GDX Gold ETF

Vaneck Vectors Gold Miners is under Algo Engine buy conditions.

GDX provides broad exposure to the leading global gold producers.

Vaneck Vectors Gold Miners is under Algo Engine buy conditions.

GDX provides broad exposure to the leading global gold producers.

Gold Road Resources is under Algo Engine buy conditions and along with NCM is our preferred gold exposure.

The company provided financial statements for the 6 month period ending June 30, which displayed revenue $135mn, EBIT, $36mn and EPS of $0.026.

Key points include:

Gold Road repaid all debt whilst retaining the undrawn facility of A$100M (US$71M). Net cash and equivalents of A$84M (US$60M) at 30 June 2020.

71,865 ounces produced* at attributable AISC of A$1,233/oz (US$875/oz)2.

Quarterly free cash flow of A$23.8M (excl. unsold bullion

and dore).

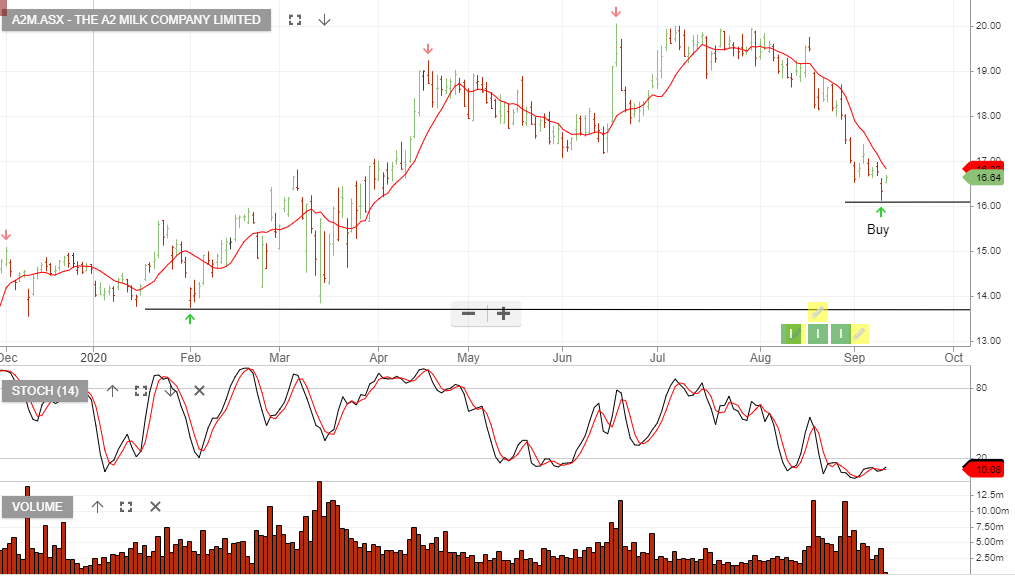

The A2 Milk Company buy at market and apply a stop-loss on a break below $16.00.

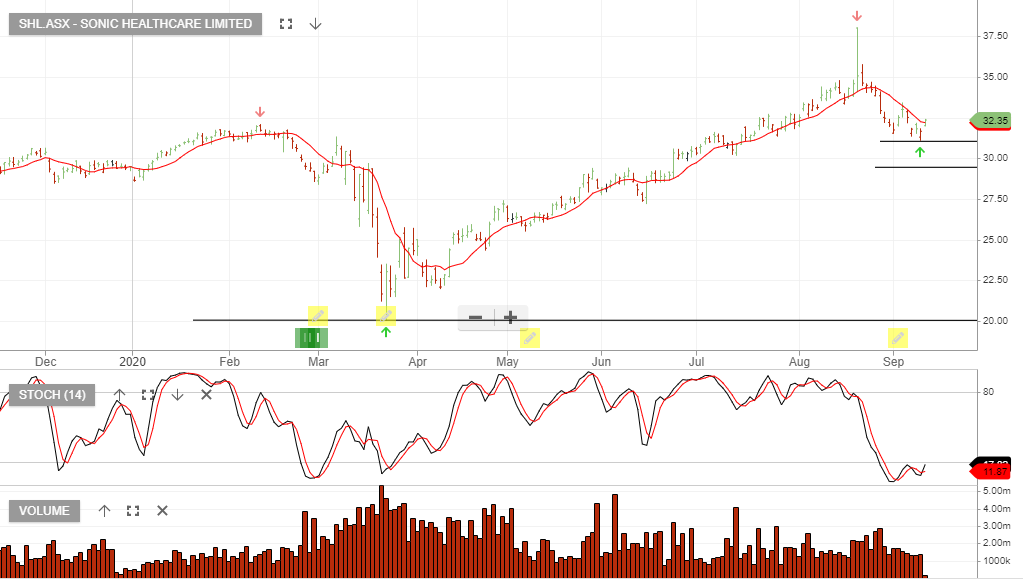

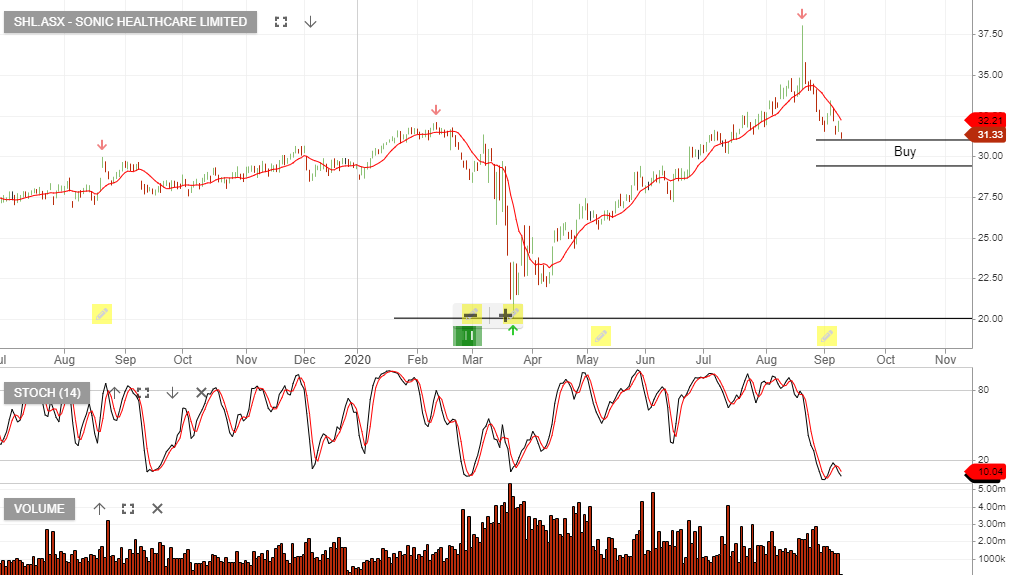

Sonic Healthcare has found buying support at the top of our entry range. Adding a $32.50 October call option generates $0.95 of income.

Start accumulating Sonic Healthcare.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

ASX is under Algo Engine buy conditions.

August cash equity volumes and average daily futures contract volumes were well down on the same time last year, -13% and -19% respectively.

FY21 earnings are likely to be flat at best and with the stock on a forward yield of 2.8%, we see it as “fully valued”. Owning the stock and selling an at the money covered call option is generating 8% cash flow.

We see value in buying ASX on any market weakness.

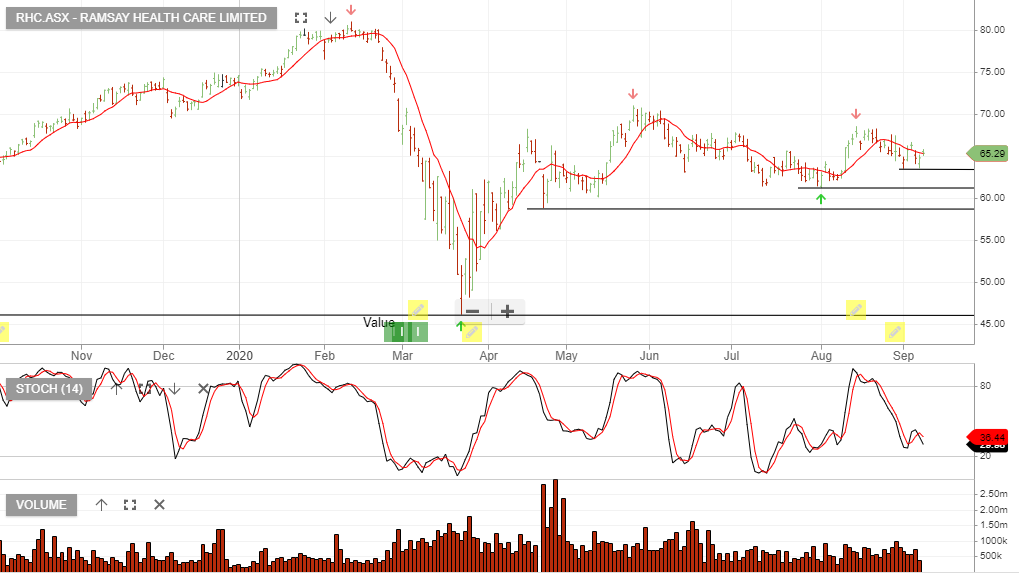

RHC delivered 8% revenue growth in FY20, with a strong 1H more than offsetting the 4% decline experienced in 2H.

Australia suffered the greatest contraction in 2H, down 8% on the same time last year. UK revenue growth remained solid, up almost 5%.

Based on normalization in FY22 earnings, we have the stock trading on a forward yield of 2.2%.

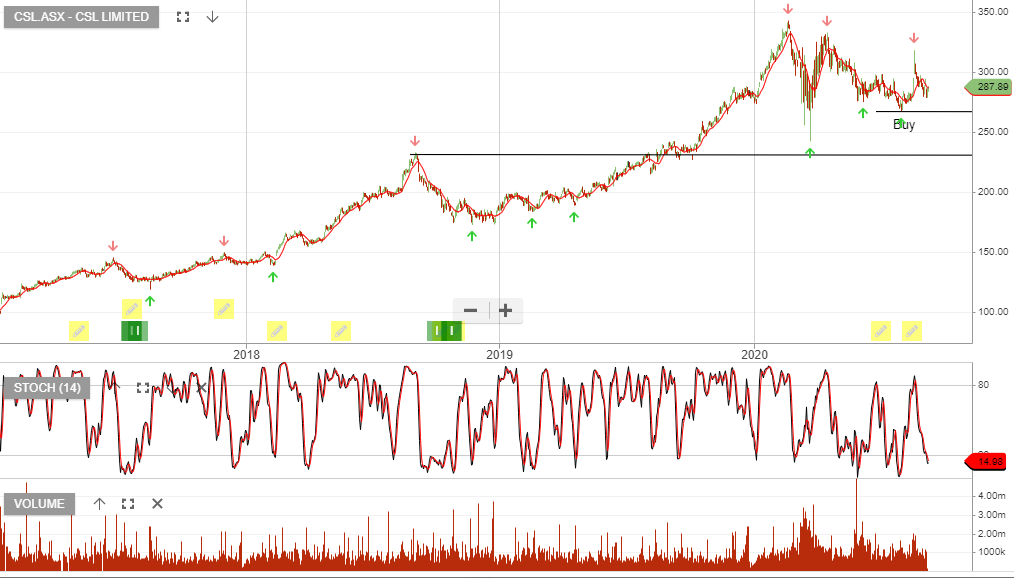

CSL is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

CSL & the Australian Government signed a Heads of Agreement to supply 51mn doses of the University of Queensland’s COVID-19 vaccine.

CSL & AstraZeneca also signed a Heads of Agreement for manufacture & distribution of 30mn doses of AZN’s COVID-19 vaccine (AZD1222).

We expect EPS to increase by 8 – 10% in FY21 and FY22. This supports a forward dividend yield of 1.1%.

Buy CSL within the $265 – $280 support range.

Or start a free thirty day trial for our full service, which includes our ASX Research.