JP Morgan Q2 Earnings

JP Morgan posted a record $33.8 billion in second-quarter revenue and $4.69 billion in profit for the period.

The firm set aside $8.9 billion for expected loan defaults across its operations.

Jamie Dimon told analysts, If a relatively benign scenario emerges, JP Morgan will have too much capital saved and could resume stock buybacks as early as the fourth quarter. If a more severe recession happens, caused by a second wave of infections in the fall, the bank could be forced to cut its dividend.

Federal stimulus programs have supported individuals and small businesses in the second quarter, masking the true impact of the pandemic. It, therefore, seems reasonable to expect further deterioration in bad loan provisions.

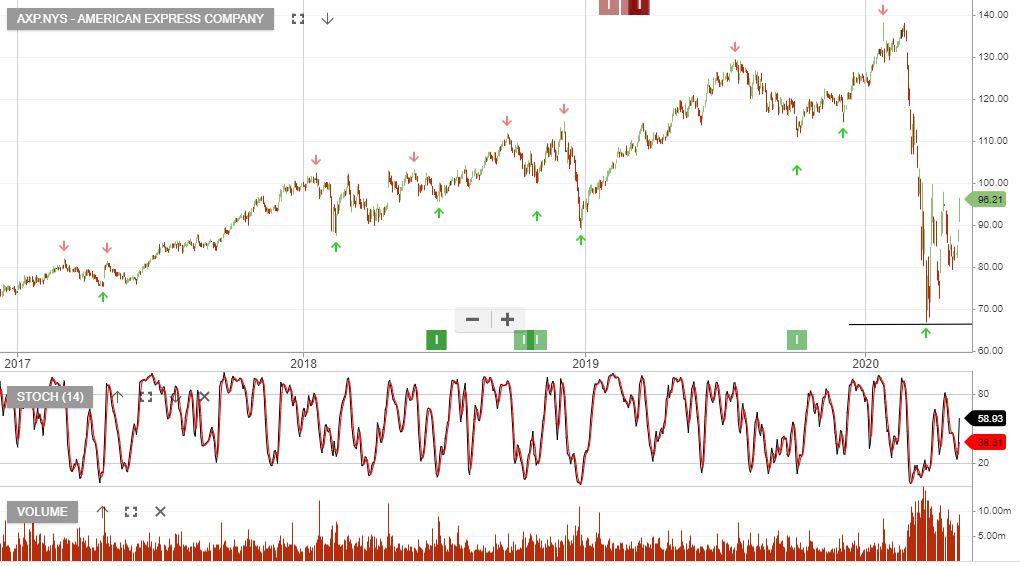

A break below $90 in JPM will be seen as a loss of upside momentum.