Fortescue Metals – Buy

Fortescue Metals Group is under Algo Engine buy conditions. Buying support is likely to build at $15.50.

Fortescue Metals Group is under Algo Engine buy conditions. Buying support is likely to build at $15.50.

Cleanaway Waste Management is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support at the recent $2.15 higher low formation.

Bega Cheese has continued to see buying interest above the $5.00 support level.

Pro Medicus is a current holding in our ASX high conviction model. Since adding the position on the 11 of Sept, the stock has rallied 18%.

OceanaGold is under Algo Engine buy conditions. We highlight the early evidence of buying interest rebuilding and the short-term indicators turning higher.

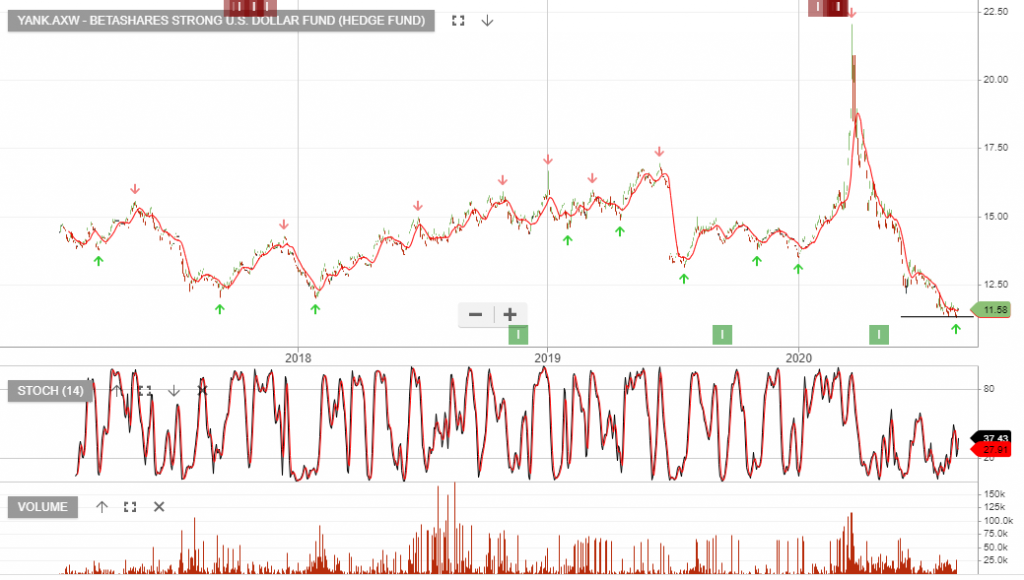

Betashares Strong U.S. Dollar Fund (Hedge

The US dollar has been trading lower over recent weeks and should we see a pick up in market volatility and risk-off sentiment builds, the US dollar may find increased buying support.

YANK looks to be finding support at $11.25

Since writing the above post back in August, YANK has traded higher and we continue to see support near the $11.25 range.

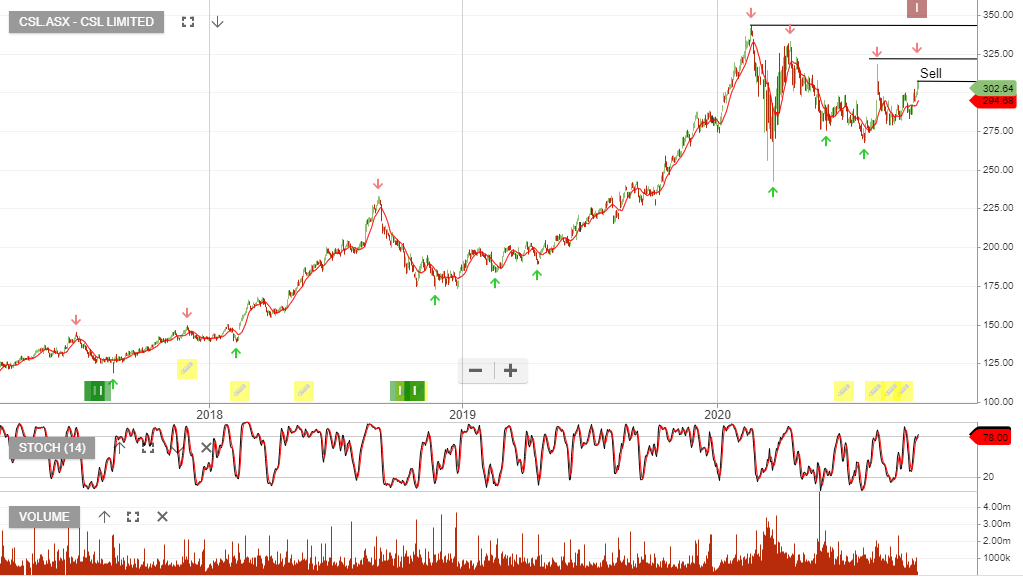

CSL has now shifted to sell conditions after being in our model portfolios since May 2015. With dividends, the stock has increased by 250%.

CSL has raised its full year profit guidance to between 3% – 8%, despite warnings of higher plasma costs. The lower end of guidance had previously been zero.

Full-year FY21 is now expected to be between $2.2bn and $2.26bn. We continue to see reliable earnings growth for CSL, however, the 40x multiple may prove to be too rich in the short-term.

Fortescue Metals Group is under Algo Engine buy conditions. Buying support is likely to build at $15.50.

Newcrest Mining remains under Algo Engine buy conditions and we recommend investors accumulate between $30 – $32.

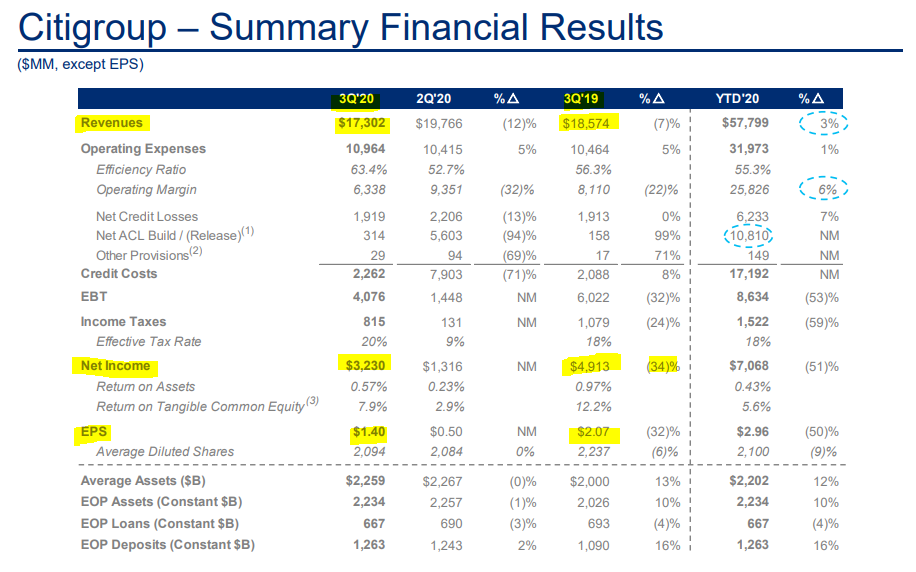

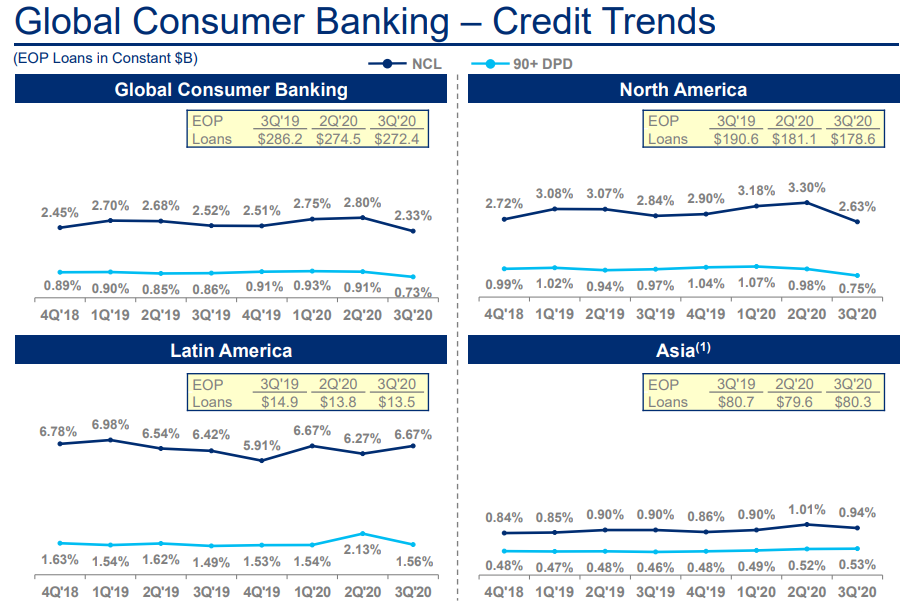

Citigroup is under Algo Engine sell conditions following the lower high formation back in August at $56.

Q3 earnings released overnight highlighted some concerning trends, such as net income down 34% and earnings per share down 32% on the same time last year.

Or start a free thirty day trial for our full service, which includes our ASX Research.