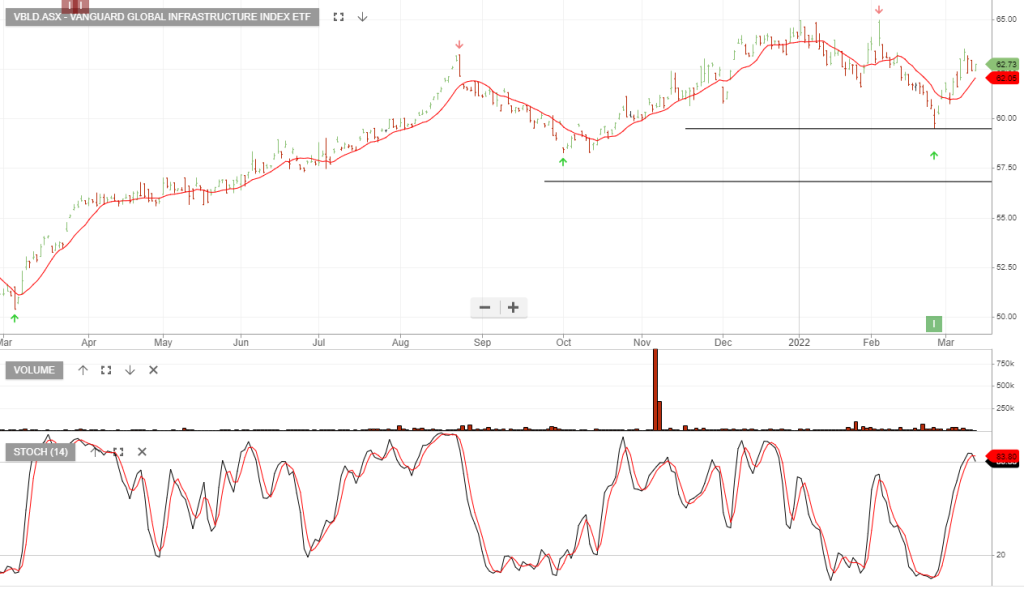

Vanguard Global Infrastructure Index is under Algo Engine buy conditions. We originally highlighted the entry opportunity back in Jan 2021 at $53 and again draw investors attention to the algo signal at $59.

The fund offers investors diversified exposure to infrastructure sectors, including transportation, energy and telecommunications.

Jan 2021 Chart:

11 March 2022

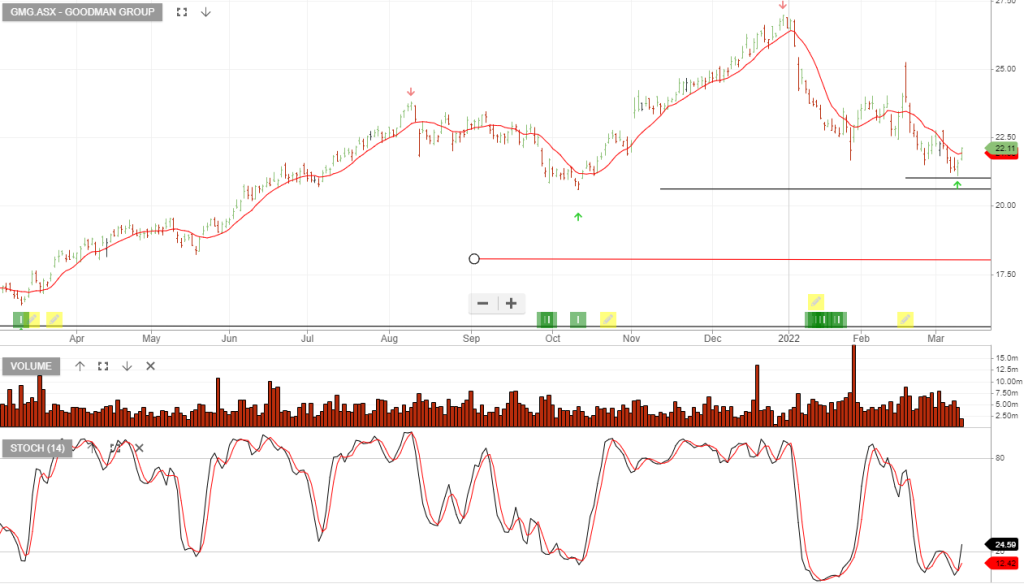

Goodman is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We expect 14% EPS growth into FY22 .

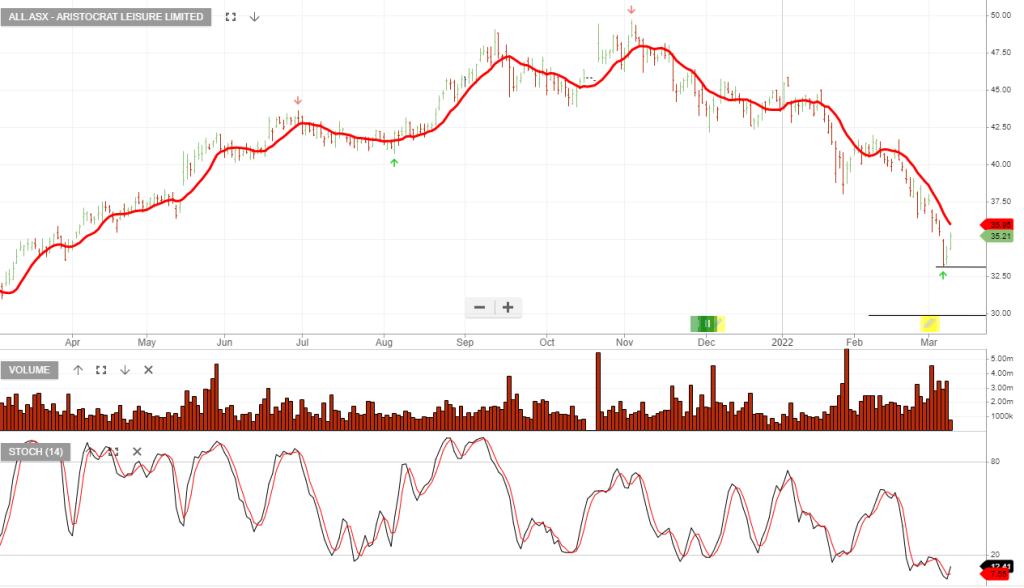

Aristocrat Leisure is under Algo Engine buy conditions.