US Labor Markets

The recovery in the U.S. labor market appeared to stagnate for a second month, as non-farm payrolls increased by just 49,000 and December’s figure was downwardly revised to show 227,000 job losses, strengthening the case for further stimulus.

A break below 3,856 in the S&P500 will be negative for the momentum traders.

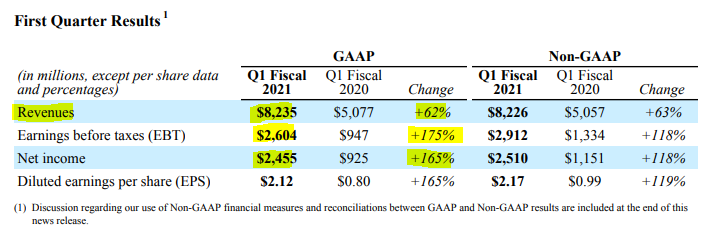

Amazon – Up 88%

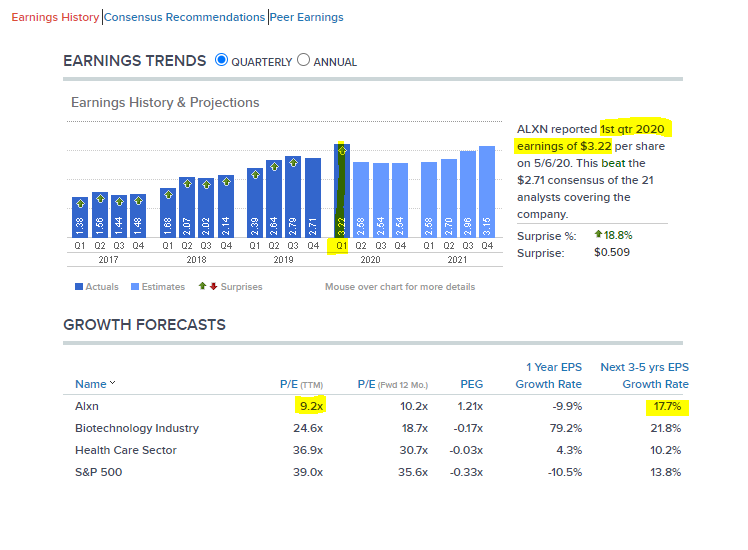

AMZN:NAS is under Algo Engine buy conditions and is up 88% since being added to our US S&P100 model portfolio on 1/8/2019.

For the December quarter, AMZN posted record revenues of more than $125B, up a whopping 44% on the same time last year. AWS, (cloud services), had net sales of $12.7B with an operating income of $3.6B, more than half of the firm’s overall operating income.

Facebook – Algo Sell

NYS:FB is under Algo Engine sell conditions.

We’re seeing falls in daily usage but global growth in overall user numbers continues to increase.

The company warned about the impact from Apple’s privacy changes and called the latter a “significant competitor.” Recent trends suggest slower growth in its advertising business and we may see lower revenue numbers in the second half of 2021.

We will be watching Google/Alphabet numbers when they report later this week.

S&P500 – Long or Short?

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Biogen – Buy Signal

NYS:BIIB is under Algo Engine buy conditions and is a current holding in our US model portfolio.

Biogen is an NYSE listed biotech company specializing in the discovery, development, and delivery of therapies for the treatment of neurological disease to patients worldwide.

The stock rallied 11% overnight after the FDA accepted an application for Biogen’s experimental Alzheimer’s drug.

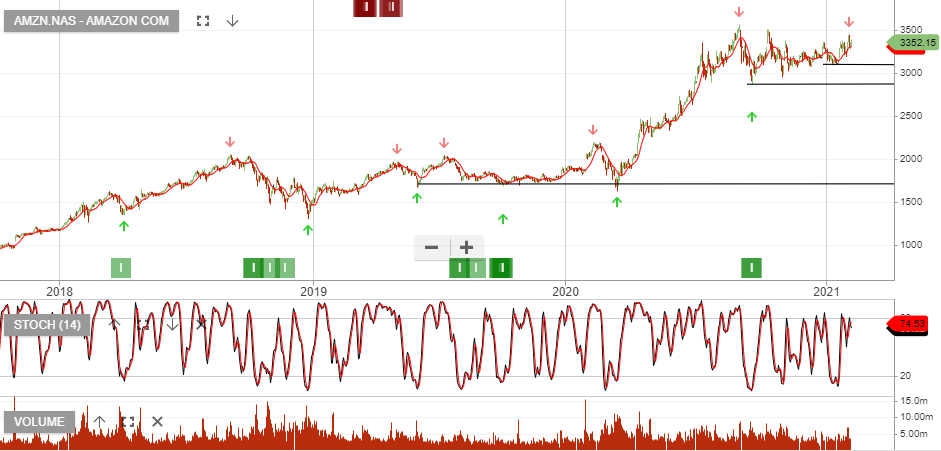

AbbVie – Buy Signal

AbbVie is now under Algo Engine buy conditions. We’re looking for buying support to build within the $85 – $95 range.

AbbVie reported Second-Quarter 2020 earnings with worldwide net revenues $10bn, an increase of 26% on a reported basis, or a decrease of 5% on a comparable operational basis, due to the COVID-19 pandemic.

AbbVie announced it completed its acquisition of Allergan, which was acquired on the 8th May, 2020.

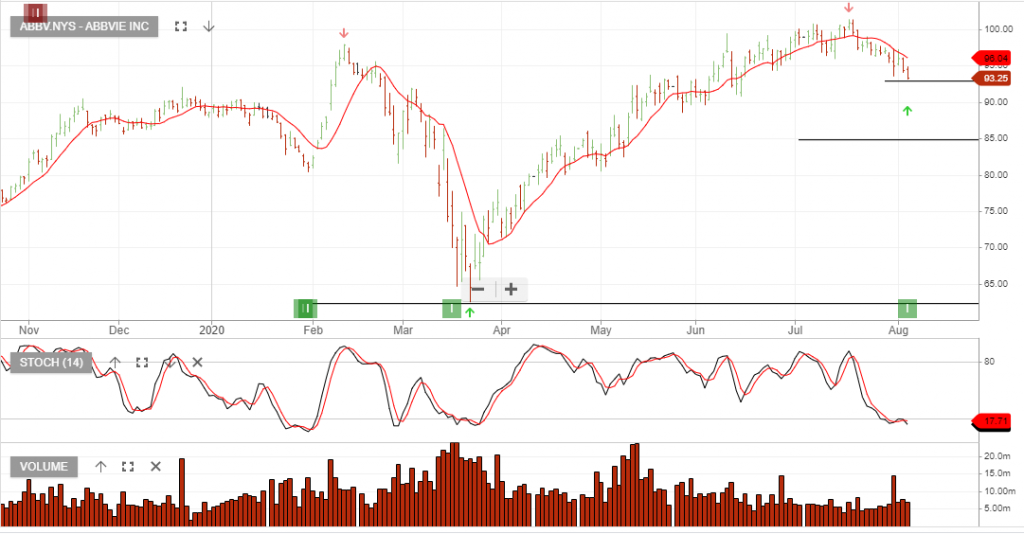

Alexion – Algo Buy

Alexion Pharmaceuticals today announced that the company will report its financial results for the second quarter ended June 30, 2020, before the US financial markets open on July 30, 2020.

Alexion is a recent Algo Engine buy signal from the NASDAQ top 100 group of companies. We’ve added this to our portfolio and will review the upcoming result with close interest.

NASDAQ – Leading Indicator

The NASDAQ remains our leading indicator of global equity markets.

We draw your attention to the index breaking below the 10-day average, this provides an early warning for stalling momentum.

For more detail on shorting/hedging strategies, please call me on 1300 614 002.

Goldman Sachs – Q2 Earnings

Goldman Sachs Group remains under Algo Engine sell conditions.

Goldman reported Q2 revenue of $13.3bn & $2.4bn in profit. Estimates were for $3.78 in EPS and the number came in much higher at $6.26 earnings per share.

The report came out before the bell last night and GS was up 5.5% yet at the close, up only 1.3%.

Banks with exposure to trading revenue have seen strong market conditions in the June quarter, however, it’s likely that trading revenue will slow down in the back half of 2020.

Goldman set aside a higher than expected, $1.59bn for potential credit losses.

We continue to have a cautious outlook on the sector as we head into the remainder of 2020, downside risks remain from the economic uncertainty and the significant pressure from low-interest rates.