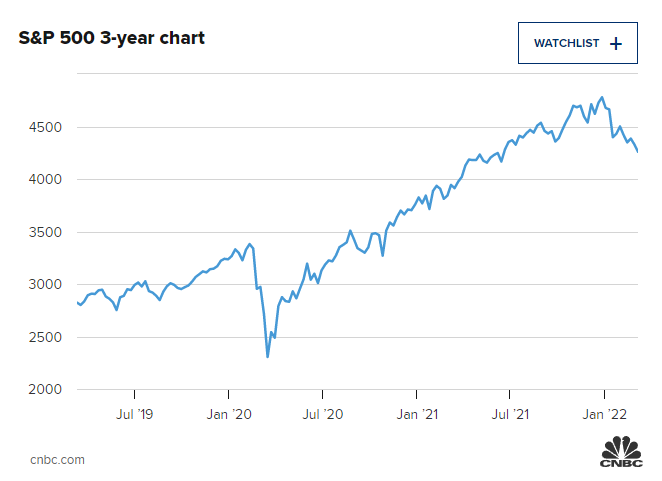

S&P500 Chart Review

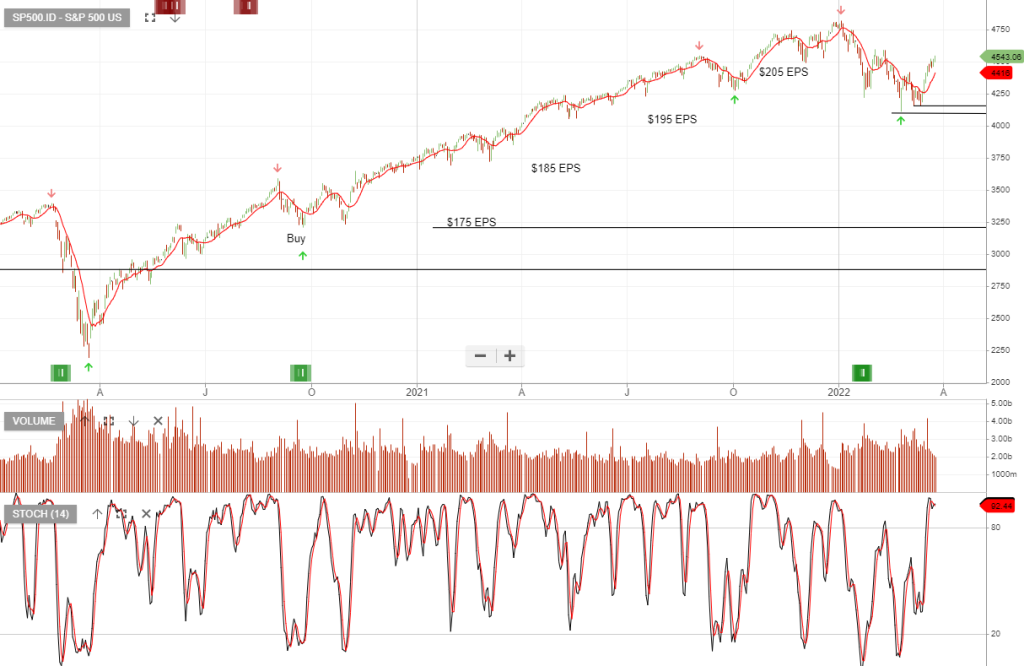

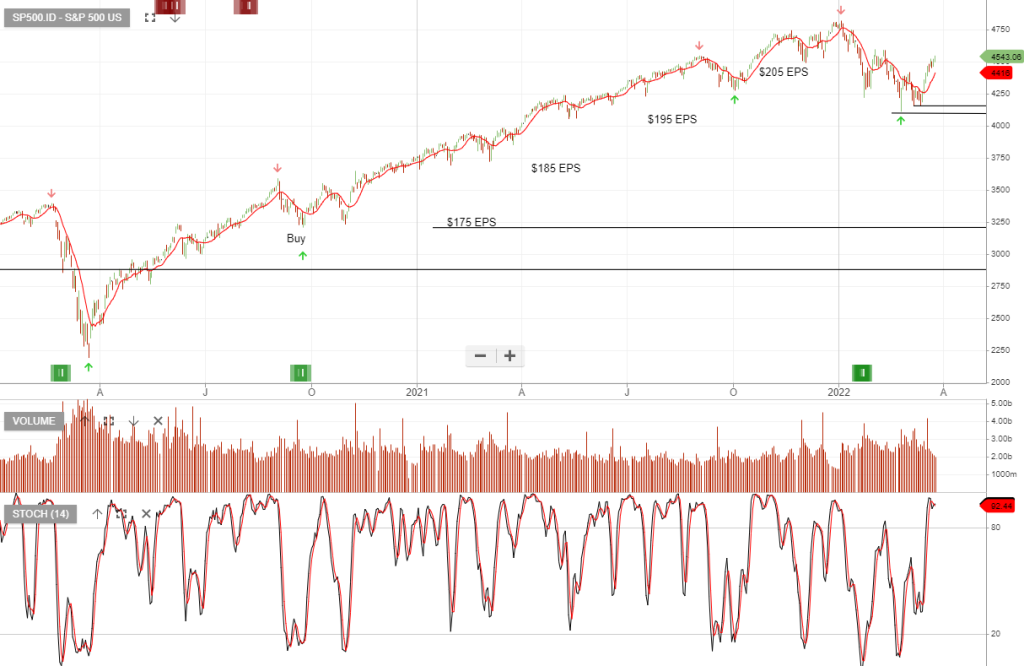

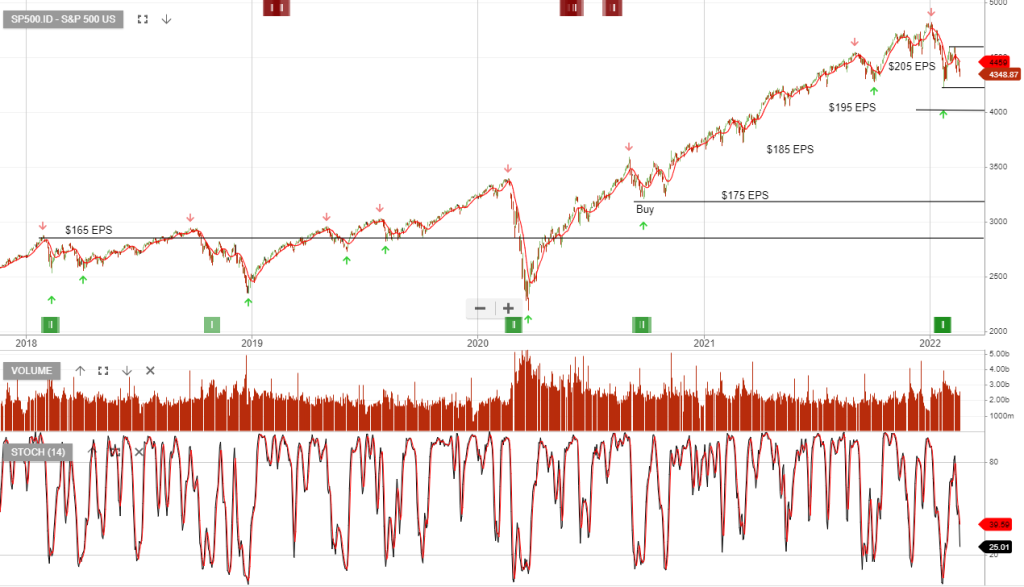

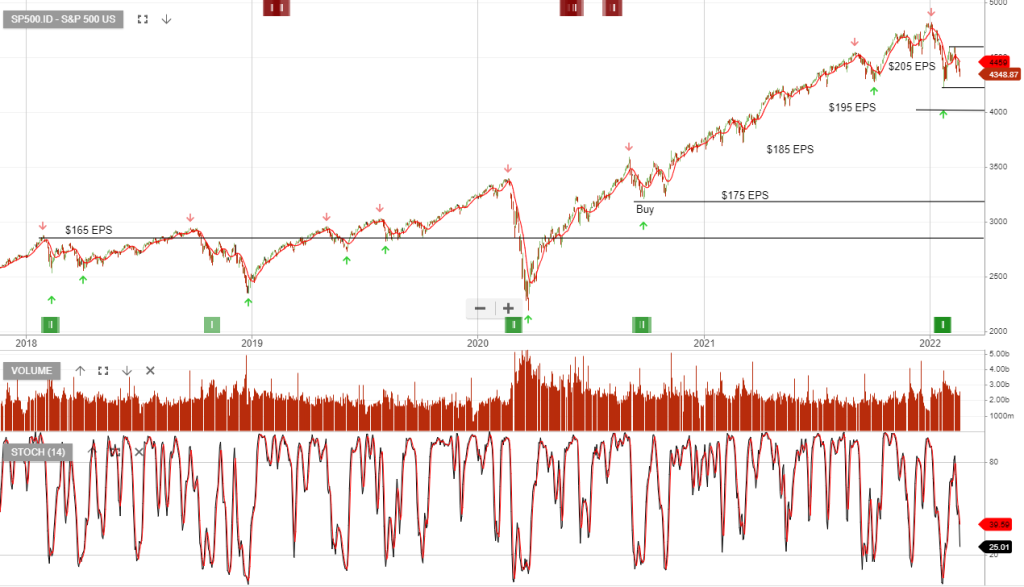

The S&P500 continues to trade higher following the recent Algo Engine buy signals. Short-term, the momentum indicators remain positive and the price action is above the 10-day average.

The S&P500 continues to trade higher following the recent Algo Engine buy signals. Short-term, the momentum indicators remain positive and the price action is above the 10-day average.

Take-Two announced on Jan 10 that it would be buying Zynga for $12.7b. The current weakness in the share price provides for an attractive entry point.

Solana remains under buy conditions and any minor pullback will likely see increased buying activity above the recent $78 support level.

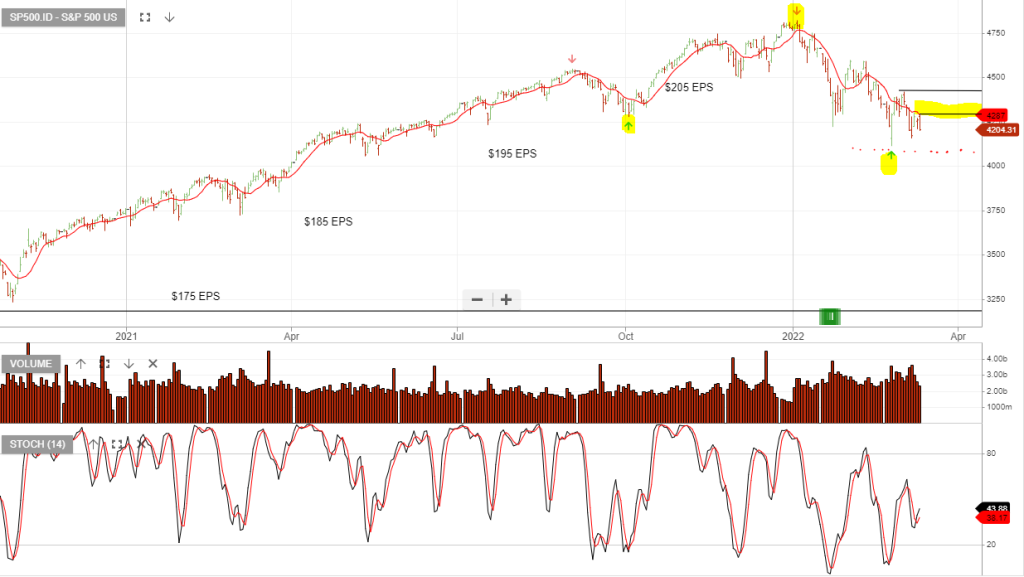

The graph of the S&P500 shows faltering short-term momentum with overhead resistance at 4590 in the S&P500 index.

Join Monday night’s webinar, where I’ll provide detail on the technical patterns that traders and investors should be watching.

Free trial: https://www.investorsignals.com/register

12/2 update:

19/2 update: The S&P500 remains below the 10-day average.

12/3 Update: The S&P500 remains below the 10-day average.

Markets may have little reaction if the central bank carries out its quarter-point hike on Wednesday.

The Fed’s rate hike is expected, but investors will be watching to see what the central bank has to say about inflation and the economy, as well as its projections for future interest rate hikes.

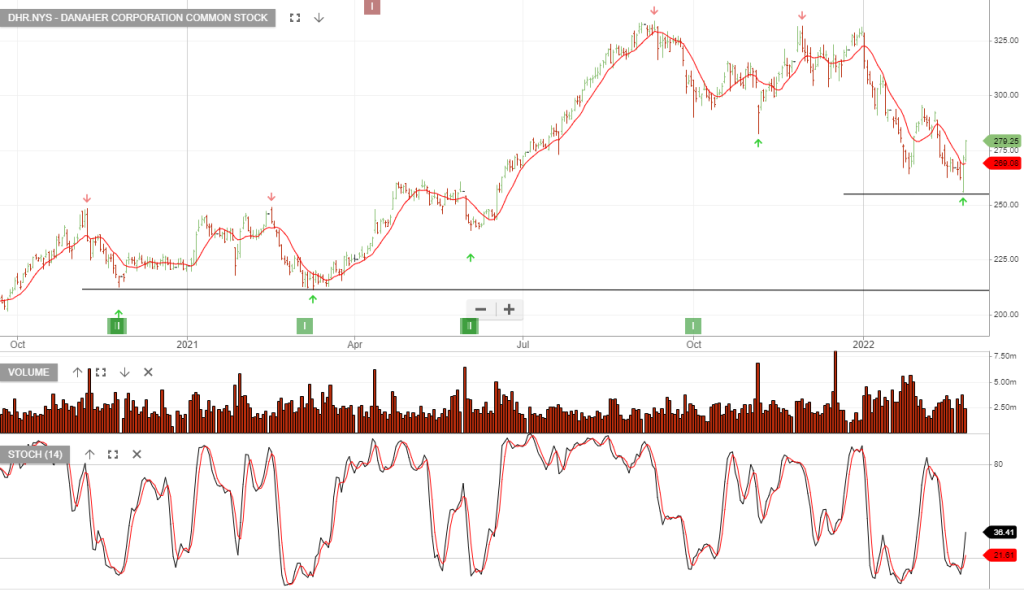

Danaher Corporation Common is under Algo Engine buy conditions.

4Q Dec 2021: net earnings were $1.8 billion, or $2.39 per diluted share which represents + 44% year over year. Non-GAAP earnings per share were $2.69 or + 29% y/y.

Revenues increased +20.5% year-over-year to $8.1 billion.

Full-year 2021: net earnings were $6.3 billion, or $8.50 per share which represents +74% year-over-year increase. Non-GAAP earnings per share for 2021 were $10.05, or +59 over the comparable 2020 amount. Revenues for the full year 2021 increased 32.0% to $29.5 billion.

Operating cash flow for the full year 2021 was $8.4 billion, representing a 34.5% increase year-over-year

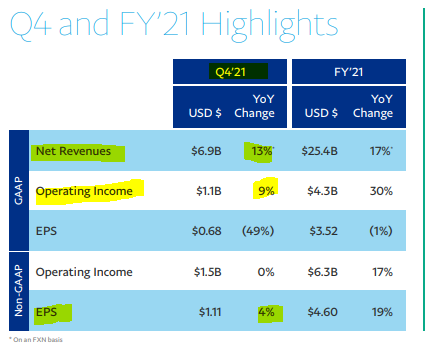

Q4’21: Solid finish to another strong year

Total Payment Volume (TPV) of $339.5 billion, growing 23% on a spot and FX-neutral basis (FXN); net revenues of $6.9 billion, growing 13% on a spot and FXN basis.

FY’22: Expect TPV to reach $1.5 trillion and revenue to surpass $29 billion

• TPV is expected to grow 19%-22% at current spot rates.

• Revenue expected to grow 15%-17% on a spot basis; excluding eBay, revenue is expected to grow 19%-21%

• 15 to 20 million NNAs expected to be added to PayPal’s platform in FY’22.

We see long-term value in Paypal for the patient investor and anticipate that the company will make attractive bolt-on acquisitions, supported by low company debt and free cash flow, which will help support the growth story.

Short term, traders may wish to position a trade around the highlighted setup below, with a stop loss below the recent pivot low.

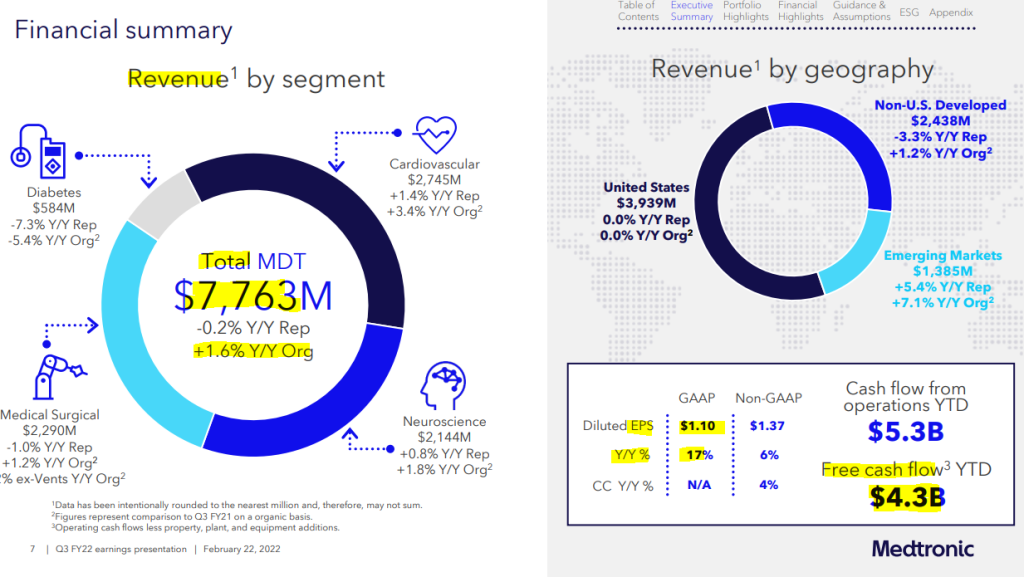

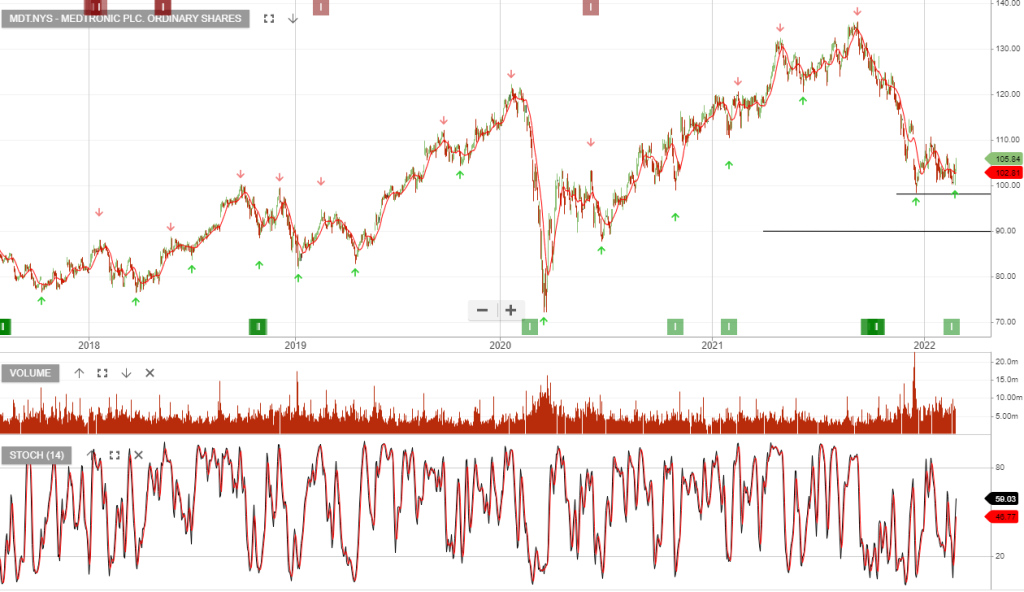

Medtronic plc. Ordinary is under Algo Engine buy conditions.

Medtronic sees rebound in elective procedures as Omicron surge wanes. Fourth-quarter profit was in line with Wall Street estimates.

The graph of the S&P500 shows faltering short-term momentum with overhead resistance at 4590 in the S&P500 index.

Join Monday night’s webinar, where I’ll provide detail on the technical patterns that traders and investors should be watching.

Free trial: https://www.investorsignals.com/register

Traders will be monitoring next week’s price action based on the above pattern.

19/2 update: The S&P500 remains below the 10-day average.

The graph of the S&P500 shows a continuation of the bullish move and a recent Algo Engine buy signal at the January low. Short-term we have faltering momentum with overhead resistance at 4590 in the S&P500 index.

Join Monday night’s webinar, where I’ll provide detail on the technical patterns that traders and investors should be watching.

Free trial: https://www.investorsignals.com/register

Traders will be monitoring next week’s price action based on the above pattern.