Register for Tonight’s Webinar

Tonight’s webinar begins at 7pm. Please register and we’ll send you the webinar link, just before the start time.

Tonight’s webinar begins at 7pm. Please register and we’ll send you the webinar link, just before the start time.

Pro Medicus is under Algo Engine buy conditions.

PME announced a $25m seven year deal with NYU Langone Healthcare, which has now followed the recent $22m 5 year deal with Northwestern Memorial Healthcare.

These deals provide further evidence of Pro Medicus’ acceptance among some of the largest hospital groups in the US.

The stock is expensive, but the growth story continues to look compelling.

Technically, we have seen a recent higher low with strong buying off the $24.50 level in Friday’s session.

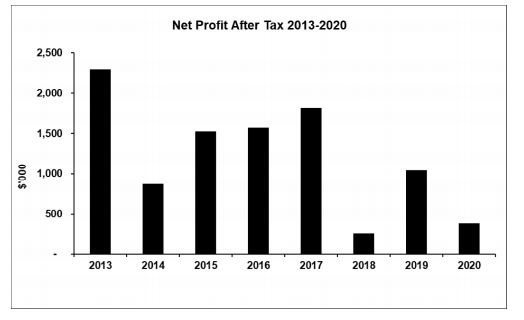

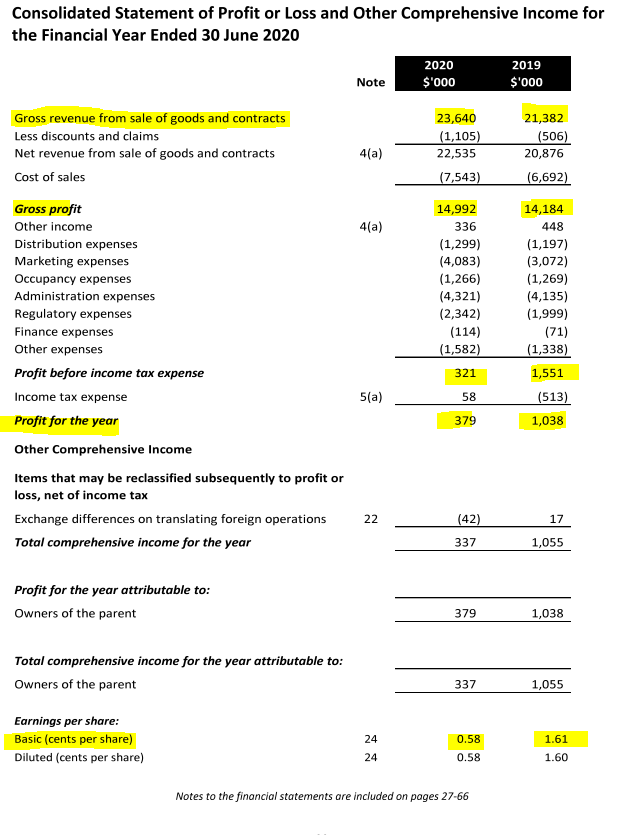

Medical Developments International is a stock that has been brought to my attention by a client, which has then prompted a review of the company.

About – Medical Developments International is one of Australia’s leading specialised healthcare companies. With an industry-leading range of products in the areas of pain management, asthma and resuscitation, plus veterinary equipment.

We’ll continue to monitor the MVP business and we’ll conduct further research on the potential drivers of future revenue and profit growth.

In the meantime, Pro Medicus remains our prefered “high growth” medical play, but we now add MVP to our watchlist.

ETFS S&P Biotech is under Algo Engine buy conditions and is a current holding in our “ASX All ETF” model portfolio.

Watch for the short-term indicators to reverse higher as buying support begins to build near the $53 price level.

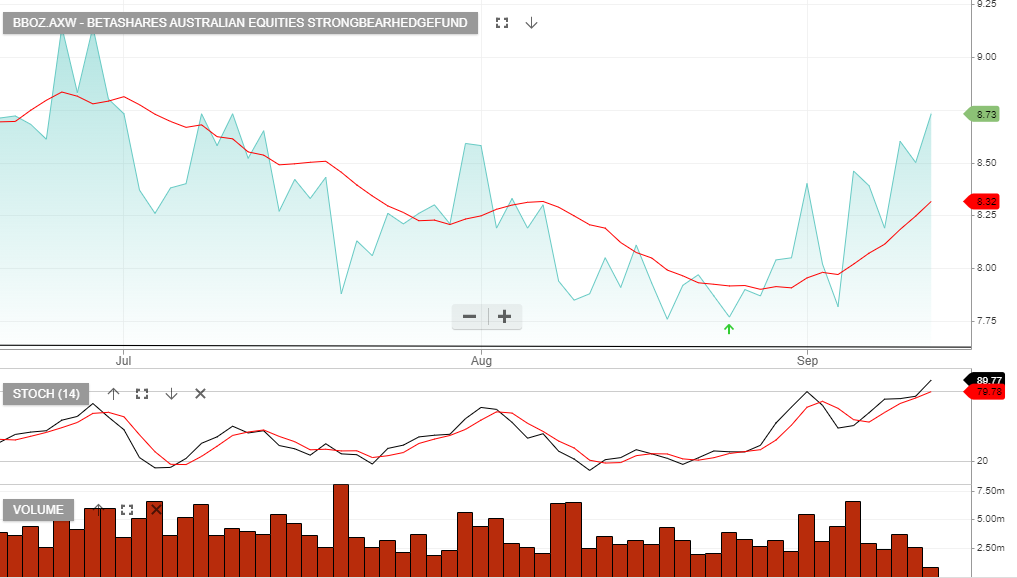

BBOZ is now up 15% from the lows, whilst BBUS is up 10%. For more detail on the inverse ETF strategies, please call our office on 1300 614 002.

OceanaGold is now under Algo Engine buy conditions.

We’ve now sold the $290 November call for $12.10 credit.

We’ve now sold the $32.50 October calls for $1.00 credit.

We’ve now sold the $17.50 October call options for $0.28.

APA is likely to find increased buying support between the $9.50 and $10.25, supported by 4.5% dividend yield and single-digit earnings growth.

About APA – Our 7,500-kilometre East Coast Grid of interconnected gas transmission pipelines provides the flexibility to move gas around eastern Australia, anywhere from Otway and Longford in the south, to Moomba in the west and Mount Isa and Gladstone in the north. In Western Australia and the Northern Territory, our pipelines stretch thousands of kilometres to supply gas to power major cities, towns and remote mining operations.

Apart from our interconnected natural gas pipelines, we own and operate the Ethane Pipeline which supplies ethane from the Cooper Basin production facility at Moomba, South Australia, to an ethylene plant in Botany, Sydney.

And it’s not just pipelines. We also own and operate the Mondarra Gas Storage and Processing Facility and the Emu Downs Wind Farm in Western Australia, Diamantina and Leichhardt Power Stations in Queensland, the Dandenong LNG Storage Facility in Victoria and the Central Ranges Gas Distribution Network servicing Tamworth in New South Wales.

Or start a free thirty day trial for our full service, which includes our ASX Research.