Danaher Corporation

Danaher Corporation Common is under Algo Engine buy conditions.

Danaher Corporation Common is under Algo Engine buy conditions.

Tech’s megacaps announced major increases in capex for 2026, with the four hyperscalers now expecting combined spending of close to $700 billion.

Reaching those numbers is going to mean a big drop in free cash flow, with Amazon projected to turn negative this year.

The four hyperscalers are now projected to increase capital expenditures by more than 60% from the historic levels reached in 2025, as they load up on high-priced chips, build new mammoth facilities and buy the networking technology to connect it all.

Getting to those kinds of numbers is going to require sacrifice in the form of free cash flow. Last year, the four biggest U.S. internet companies generated a combined $200 billion in free cash flow, down from $237 billion in 2024.

While Amazon laid out the most aggressive spending plan among the megacaps, Alphabet wasn’t far behind. Pivotal Research projects Alphabet’s free cash flow to plummet almost 90% this year to $8.2 billion from $73.3 billion in 2025.

Analysts at Barclays now see a drop of almost 90% in Meta’s free cash flow, after the social media company said last week that capex this year will reach as high as $135 billion.

The index has created overhead resistance and is now below the 10-day average.

NASDAQ

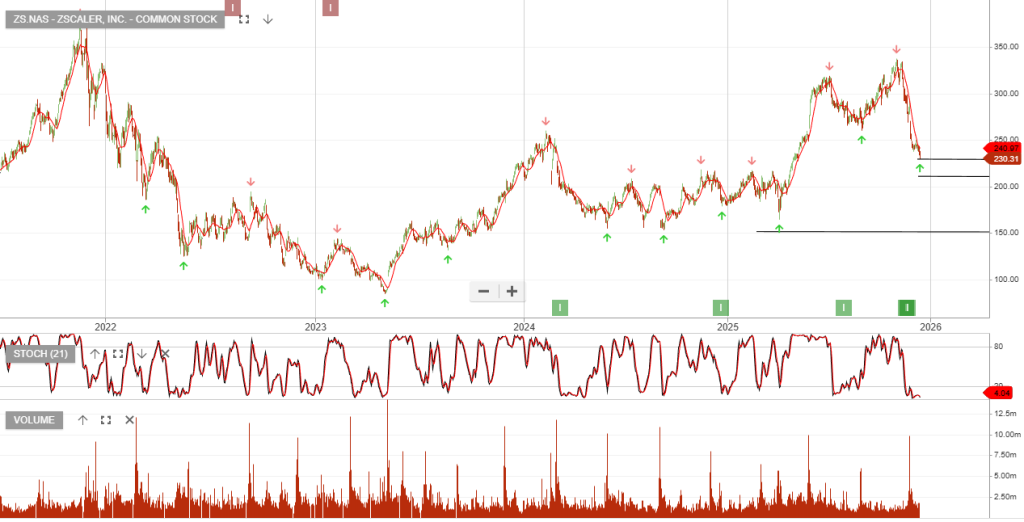

Zscaler, Inc. – Common Add to watchlist

MMM:NYS is under Algo Engine buy conditions.

Zscaler, Inc. – Common: Buy on a price move above the 10-day average.

First quarter 2026 earnings: EPS and revenues exceed analyst expectations

First quarter 2026 results:

Revenue exceeded analyst estimates by 1.8%. Earnings per share (EPS) also surpassed analyst estimates by 37%.

Revenue is forecast to grow 16% p.a. on average during the next 3 years.

Oracle Corporation is rated a Buy driven by AI and cloud momentum.

ORCL’s cloud revenue surged 28% YoY, fueled by a $300B OpenAI deal.