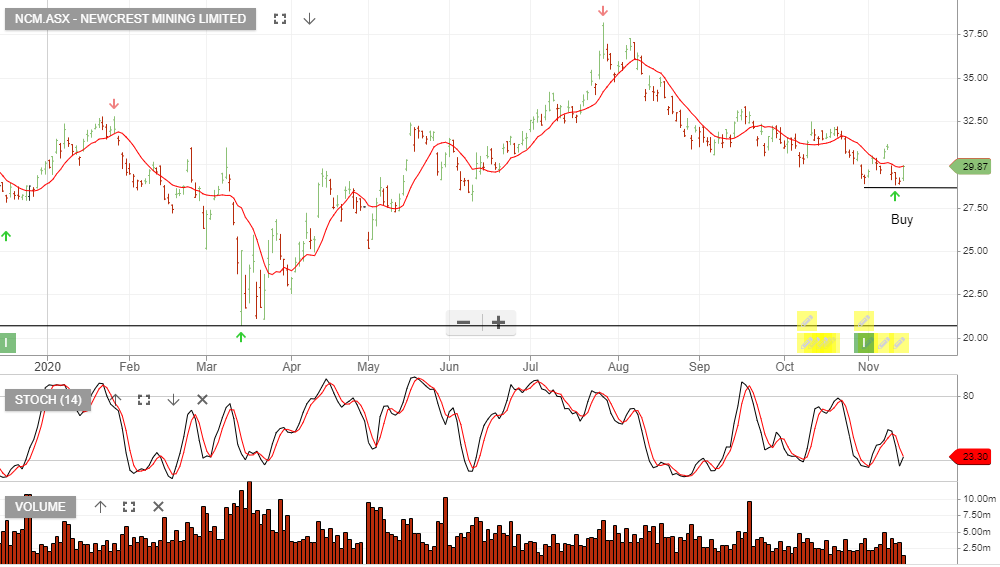

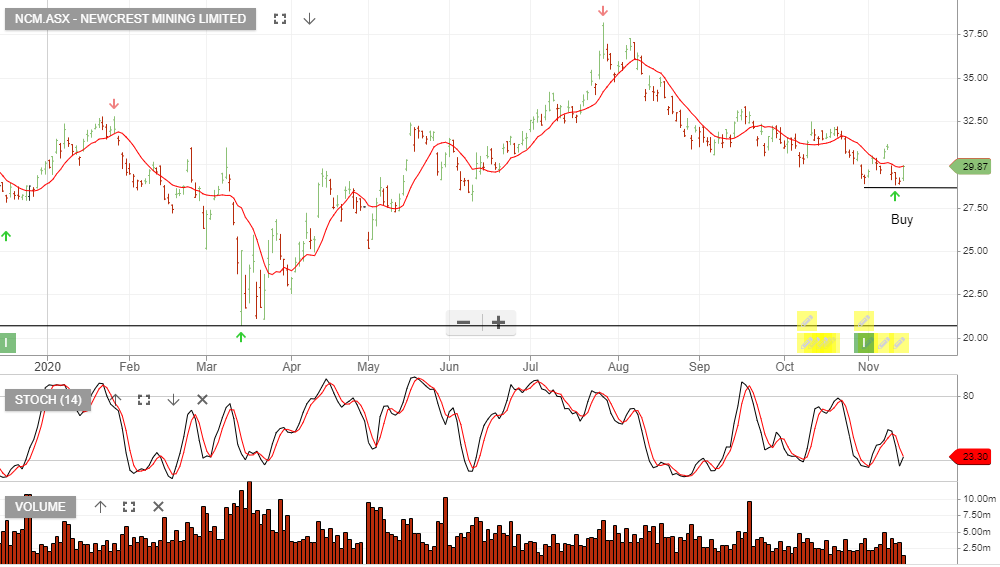

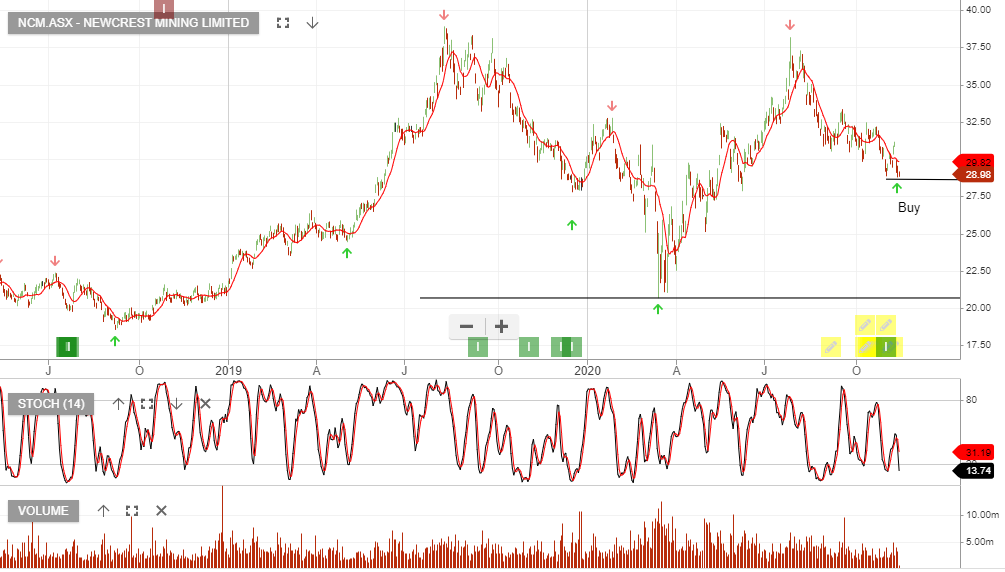

Newcrest – Buy

Newcrest Mining remains under Algo Engine buy conditions. We suggest investors accumulate NCM near the $29 support level.

Newcrest Mining remains under Algo Engine buy conditions. We suggest investors accumulate NCM near the $29 support level.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Commonwealth Bank of remains under Algo Engine sell conditions.

1Q21 earnings of $1.8bn were down 16% on the same time last year. CBA’s operational performance in 1Q21 does not justify the premium it is trading on versus peers.

Our preferred exposure to banks is through the BetaShares Global Banks

Newcrest Mining remains under Algo Engine buy conditions. We suggest investors accumulate NCM near the $29 support level.

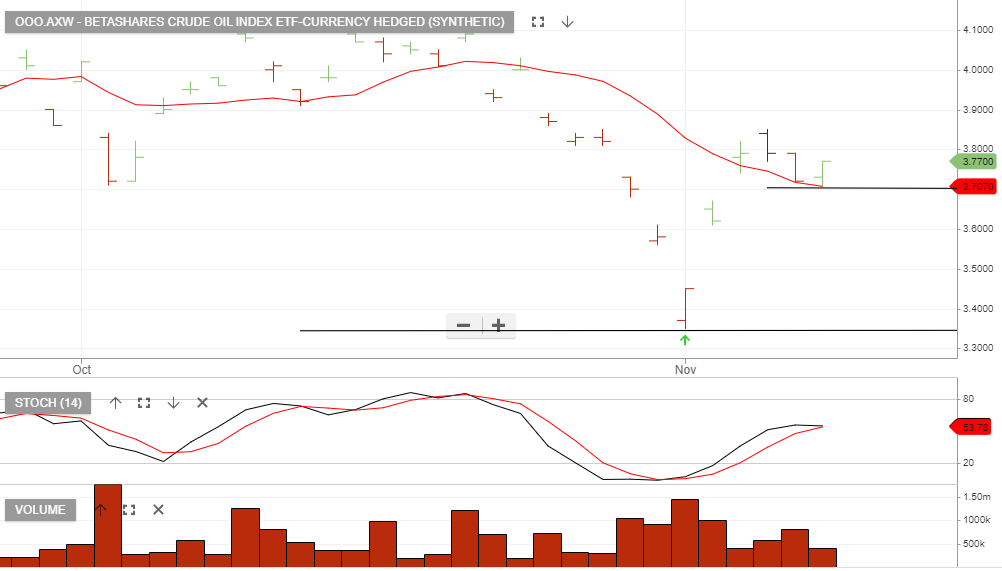

BetaShares Crude Oil Index ETF-Currency Hedged should perform well under an environment with an announced vaccine and an easing of travel restrictions.

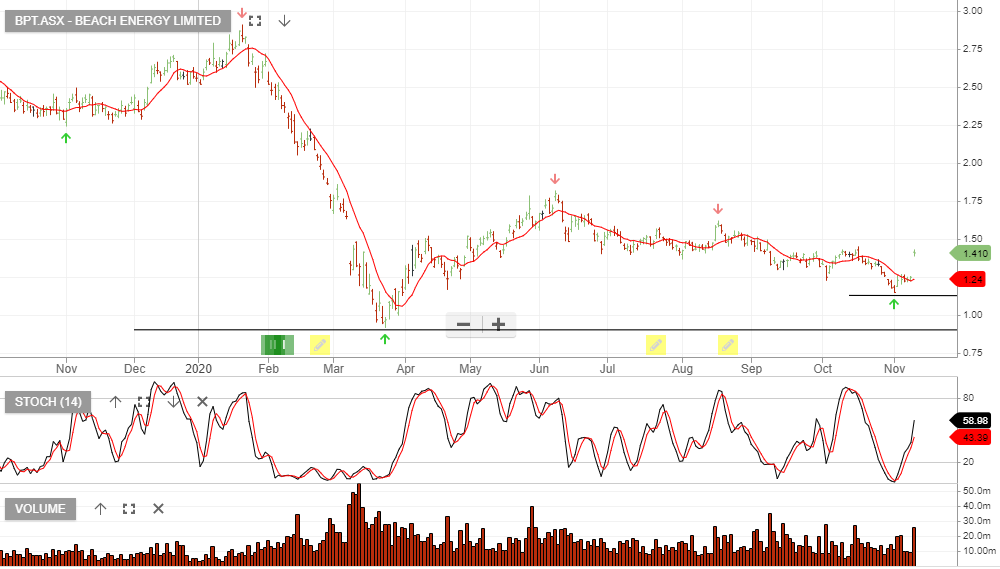

Beach Energy is the only top 100 energy stock under algo engine buy conditions. Buying interest is building above the $1.15 support level.

FY20 underlying NPAT of A$500mn was ahead of market expectations.

REA Group is under Algo Engine buy conditions since switching in mid-September at $106.

REA has reported 1Q21 results ahead of analysts estimates with revenue of $196mn nd EBITDA of $124mn.

Although the management outlook statement remains positive, we have some concerns about valuation and consider the stock near resistance.

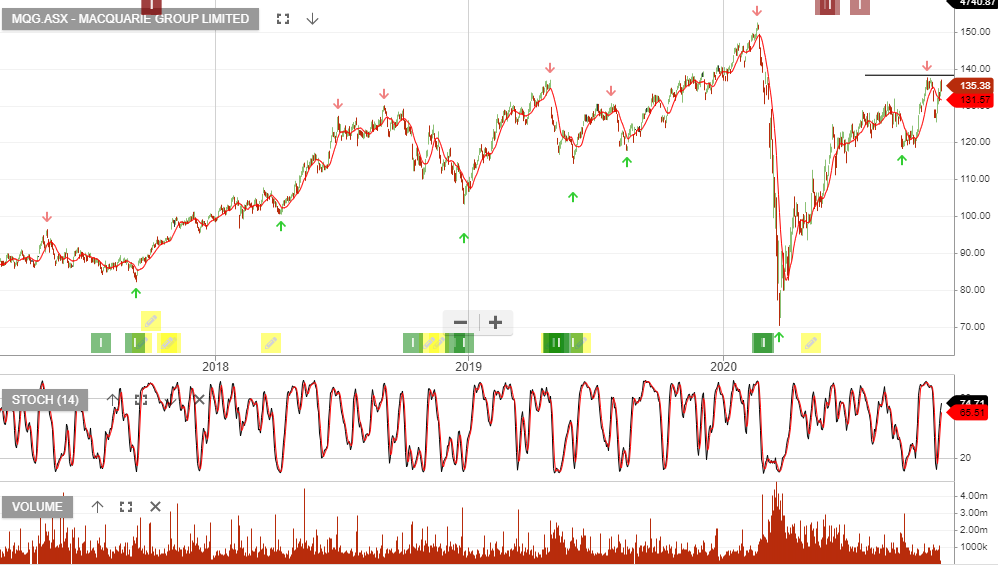

Macquarie Group is under Algo Engine sell conditions and has overhead price resistance at the $135 level.

MQG reported 1H21 net profit of $985mn down 23% on the same time last year.

Woolworths Group has been trading sideways in 2020 within the $35 to $40 price range. This provides a trading range for investors to consider or alternatively, selling calls at the upper band to generate extra cash flow.

On a valuation basis, using 10% EPS growth into 2022, it supports a 3% fully franked dividend yield and places the stock on a 34x forward PE ratio.

Deterra Royalties is the new ASX listed company which separated from Iluka Resources. DRR owns Iron Ore royalties as the primary business.

The company is likely to see strong revenue growth over the coming years, generated by increased production from the current assets and new assets through either acquisition or financing development projects.

Based on FY22 earnings we have DRR trading on a forward yield of 5%+

Or start a free thirty day trial for our full service, which includes our ASX Research.