XJO – Technical Review

The XJO is displaying increased buying interest with support at 7336. A break below this level will be negative.

The XJO is displaying increased buying interest with support at 7336. A break below this level will be negative.

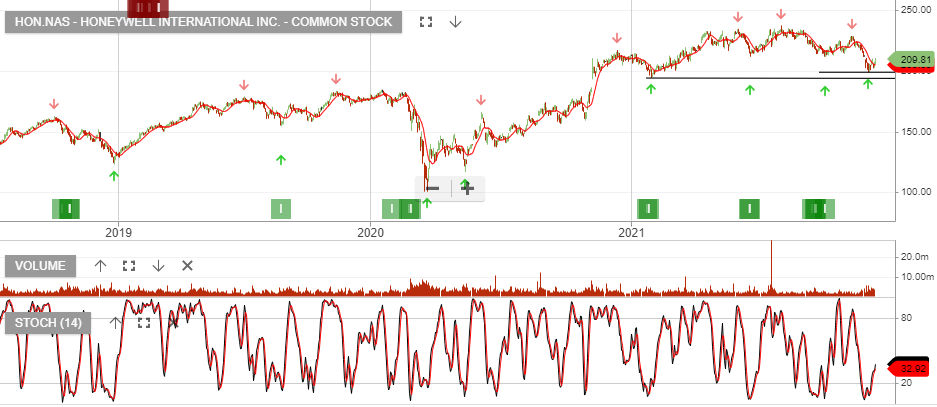

Honeywell International Inc. – Common is under Algo Engine buy conditions and we see buying support increasing above the $200 higher low formation.

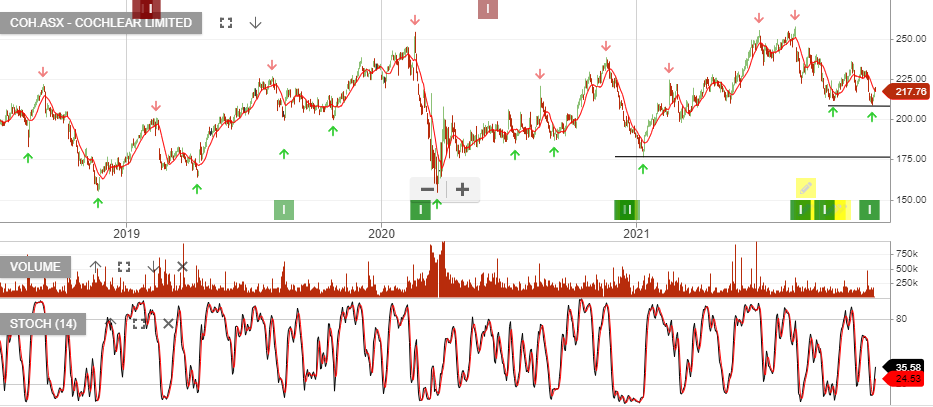

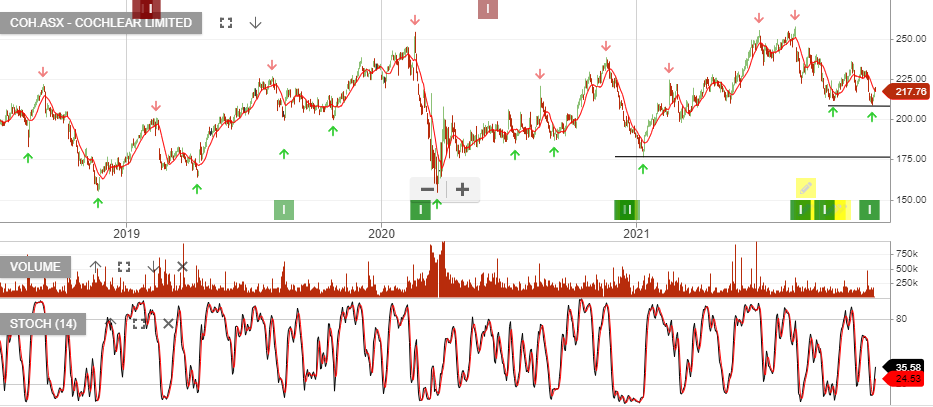

Cochlear is under Algo Engine buy conditions and we expect increased buying support above $210.

Treasury Wine Estates is under Algo Engine buy conditions.

Cochlear is under Algo Engine buy conditions and we expect increased buying support above $210.

VanEck Australian Banks is under Algo Engine buy conditions.

Treasury Wine Estates is under Algo Engine buy conditions.

Neuren Pharmaceuticals is under Algo Engine buy conditions.

Neuren Pharmaceuticals reported the successful completion of its Share Purchase Plan (SPP) at $2.05 per share, which closed on Friday 1 October 2021. The SPP was offered to give all shareholders in Australia and New Zealand the opportunity to subscribe for additional shares at the same price as was offered to institutional and sophisticated investors in the recent placement.

Total gross proceeds of $23.3 million from the placement and SPP will accelerate the development and increase the value of NNZ-2591 for four neurodevelopmental disorders, by enabling a Phase 2 clinical trial in Prader-Willi syndrome and the foundational work for Phase 3 development across Prader-Willi, Phelan-McDermid, Angelman and Pitt Hopkins syndromes. NNZ-2591 has Orphan Drug designation from the US Food and Drug Administration for all four disorders and from the European Medicines Agency for three.

Neuren CEO Jon Pilcher commented: “We are pleased with and grateful for the support of shareholders in both the placement and the SPP. Neuren is now in a strong financial position as we approach the Rett syndrome Phase 3 results for trofinetide and advance the development of NNZ-2591 for multiple neurodevelopmental disorders in parallel.”

7/12 update:

Neuren added more than $280 million in market value, after telling investors a phase III trial for the treatment of Rett syndrome using its trofinetide drug showed statistically significant benefits for 187 patients.

Neuren has partnered with US drugs giant Acadia for trofinetide’s development and says it’s eligible to receive milestone payments of up to $US455 million.

Leon’s live webinar will be held tonight at 8:00pm NSW time. It will be available for members and non-members to access. Join us to find out what stocks we’re buying and selling in today’s market.

https://kd169.infusionsoft.com/app/form/e0c8fab55abf644c15dec83cd84a421a

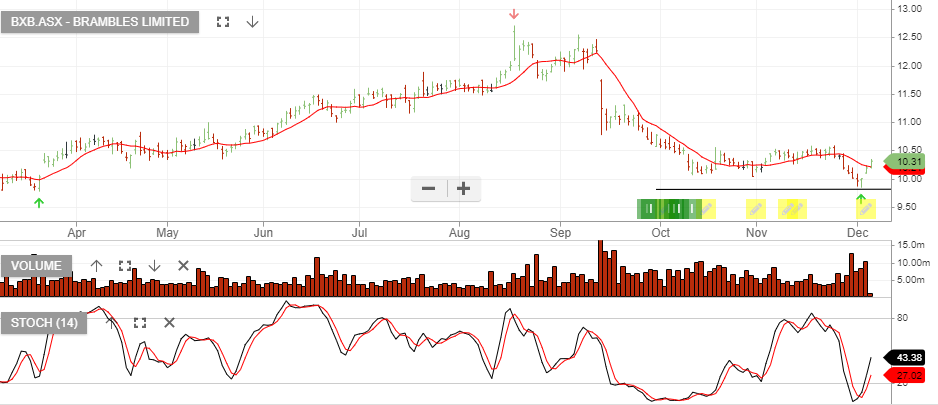

Brambles is under Algo Engine buy conditions and has now been added into our ASX model portfolio.

6/12 update: Buy BXB and hold above the recent pivot low or for short-term traders, hold whilst the price action remains above the 10-day average.