Watch Monday’s Opportunities in Review Webinar

The recording from Monday’s webinar is available below:

The recording from Monday’s webinar is available below:

For our next Live Webinar, I will review high conviction ASX and US buy and sell opportunities from the recent algo engine and model portfolio signals.

To be sent the invitation, you must register your details here.

If you missed yesterday’s webinar, then you can watch it below.

In our next webinar, I will review high conviction ASX buy and sell opportunities from the recent algo engine and model portfolio signals.

If you cannot make the time, then register anyway and we’ll email you a link to watch the replay.

One of the first lessons that we learned working on a dealing desk is that instability in sovereign bond markets can create sudden turmoil across a wide range of financial products.

The reason for this is because the aggregate amount of global bonds outstanding dwarfs the value of all the shares of stock in the world, combined.

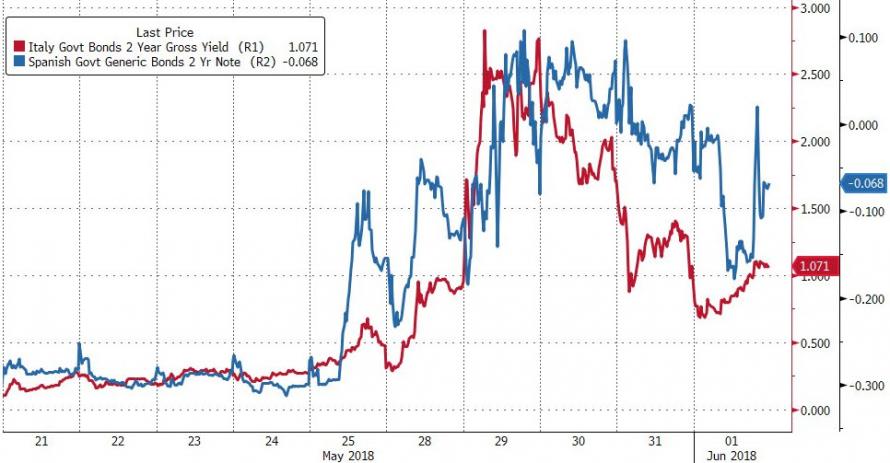

Last Tuesday, global financial markets were spun into a frenzy as Italian sovereign bond yields exploded to the upside.

The catalyst for the move was President Mattarella’s rejection of the new government’s candidate for Finance minister, Paolo Savona.

Mr Savona is an outspoken critic of the EU and the Euro currency

As a result, Italian 2-yr bond yields rose from .68% to 2.42% in one day. That’s a rise of 250% in just 24 hours!!

Looking past the political aspect of this week’s events, Italy is well on its way to becoming the next financial basket-case in Europe.

Regardless of who governs Italy, the country will need to re-finance over 350 billion worth of debt maturities and close to 300 billion worth of non-performing loans over the next five years.

We consider the ongoing debt stress in Italy as a potential source of contagion for global equity markets, including the ASX 200 Index.

Italian Sovereign Yields

Italian Sovereign Yields

Did your miss our Webinar last night on our Charts and the Algo Engine? You can watch the replay below.

Our final webinar in the 3 part series will be held on Wednesday the 13th of December 2017 at 12:30pm QLD time, 1:30pm NSW/VIC time and 1:30am WA time. This is a daytime session. The topic will be Trading ASX 50 CFDs with Saxo Go.

If you missed our Webinar last night, then you can catch up by watching it here.

Our next Webinar is this Thursday night – Register Now.

Join us in this webinar as we explain the new features and best ways to navigate through the research, charts, algo engine & new model portfolio features. You’ll also be invited to a 30-day free trial of the technology.

Don’t miss the opportunity to build your understanding on how to benefit from our new technology, as your window to the market.

Join us in this webinar as we look at shorter-term trading strategies for both long & short positions & we review how we utilise the Saxo Trader Go platform to take advantage of trading opportunities within the ASX top 50 stocks. We explore the features, how to place and manage orders and look at how short term traders can use the Investor Signals’ research to trade both long and short signals using CFD’s.

Don’t miss the opportunity to learn how we apply proven techniques to shorter term trading on ASX 50 CFD’s.

In December, we are conducting the following webinars. Please register your interest by using the register link below. We will email you, one hour before each Webinar begins, with the link to join in.

Join us in this webinar as we recap on the major trends of 2017 and explore which ones will continue in 2018 and which ones have come to an end. Find out what stocks to add and what stocks to remove from your portfolio, before it’s too late.

Don’t miss the opportunity to build your understanding of the big trends impacting equities and, more importantly, which stocks should and shouldn’t be in your portfolio heading into 2018.

Join us in this webinar as we explain the new features and best ways to navigate through the research, charts, algo engine & new model portfolio features. You’ll also be invited to a 30-day free trial of the technology.

Don’t miss the opportunity to build your understanding on how to benefit from our new technology, as your window to the market.

Join us in this webinar as we look at shorter-term trading strategies for both long & short positions & we review how we utilise the Saxo Trader Go platform to take advantage of trading opportunities within the ASX top 50 stocks. We explore the features, how to place and manage orders and look at how short term traders can use the Investor Signals’ research to trade both long and short signals using CFD’s.

Don’t miss the opportunity to learn how we apply proven techniques to shorter term trading on ASX 50 CFD’s.

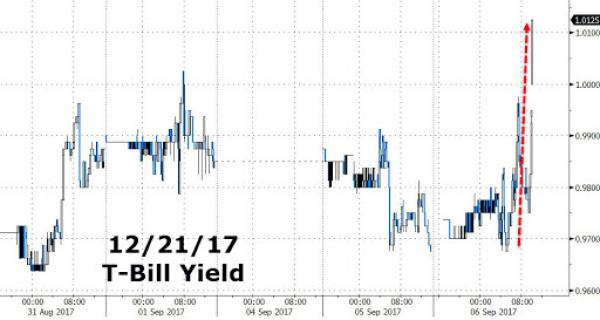

US Stock indexes may have dodged a bullet today when President Trump defied his White House advisors and sided with Democrats to defer the debt ceiling debate until December.

Using the legal structure of a “continued resolution” linked to emergency aid to victims of hurricane Harvey, the proposal would suspend the borrowing cap, currently at $19.9 trillion, until December 15th.

And while this manoeuvre calmed the nerves of T-Bill investors into the October maturity, the fear premium of a government shutdown has just been transferred to the December maturity.

Over the next few days we expect to hear more about how this political tactic will impact the administration’s legislative goals on tax reform, infrastructure programs and border security.

The prime risk to US equity markets is that credit agencies view this failure to address the debt ceiling as cause to downgrade US Sovereign debt ratings.

In short, “kicking the can” down the road has not made US assets less risky at current levels.

December T-Bill Yields

December T-Bill Yields

Or start a free thirty day trial for our full service, which includes our ASX Research.