Telstra – Dividend Support

Commentary from the TLS chairman today suggests a strong desire to maintain a 16cps dividend, through to 2023.

Commentary from the TLS chairman today suggests a strong desire to maintain a 16cps dividend, through to 2023.

Gold has been under selling pressure from recent USD strength and yields on the US10YR treasuries moving higher. These factors are now largely priced in and we expect to see firmer gold prices over the coming months.

GDX should see increased buying above the $51.50 support level.

OceanaGold is under Algo Engine buy conditions.

Newcrest and Gold Road remain our preferred allocations, although Oceana Gold offers among the best long-term production growth opportunities through the Haile, Waihi and Golden Point mines.

The 3QCY20 operational result was weak, compared to market expectations with short-term production below estimates. The soft quarter was largely driven by impacts of exceptional rainfall and Covid-19 staffing related matters at Haile.

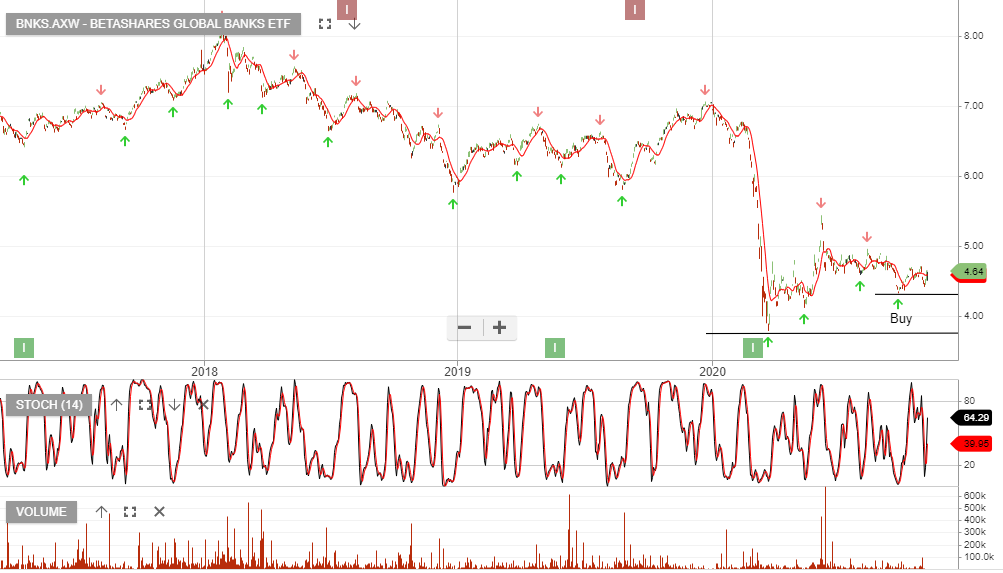

BetaShares Global Banks is our preferred bank exposure. Taking a global perspective and holding an overweight allocation to JP Morgan provides a low-risk profile and potentially greater upside.

Amcor provides a defensive buy-write option play.

The company reports Q1 earnings on Friday where the market will be looking for confirmation on the 5 – 10% EPS growth outlook.

Nat Gas prices continue to rebound from the historic lows reached mid this year.

Origin share price remains under selling pressure but is likely to soon find buying support.

Origin’s September quarter revenue of A$374m was down 39% from the prior quarter. Lower prices were in part offset by higher production volumes.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Tonight’s webinar will begin at 8pm NSW time. The link will be emailed 15 minutes before it starts.

All members and trial subscribers will be sent the email.

If you’d like to join the webinar and are not a member, then trial our service today.

APA is under Algo Engine buy conditions and we see support building at the recent $10.50 higher low formation.

Newcrest Mining remains under Algo Engine buy conditions. NCM has reported an in line 1QFY21 result with group production of 503koz.

The company expects an improved production performance in 2Q.

We suggest investors accumulate NCM above the $29 support level.

Or start a free thirty day trial for our full service, which includes our ASX Research.