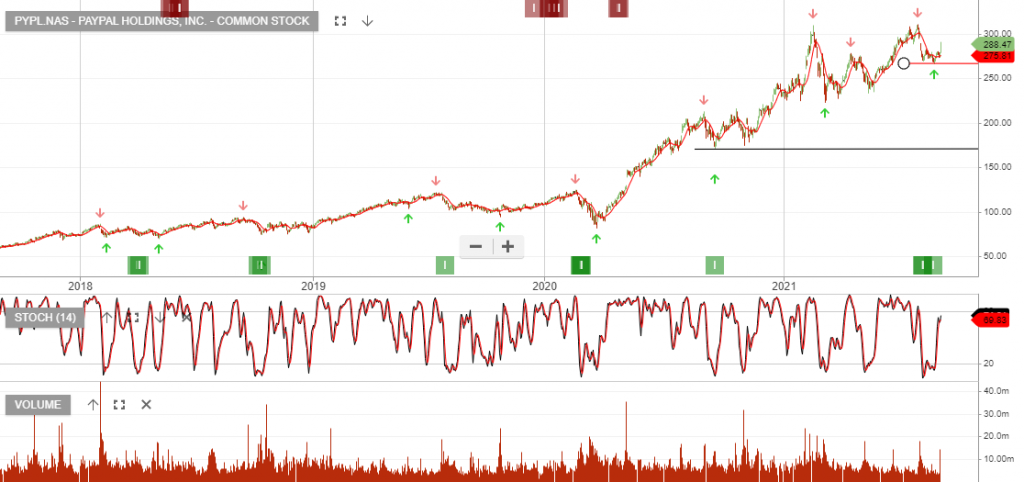

Paypal – Buy

Boeing – Buy

Paypal – Buy Signal

PayPal Holdings, Inc. – Common is under Algo Engine buy conditions and has been in our US S&P100 model portfolio since Sep 2020. The stock is up 63.80% after 347 days.

The low earlier this month at $266 triggered another buy signal which makes it the second cluster of buy signals since the original switch to buy in 2020.

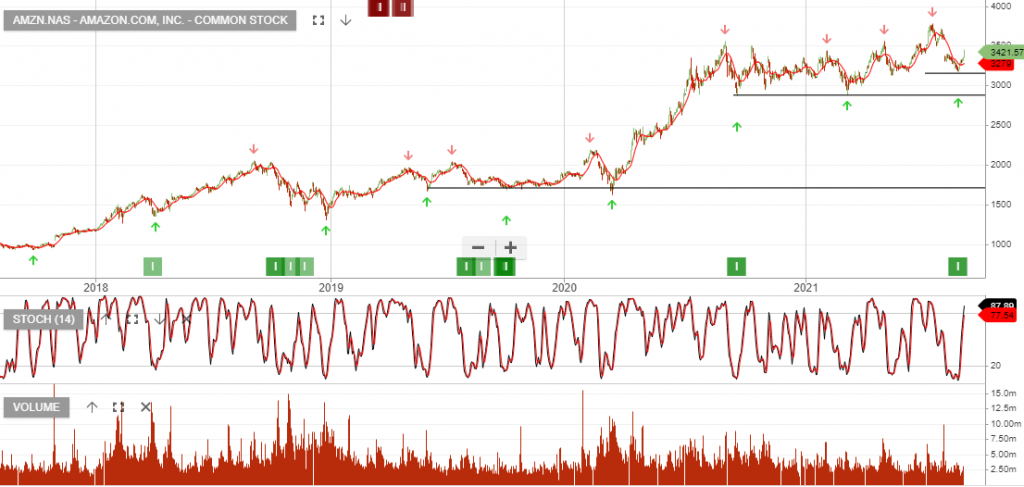

Amazon – Buy Signal

Amazon.com, Inc. – Common is under Algo Engine buy conditions and has been in our US S&P100 model portfolio since Aug 2019. The stock is up 84.40% after 761 days.

Last week’s low at $3,175 triggered another buy signal which makes it the third cluster of buy signals since the original switch to buy in 2019.

Amgen – Buy Signal

Amgen Inc. – Common is under Algo Engine buy conditions and is a current holding in our US S&P100 model portfolio.

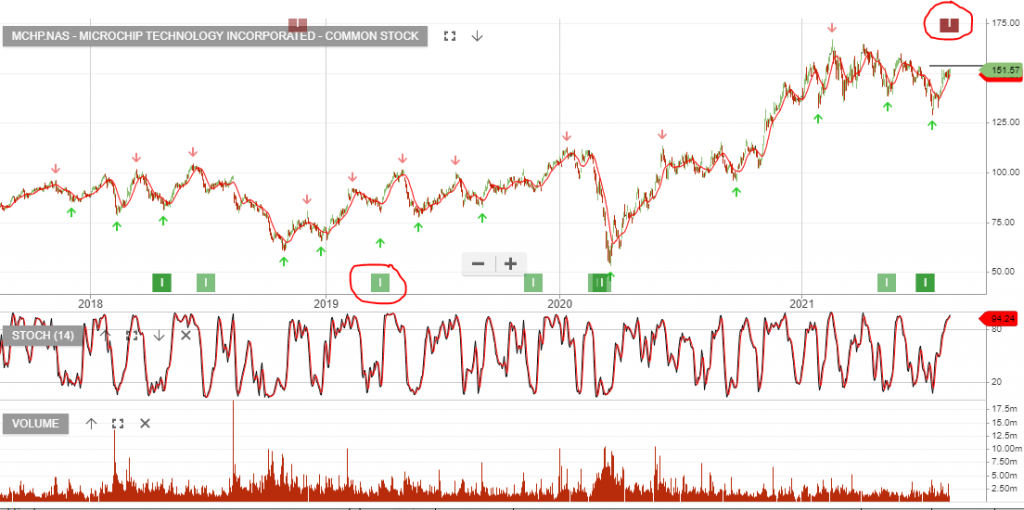

Microchip Technology: 90.95% Gain

MCHP:NAS was added to our NASDAQ 100 model portfolio on 28/3/2019 at $81.15. The position was closed yesterday for a 90.95% gain after an 868-day holding period.

To review the current holdings of other stocks in our models, please login or start your free trial today

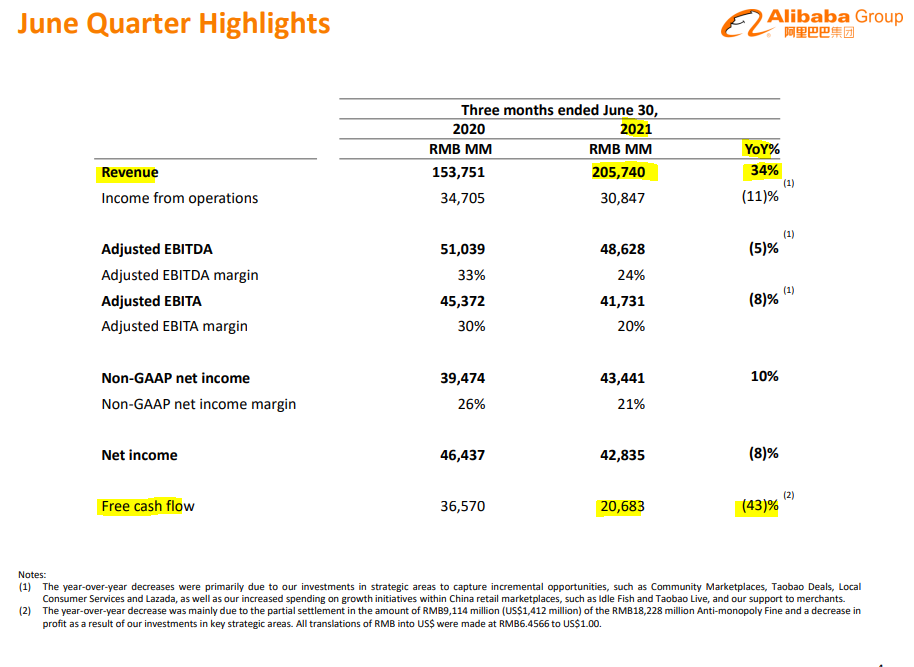

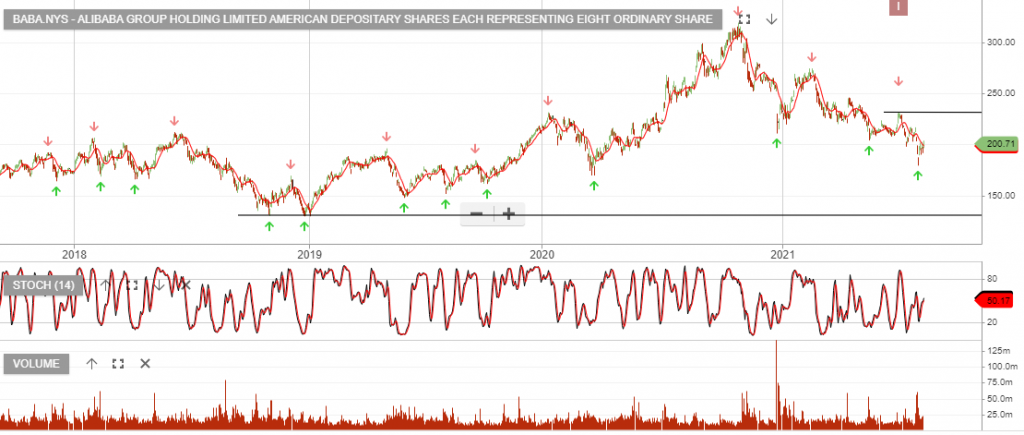

Alibaba – June Earnings

Alibaba Group Holding Limited American Depositary Shares each representing eight Ordinary is finding buying support above the recent $190 low.

We expect the earnings picture to improve over the next 12 months as a result of the regulatory impacts subsiding.

The June result was mixed with strong revenue growth, yet weak free cashflow, relative to the same time last year. We’ll review the September quarter results with interest, looking for an improvement.

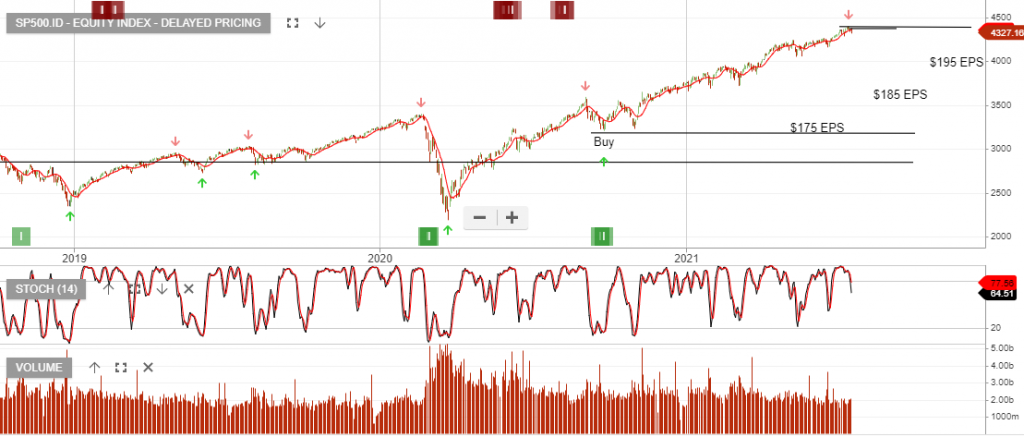

US Earnings – Our Focus

Week 2.

Monday, July 19th: IBM.

Tuesday, July 20th: Travelers, UBS, Philip Morris International United Airlines and Netflix.

Wednesday, July 21st: Verizon, Johnson & Johnson, Coca-Cola, Texas Instruments and Kinder Morgan.

Thursday, July 22nd: AT&T, Dow, Abbott Labs, American Airlines, Intel, Twitter, Snap, VeriSign, Domino’s Pizza, and Las Vegas Sands.

Friday, July 23rd: American Express and Honeywell.

Week 1.

Tuesday, July 13th: PepsiCo, JPMorgan Chase and Goldman Sachs.

Wednesday, July 14th: Bank of America, Citigroup, and Wells Fargo

Thursday, July 15th: Morgan Stanley, Charles Schwab, U.S. Bancorp, Taiwan Semi, UnitedHealth, and Alcoa.

Friday, July 16th: Ericsson and State Street.

Managed Fund – Apply Now!

The Fund focuses on Australian and United States large-cap securities and ETFs, to deliver superior risk-adjusted investment returns.

Our unique point of difference is our proprietary algorithm-based investment models, which are designed to quantify market momentum and remove much of the emotional human bias in the investment decision-making process.

Two classes of units in the Fund are offered:-

Class A Units – which provide investment exposure to ASX Listed securities and exchange-traded funds.

Class B Units – which provide investment exposure to United States listed securities and exchange-traded funds.

For more information, please visit https://www.investorsignals.com/managed-fund/